Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

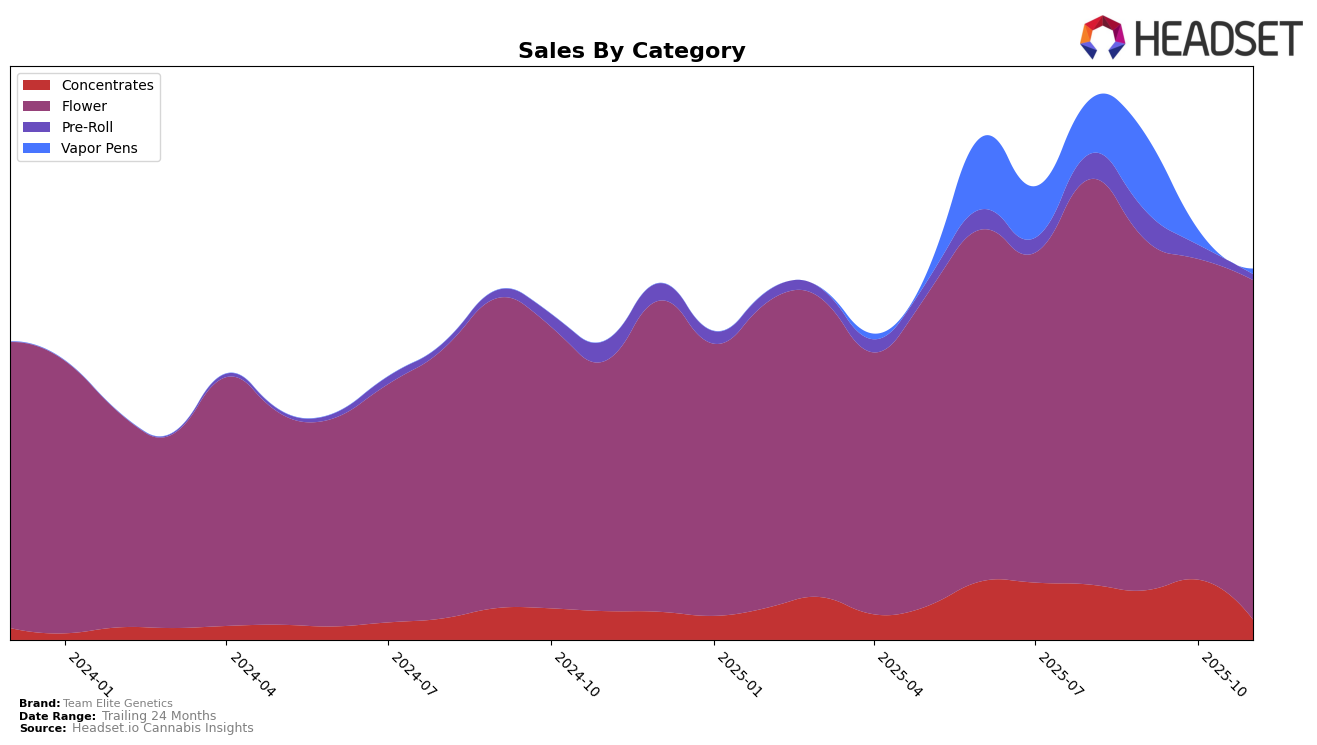

In the competitive landscape of the cannabis industry, Team Elite Genetics has demonstrated varied performance across different product categories and states. In California, the brand's presence in the Concentrates category saw a significant drop from 21st place in October 2025 to falling out of the top 30 by November 2025. This decline is noteworthy as it indicates a potential challenge in maintaining market share within this category. Conversely, in the Flower category, Team Elite Genetics showed resilience by moving up from 31st place in October to 27th in November, suggesting a positive trend and possible consumer preference for their flower products. The Vapor Pens category also saw an interesting trajectory, with the brand ranking 59th in September and not appearing in the top 30 in subsequent months, hinting at potential difficulties in sustaining momentum in this segment.

Across all categories, the sales figures reflect the dynamic shifts in consumer demand and competition. For instance, in the Concentrates category, despite a promising start with a 21st rank in October, the brand experienced a drastic drop in sales by November, which could be attributed to increased competition or changing consumer preferences. Meanwhile, the Flower category maintained relatively stable sales, albeit with a slight dip in October, before climbing back up in November. This stability in Flower sales might be a strategic area for Team Elite Genetics to capitalize on. The absence of the brand from the top 30 Vapor Pens rankings in October and November suggests a need for strategic reevaluation in this category to regain market presence. Overall, these movements highlight the importance of adaptability and strategic focus in navigating the ever-evolving cannabis market landscape.

Competitive Landscape

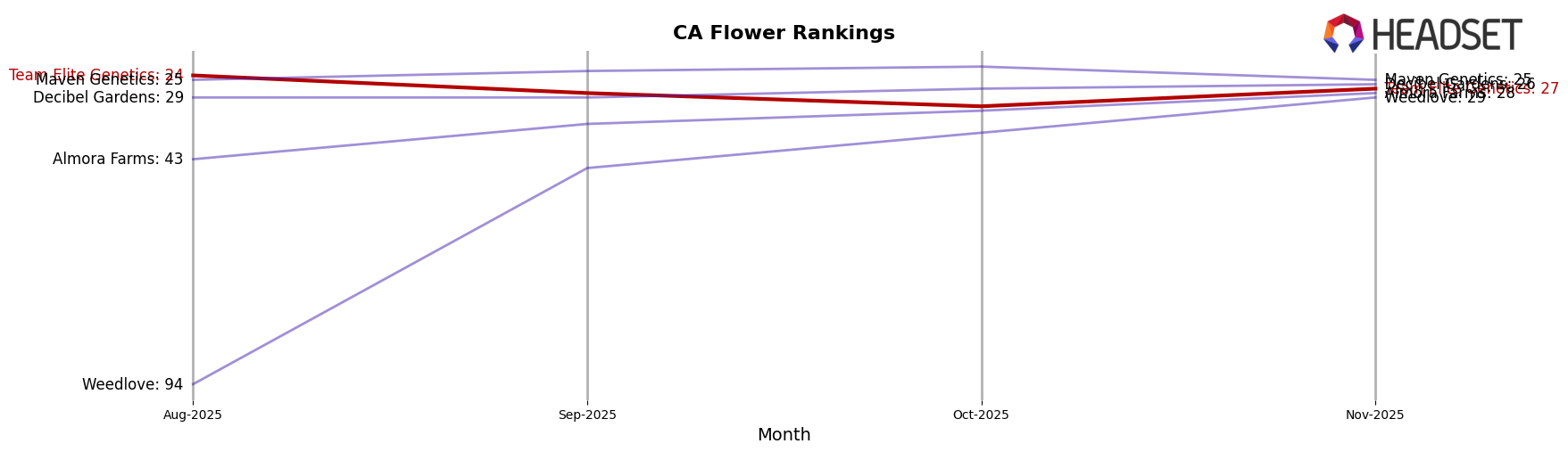

In the competitive landscape of the California flower category, Team Elite Genetics has experienced fluctuations in its ranking, moving from 24th in August 2025 to 27th by November 2025. This downward trend in rank is accompanied by a decrease in sales, which contrasts with the performance of competitors such as Maven Genetics, which improved its rank from 25th to 22nd between August and October before slightly dropping to 25th in November, while maintaining relatively strong sales. Meanwhile, Decibel Gardens showed a steady climb from 29th to 26th, reflecting a positive sales trajectory. Notably, Almora Farms and Weedlove have demonstrated significant upward momentum, with Weedlove making a remarkable leap from 94th in August to 29th in November, driven by a substantial increase in sales. These dynamics suggest that while Team Elite Genetics faces challenges in maintaining its competitive position, there is potential for strategic adjustments to regain market share.

Notable Products

In November 2025, Styrofoam Cup (3.5g) maintained its position as the top-performing product for Team Elite Genetics, with impressive sales reaching 4811 units, marking a significant increase from the previous months. Nova Cane (3.5g) climbed to the second position, up from third place in October, demonstrating a notable surge in demand. J1 (3.5g) experienced a slight drop to third place, despite consistent sales over the preceding months. Purple Dump Truck (3.5g), which only entered the rankings in October, rose to fourth place, showing promising growth. John Connor (3.5g) slipped to fifth place, reflecting a decrease in sales compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.