Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

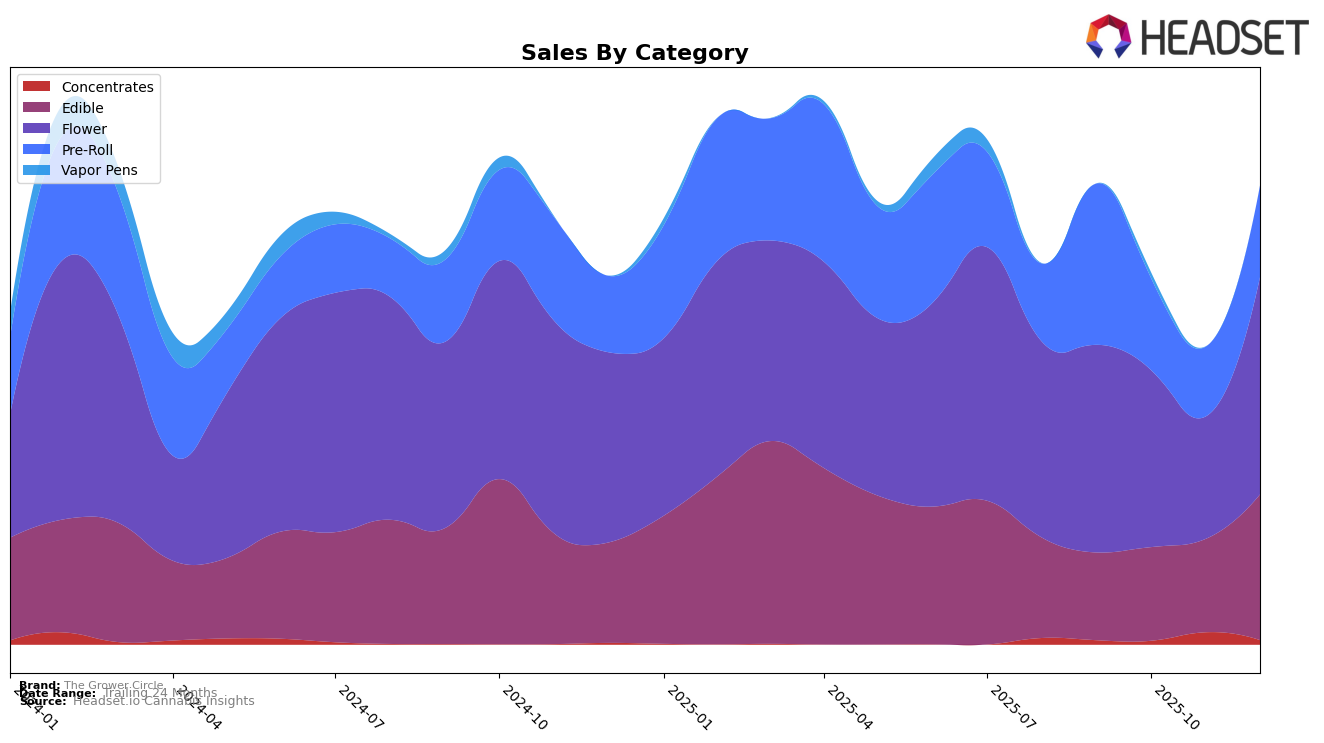

The Grower Circle has shown varied performance across different product categories in Nevada. In the concentrates category, the brand made a notable entry into the top 30 rankings in December 2025, securing the 26th position. This marks a significant achievement as the brand was not in the top 30 in the preceding months, indicating a positive upward trend. On the other hand, the flower category saw fluctuating rankings, with The Grower Circle dropping from 29th in September to 44th in November, before recovering to 31st in December. This suggests a potential recovery in sales or increased market competition during the holiday season.

The edible and pre-roll categories present a different story for The Grower Circle in Nevada. The edible category maintained a steady performance with a consistent 15th rank from September through November, before climbing to 13th in December, possibly driven by increased consumer demand during the festive period. The pre-roll category, however, witnessed a more dynamic shift. The brand's rank fell from 12th in September to 22nd in November, suggesting challenges in maintaining market share, but it rebounded to 15th by December. This rebound could indicate improved distribution strategies or successful promotional efforts. Overall, The Grower Circle's performance across these categories highlights both opportunities and challenges in maintaining a competitive edge in the Nevada market.

Competitive Landscape

In the competitive landscape of the Nevada flower market, The Grower Circle has experienced notable fluctuations in its ranking and sales performance from September to December 2025. Despite a dip in November, where it fell to rank 44, The Grower Circle rebounded to rank 31 in December, indicating resilience amidst competitive pressures. This fluctuation is particularly significant when compared to competitors like GB Sciences, which consistently maintained a higher rank, peaking at 24 in November, and Prime Cannabis, which showed a steady improvement to rank 30 by December. Meanwhile, THC Design and High Heads trailed behind, with THC Design not breaking into the top 20 during this period. The Grower Circle's sales trajectory, with a significant recovery in December, suggests potential for growth, but highlights the need for strategic initiatives to maintain and improve its competitive position against brands like GB Sciences, which demonstrated stronger sales momentum.

Notable Products

In December 2025, the top-performing product from The Grower Circle was Flight Bites - Sour Watermelon Gummies 10-Pack, which rose to the number one rank with sales reaching 1399.0 units. Following closely, Flight Bites - Sunset Punch Gummies 10-Pack held the second position, a slight drop from its top rank in November. Flight Bites - Rainbow Crunch Hash Rosin Gummies 10-Pack made a significant leap to third place, having not been ranked in November. Family Ties (3.5g) maintained a consistent performance, moving up to fourth place from fifth in November. Meanwhile, Flight Bites - Strawberry Shortcake Hash Rosin Gummies 10-Pack entered the rankings for the first time in December, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.