Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

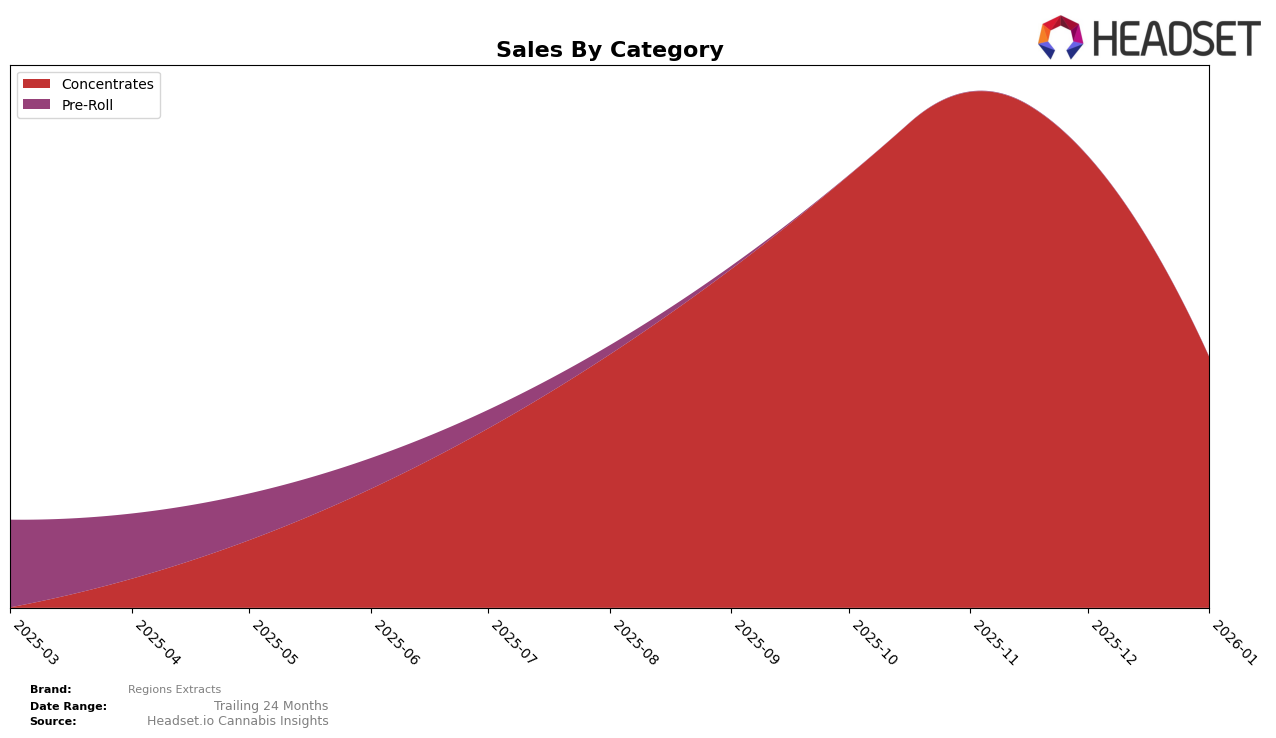

Regions Extracts has demonstrated varied performance across different states and categories, with some notable shifts in their rankings. In Arizona, the brand has maintained a presence in the Concentrates category, though not without fluctuations. Starting at the 12th position in October 2025, they improved slightly to 11th in November, only to drop back to 12th in December and further down to 18th by January 2026. This decline in ranking coincides with a significant drop in sales from November to January, suggesting potential challenges in maintaining market share or increased competition in the Arizona concentrates market.

While Regions Extracts has been able to secure a position within the top 30 brands in Arizona's concentrates category, their absence from the rankings in other states or categories might indicate either a strategic focus or a need for expansion. The lack of presence in other top 30 lists could be seen as a missed opportunity for growth, especially if competitors are gaining traction in those areas. Understanding the dynamics in these other markets and categories could provide Regions Extracts with insights into potential areas for market penetration or product diversification.

Competitive Landscape

In the Arizona concentrates category, Regions Extracts experienced a notable fluctuation in its market position from October 2025 to January 2026. Initially ranked 12th in October, the brand climbed to 11th in November, demonstrating strong sales momentum. However, by January 2026, Regions Extracts had slipped to 18th place, indicating a significant decline in sales performance. This drop contrasts with competitors like Sweet Science, which maintained a steady 16th rank throughout the period, and Achieve, which consistently held the 17th position. Meanwhile, Easy Tiger showed volatility similar to Regions Extracts, peaking at 11th in December before falling to 19th in January. These dynamics suggest a competitive and shifting market landscape, where Regions Extracts needs to strategize effectively to regain its earlier momentum and improve its standing against stable performers like Sweet Science.

Notable Products

In January 2026, Jungle Juice Badder (1g) reclaimed the top spot among products from Regions Extracts, maintaining its leading position from October 2025 with a notable sales figure of 774 units. Margy Cake Badder (1g), which had briefly overtaken Jungle Juice in November, settled back into the second position. Summer Monsoon Badder (1g) consistently held the third position, showing steady performance across the months. G-13 Shatter (1g) debuted impressively in December 2025 at the top rank but shifted to fourth place in January 2026. Mad Honey Shatter (1g) followed a similar trajectory, starting strong in December but rounding out the top five by January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.