Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

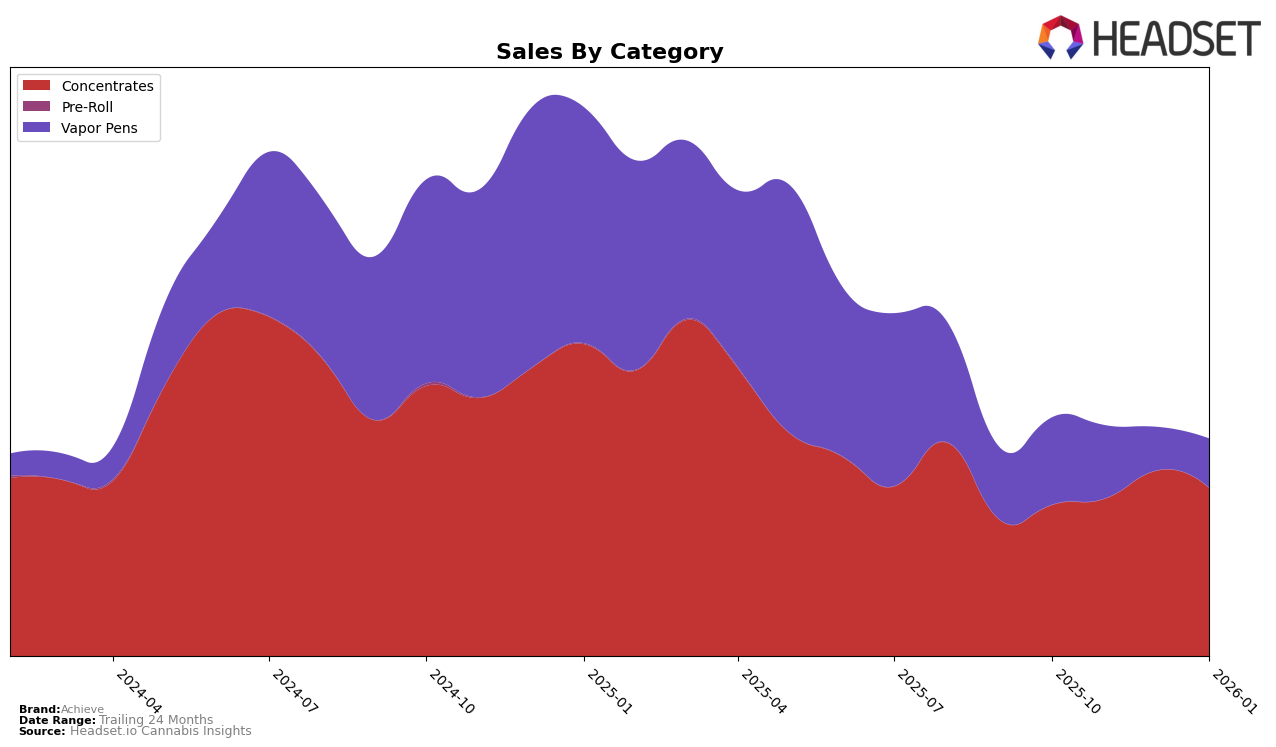

Achieve has shown a consistent presence in the Arizona market, particularly within the Concentrates category. Over the last four months, the brand maintained a steady ranking at 17th place from November 2025 to January 2026, after initially being ranked 21st in October 2025. This steady performance indicates a solid foothold in this category, with sales peaking in December 2025. However, the brand's absence from the top 30 in other states or provinces suggests there is room for expansion and improvement in its market reach beyond Arizona.

In the Vapor Pens category, Achieve's rankings in Arizona have fluctuated, with the brand not breaking into the top 30. Starting from a position of 47th in October 2025, the brand's rank slipped to 56th in December before slightly recovering to 53rd in January 2026. This downward trend in rankings, coupled with a decrease in sales from October to December, suggests challenges in maintaining competitiveness in this category. The data implies that while Achieve has a strong presence in Concentrates, there is significant potential for growth and improvement in the Vapor Pens category.

Competitive Landscape

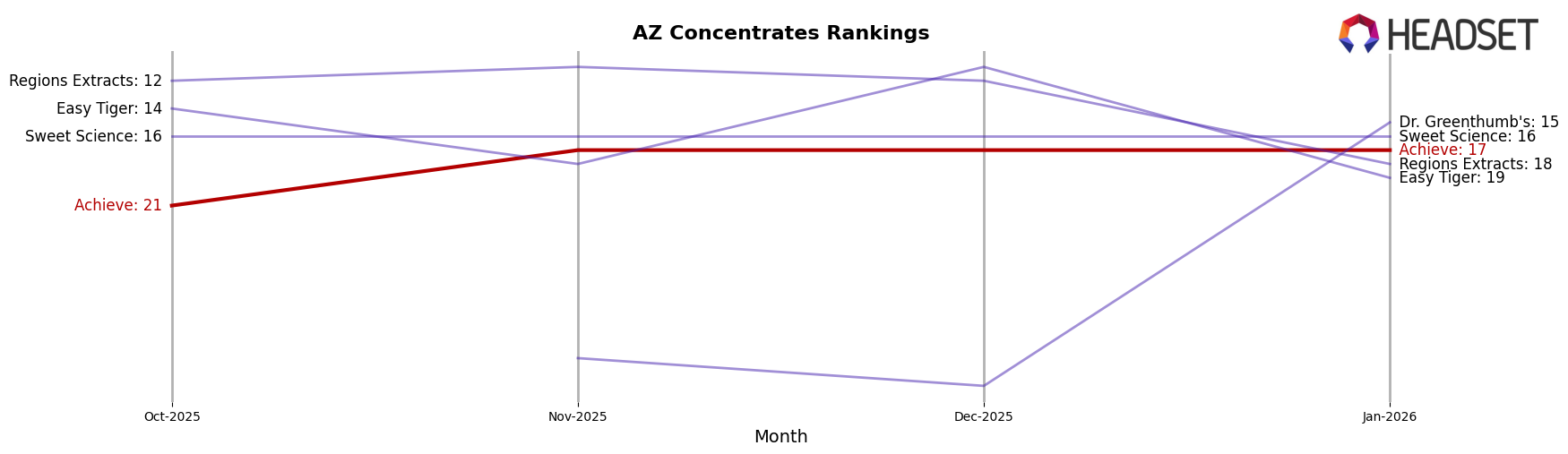

In the competitive landscape of the Arizona concentrates market, Achieve has shown a steady improvement in its rankings, moving from 21st place in October 2025 to consistently holding the 17th position from November 2025 to January 2026. This upward trend in rank is indicative of a positive trajectory in sales, with a notable increase from $54,817 in October to $67,323 in December, before a slight dip to $60,975 in January. In comparison, Sweet Science maintained a stable 16th rank throughout the same period, with sales peaking at $71,445 in January. Meanwhile, Regions Extracts and Easy Tiger experienced fluctuations, with Regions Extracts dropping from 12th to 18th and Easy Tiger from 11th to 19th by January, reflecting their respective sales declines. Notably, Dr. Greenthumb's made a significant leap from being unranked to 15th in December, highlighting a potential emerging threat. These dynamics suggest that while Achieve is on a positive path, it faces stiff competition from both established and emerging brands in the Arizona concentrates market.

Notable Products

In January 2026, the top-performing product for Achieve was Devil Driver Hash in the Concentrates category, which claimed the number one spot with a notable sales figure of 394 units. Alien Pharaoh Hash emerged as a strong contender, securing the second position. Blue Dream RSO Syringe maintained a steady presence, ranking third, despite a decrease in sales from previous months. Alien Invasion Hash climbed to the fourth spot, showing an improvement from its fifth-place ranking in December 2025. Tropicana Cherry Hash entered the rankings in January 2026, taking the fifth position, indicating a new interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.