Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

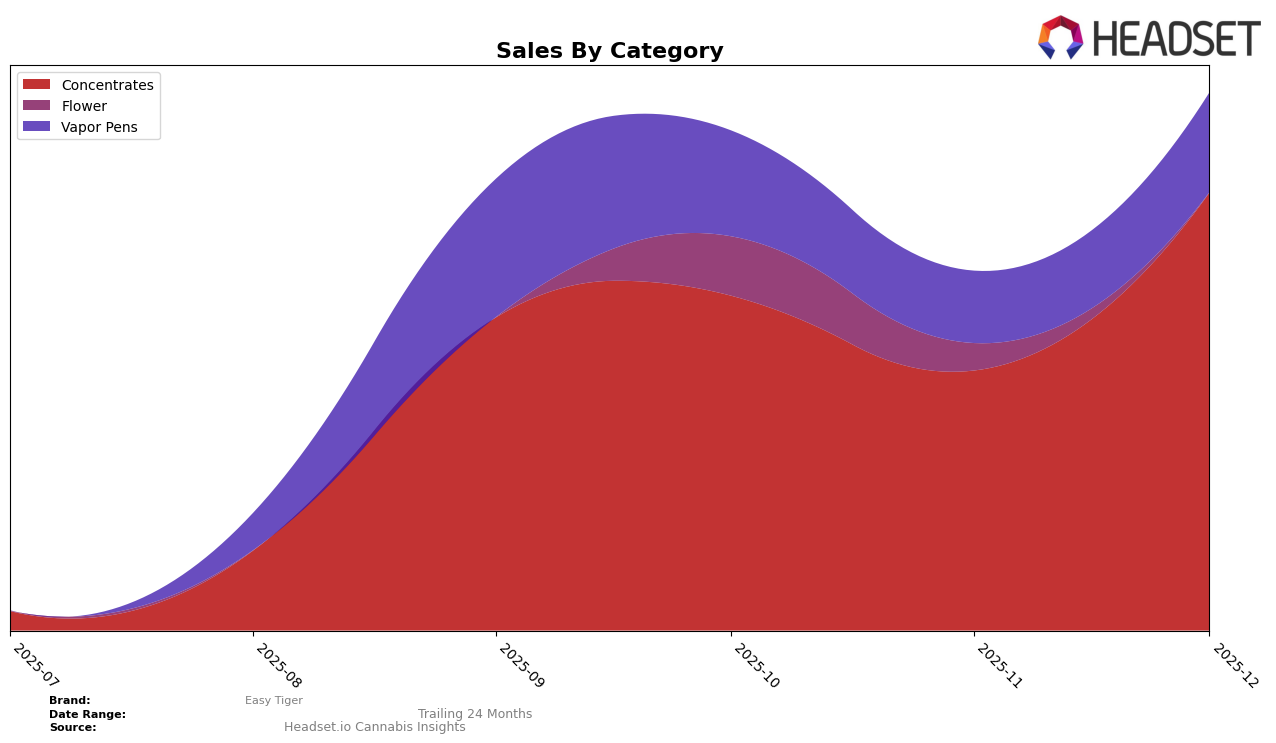

Easy Tiger has shown notable performance fluctuations across various product categories in Arizona. In the Concentrates category, Easy Tiger demonstrated a strong upward trend, moving from the 15th position in September 2025 to 11th by December 2025. This improvement is underscored by a significant increase in sales, culminating in a December sales figure that was markedly higher than prior months. Conversely, their performance in the Vapor Pens category remained relatively stable with slight fluctuations, ending December 2025 in the same position as October. However, it's worth noting that Easy Tiger did not make it into the top 30 brands in the Flower category in recent months, which could be a potential area for growth or concern depending on their strategic focus.

The lack of presence in the top 30 for Flower in Arizona suggests a missed opportunity or a strategic decision to focus on other product lines. Despite this, the Concentrates category's performance might indicate a strong market fit or successful marketing strategies within that segment. The Vapor Pens category, although not experiencing significant rank changes, still reflects a consistent presence in the market. The overall trends suggest that Easy Tiger is making strategic gains in certain areas, while there may be room for improvement or strategic shifts in others, particularly in categories where they are not currently ranking. These insights could be crucial for stakeholders looking to understand Easy Tiger's market dynamics and potential areas for expansion or reinforcement.

Competitive Landscape

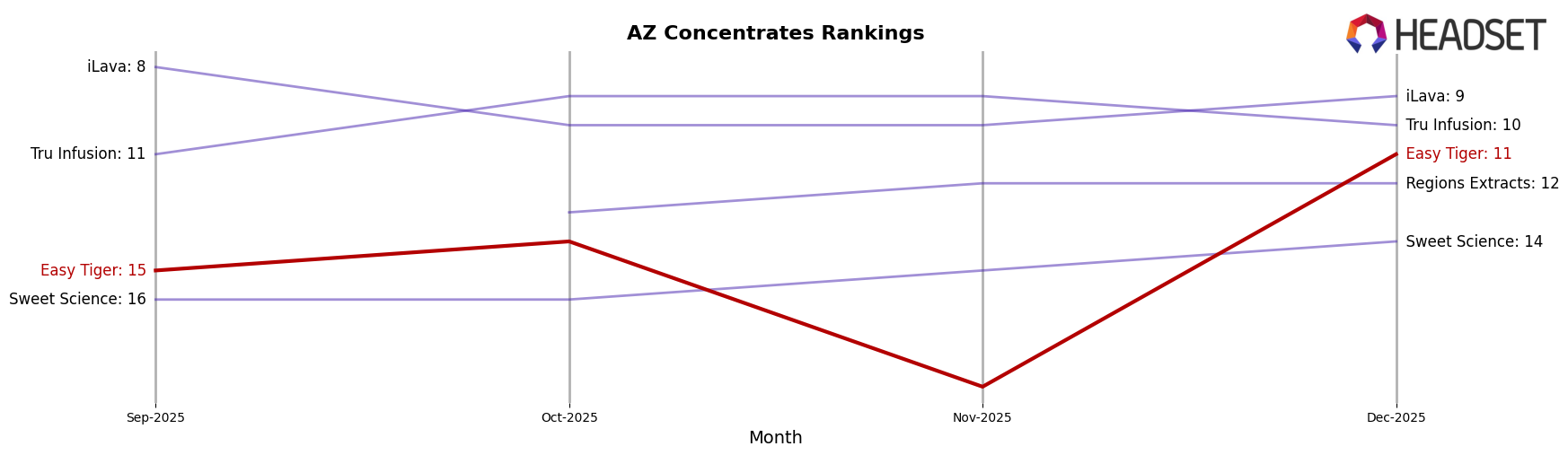

In the competitive landscape of concentrates in Arizona, Easy Tiger has shown a notable fluctuation in its rankings over the last few months of 2025. Starting at 15th place in September, Easy Tiger experienced a dip to 19th in November, before making a significant recovery to 11th in December. This rebound is particularly impressive when compared to brands like iLava and Tru Infusion, which have maintained relatively stable positions in the top 10. The December surge in Easy Tiger's rank coincides with a noticeable increase in sales, suggesting a successful strategy or product launch that month. Meanwhile, Sweet Science and Regions Extracts have shown more gradual improvements, with Sweet Science climbing from 16th to 14th and Regions Extracts maintaining a steady presence around the 12th position. This dynamic market environment highlights the importance of strategic agility for Easy Tiger to capitalize on its recent momentum and continue climbing the ranks.

Notable Products

In December 2025, Rainbow Guava Live Hash Rosin (1g) emerged as the top-performing product for Easy Tiger, leading the sales with a notable figure of 513 units sold. Pomelo Punch Live Hash Rosin (1g) secured the second position, improving from its absence in the rankings in October and November. Sub Z Live Hash Rosin (1g) maintained a consistent presence, holding steady at the third position after rising from fourth in October. Pete's Peaches Live Hash Rosin (1g) showed a slight decline, dropping to fourth from its first-place rank in October. Meanwhile, Pete's Peaches Live Resin Disposable (0.5g) debuted at fifth, marking its presence in the rankings for the first time in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.