Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

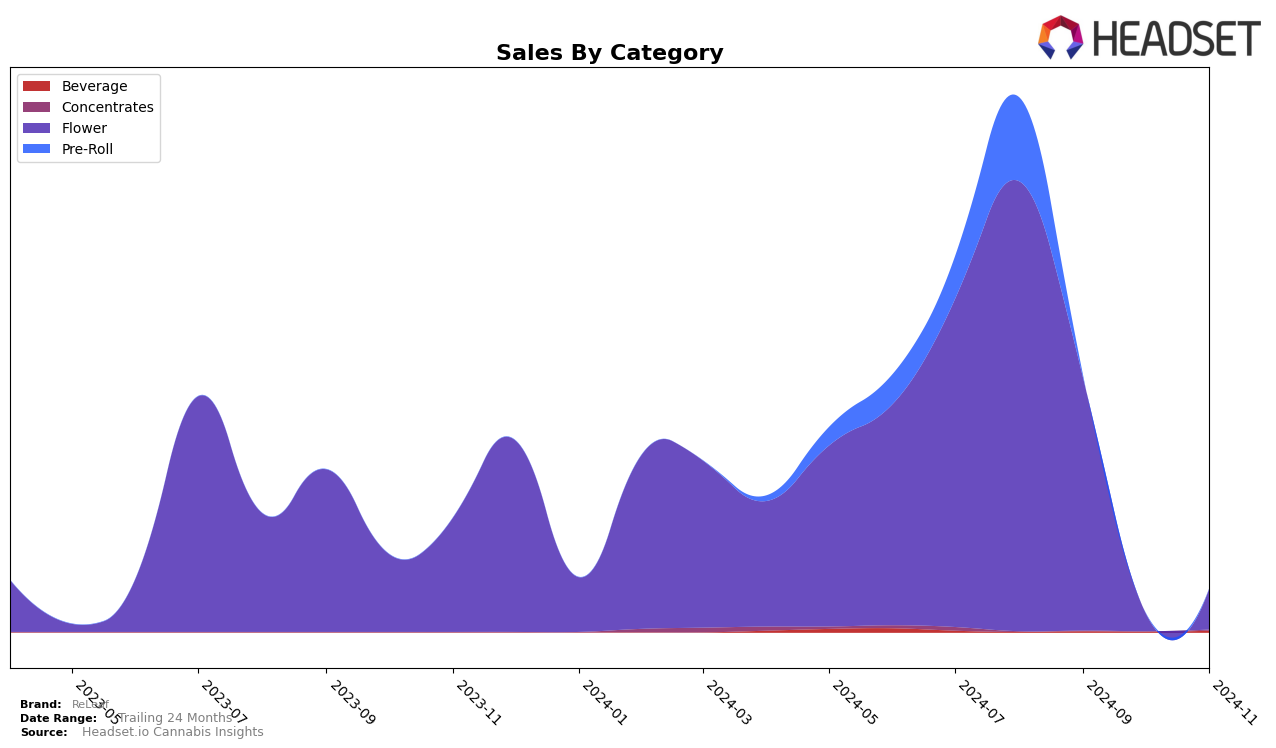

ReLeaf's performance in the cannabis market shows interesting trends across different states and product categories. In Michigan, the brand has not been able to break into the top 30 for either the Flower or Pre-Roll categories as of the latest data. This absence from the top rankings could indicate challenges in market penetration or competition within these categories. The data suggests that while ReLeaf has generated sales, the brand may need to enhance its strategies to climb the rankings and capture more market share in Michigan's competitive landscape.

Despite the lack of top 30 placements, ReLeaf's sales figures in Michigan provide some insights into their market activity. For instance, sales in the Flower category reached $446,546 in August 2024, indicating a presence in the market despite the absence from the top rankings. This suggests that while ReLeaf is generating revenue, there may be opportunities to optimize their product offerings or marketing efforts to improve their standings. The data highlights the importance of strategic adjustments to better compete with leading brands and achieve higher visibility in the state's cannabis market.

Competitive Landscape

In the competitive landscape of the Michigan flower category, ReLeaf has experienced notable fluctuations in its market presence. In August 2024, ReLeaf held the 71st rank, but by November 2024, it was no longer in the top 20, indicating a decline in its competitive standing. This contrasts with brands like Crude Boys, which also saw a decline but maintained a higher sales volume, and Rare Michigan Genetics, which improved its rank from 76th in September to 70th in October, suggesting a positive sales trend. Meanwhile, Bowhouse entered the top 100 in October at 96th, indicating emerging competition. The shifting ranks highlight the dynamic nature of the market and suggest that ReLeaf may need to strategize to regain its competitive edge and sales momentum in Michigan's flower category.

Notable Products

In November 2024, Pure Michigan (Bulk) emerged as the top-performing product for ReLeaf, climbing to the number one rank with sales reaching 714 units. Kush Mintz (Bulk) followed closely, securing the second position, a slight drop from its top rank in October. Coffee Pods 3-Pack (3mg) maintained a strong presence at third place, showing a notable increase from its previous position in October. Hybrid RSO Dripper (1g) held steady in fourth place, indicating consistent performance over the months. Oreoz (Bulk) re-entered the rankings in fifth place, demonstrating a return to the top five after being absent in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.