Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

In the rapidly evolving cannabis market, Retro has shown varied performance across different states and categories. Notably, in the Concentrates category in Alberta, Retro did not make it to the top 30 brands from September through December 2025, which suggests there might be challenges or increased competition in this specific segment. The absence of a ranking indicates that Retro's market penetration or consumer preference in this category may need strategic reevaluation to boost its visibility and sales.

Despite the lack of top 30 rankings in Alberta's Concentrates category, the brand's overall sales in September 2025 were recorded at $10,155. This figure provides a baseline for understanding their market presence, even if it doesn't reflect a leading position. The data implies that while Retro has a foothold in the market, there might be opportunities in other categories or states where they could potentially capitalize on less competitive environments or emerging consumer trends. Further analysis could reveal more about the brand's strategic positioning and potential areas for growth.

Competitive Landscape

In the competitive landscape of the concentrates category in Alberta, Retro has faced significant challenges in maintaining its market position. As of December 2025, Retro did not rank within the top 20 brands, indicating a struggle to capture market share compared to its competitors. In contrast, brands like Catch Me Outside and High Key have shown more stability, with ranks of 35 and 40 in October 2025, respectively. Notably, Frootyhooty experienced a decline from 36 to 41 in the same period, suggesting a potential opportunity for Retro to capitalize on shifting consumer preferences. Despite the competitive pressure, Retro's absence from the top ranks highlights the need for strategic adjustments to regain visibility and drive sales in the Alberta concentrates market.

Notable Products

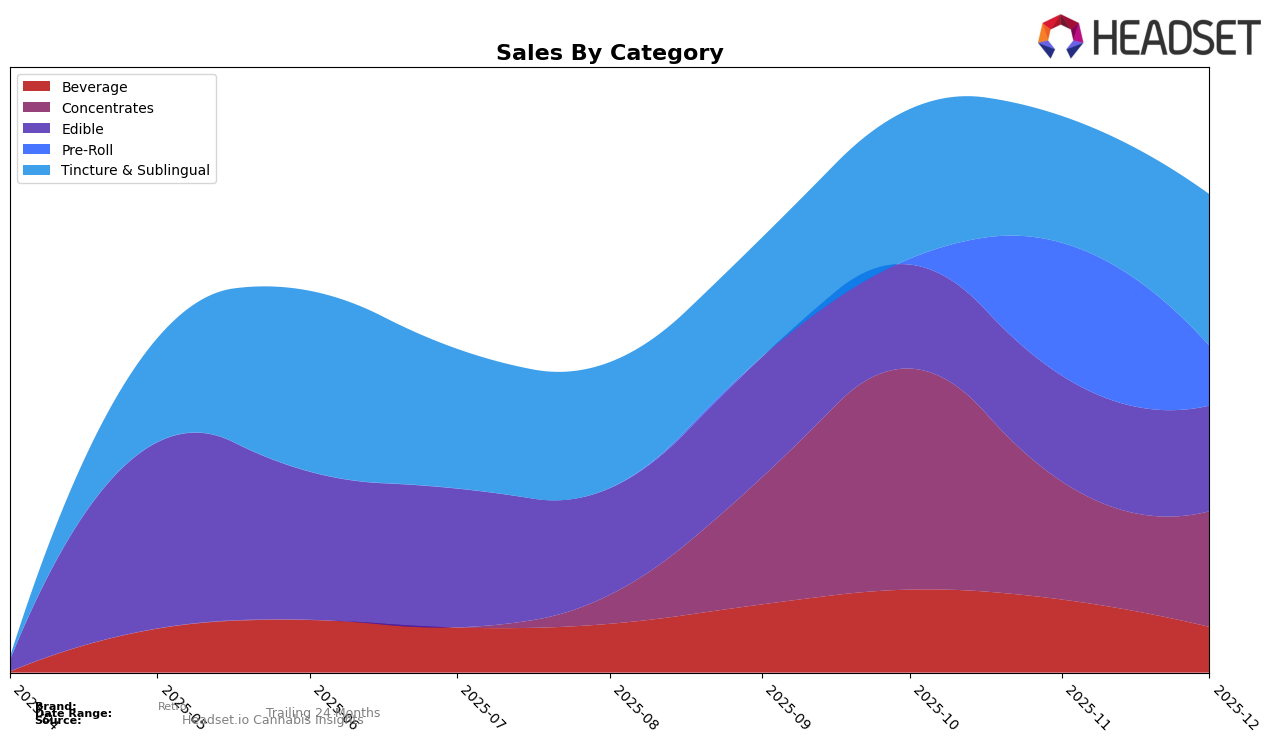

In December 2025, Retro's top-performing product was the Liquid Solventless Drop Tincture (100mg) in the Tincture & Sublingual category, maintaining its number one rank for the fourth consecutive month with sales of 369 units. The Peach Rings Gummies 10-Pack (100mg) in the Edible category secured the second spot, consistent with its performance since November, despite a slight drop in sales compared to September. Honey Oil Infused Hash (2g) in the Concentrates category held the third position, showing a decline from its second-place rank in October. Potent Pete Infused Pre-Roll 3-Pack (1.5g) debuted in the rankings in November at third place but dropped to fourth in December. Strawberry Vibes Syrup (100mg) in the Beverage category re-entered the top five in December, marking its first appearance since October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.