Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

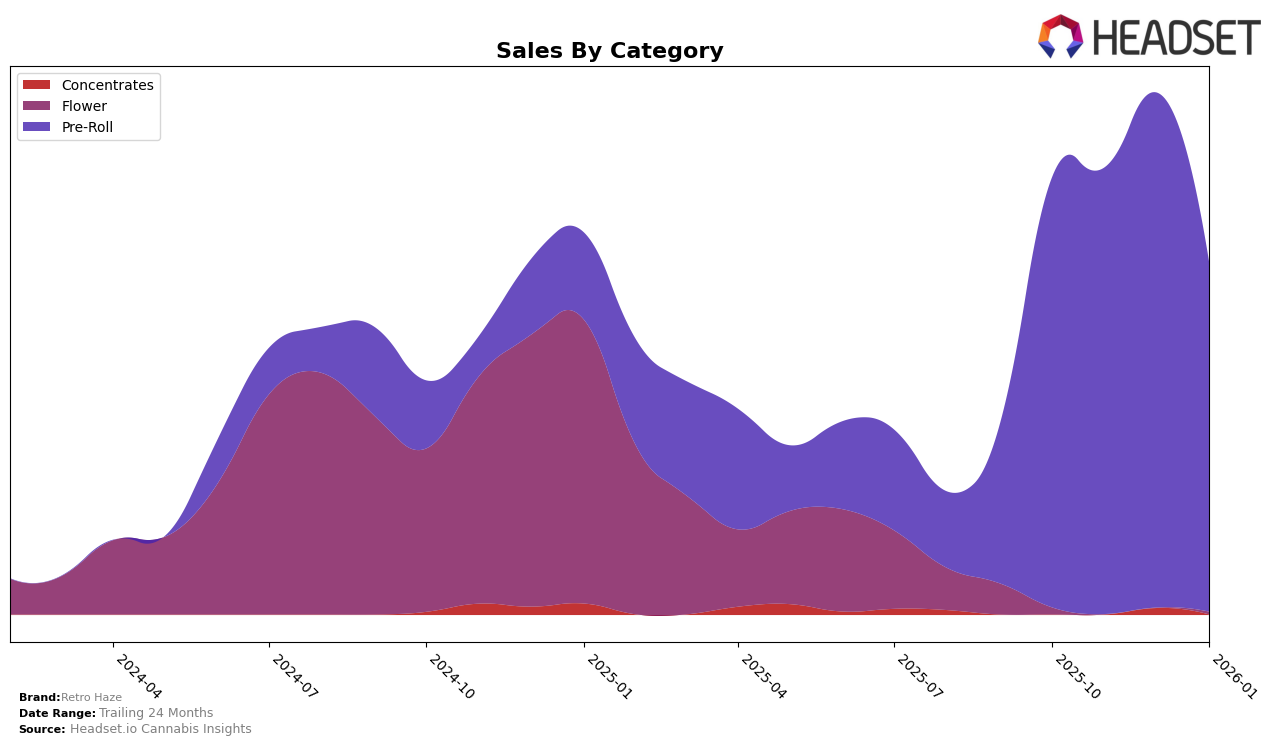

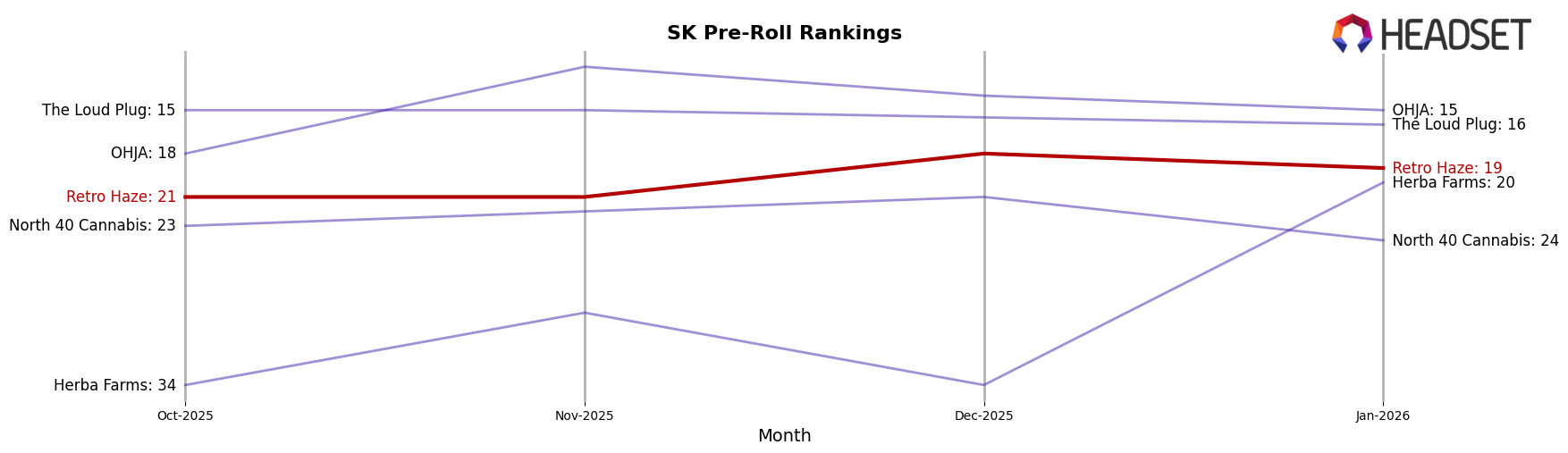

Retro Haze has shown a notable presence in the Pre-Roll category in Saskatchewan. Over the last few months, their ranking has experienced slight fluctuations, starting at 21st place in October 2025, maintaining this position in November, and then improving to 18th in December. However, there was a slight decline to 19th place in January 2026. This movement indicates that while Retro Haze has a stable position within the top 30, there is room for growth to climb higher in the rankings. The sales figures reveal a peak in December, suggesting a potential seasonal influence or successful marketing efforts during this period.

While Retro Haze's consistent appearance in the top 30 for the Pre-Roll category in Saskatchewan is commendable, the absence of rankings in other states or provinces suggests a limited geographical reach or varying competitive pressures in different markets. The brand's ability to maintain its position in a competitive category like Pre-Rolls highlights its appeal to consumers in this region. However, the decline in sales from December to January could be an area of concern, indicating potential challenges in sustaining momentum post-holiday season. Exploring strategies to enhance brand visibility and distribution in other regions could be beneficial for Retro Haze's growth trajectory.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Saskatchewan, Retro Haze has demonstrated a relatively stable yet slightly fluctuating performance in terms of rank and sales over the past few months. Retro Haze maintained its position at rank 21 in both October and November 2025, before climbing to rank 18 in December 2025, and then slightly dropping to rank 19 in January 2026. This indicates a competitive edge over brands like North 40 Cannabis, which consistently ranked lower, peaking at rank 21 in December 2025 before falling to rank 24 in January 2026. However, Retro Haze faces stiff competition from OHJA, which consistently outperformed it, peaking at rank 12 in November 2025. Despite these challenges, Retro Haze's sales saw a significant increase in December 2025, reflecting a potential seasonal boost or successful marketing strategy, although sales dipped in January 2026. This dynamic suggests that while Retro Haze is holding its ground, there is room for strategic improvements to climb higher in the rankings and sustain sales growth amidst strong competitors like The Loud Plug and OHJA.

Notable Products

In January 2026, Jack Herer Pre-Roll 3-Pack (1.5g) maintained its position as the top-selling product from Retro Haze, with sales reaching 4,168 units. Jack Herer (7g) rose to the second position in the Flower category, marking a significant improvement from its previous absence in the rankings. Heritage Hash (2g) had no sales data for January, indicating a potential drop in popularity compared to its second-place ranking in December 2025. Jack Herer Pre-Roll 5-Pack (2.5g) did not feature in the top ranks for January, after being third in December. Lemon Haze (3.5g), previously ranked in October, was not present in the January rankings, suggesting a shift in consumer preference or stock availability.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.