Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

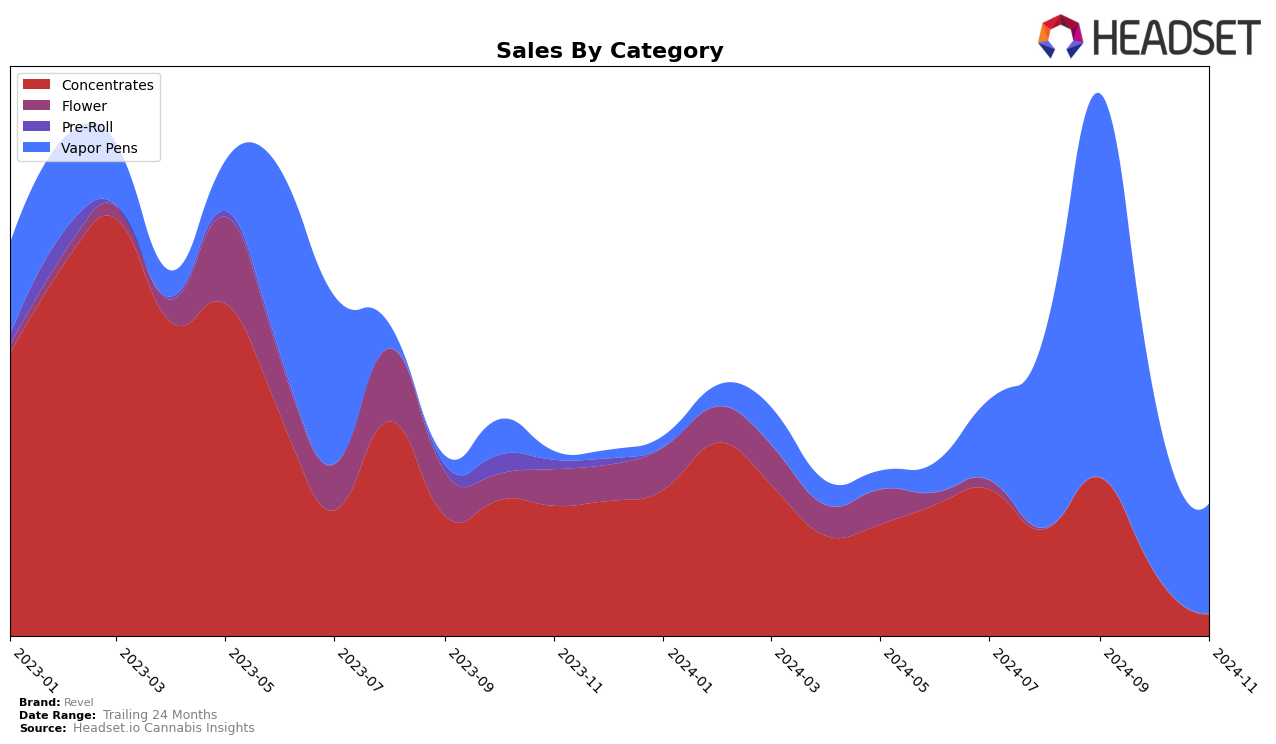

Revel's performance in the Ohio market shows a fluctuating presence across different product categories. In the Concentrates category, Revel saw a promising ascent in rankings from August to September 2024, moving from 19th to 15th place. However, by October, the brand slipped to 21st, and in November, it fell out of the top 30 entirely, indicating potential challenges in maintaining a strong foothold in this category. This decline might suggest increased competition or shifts in consumer preferences. Notably, the sales figures for Concentrates peaked in September, which could point to a temporary promotional success or seasonal demand that Revel might explore further.

In the Vapor Pens category, Revel's journey in Ohio appears more volatile. The brand started at 36th place in August, climbed to 26th in September, but then experienced a decline to 38th in October and further down to 42nd in November. This downward trend could be indicative of a need for strategic adjustments or innovations within this segment. Despite a significant sales spike in September, the subsequent months did not sustain this momentum, which may highlight a gap in consumer retention or product differentiation. Understanding these shifts and addressing them could be critical for Revel's future success in the Ohio market.

Competitive Landscape

In the Ohio Vapor Pens category, Revel has experienced notable fluctuations in its market position from August to November 2024. Starting in August at rank 36, Revel improved significantly to rank 26 in September, indicating a strong upward trend in sales performance. However, this momentum was not sustained, as Revel's rank slipped to 38 in October and further to 42 in November. This decline coincides with a decrease in sales, suggesting potential challenges in maintaining market share. In comparison, Standard Farms maintained a relatively stable presence, though it also experienced a downward trend from rank 27 in August to 39 in November. Meanwhile, Moxie and Meigs County Grown showed inconsistent rankings, with Moxie peaking at rank 34 in October and Meigs County Grown re-entering the top 50 in October after being absent in September. These dynamics highlight the competitive volatility in the Ohio Vapor Pens market, where Revel's initial gains were overshadowed by subsequent declines, emphasizing the need for strategic adjustments to regain and sustain a competitive edge.

Notable Products

In November 2024, the top-performing product for Revel was the Raspberry Lemonade Distillate Cartridge (0.5g) in the Vapor Pens category, securing the number one spot with sales of 342 units. The Girl Scout Cookies Distillate Cartridge (0.5g) also performed well, ranking second, an improvement from its fifth position in August. Trainwreck Distillate Cartridge (0.5g) followed closely at third place, though it was not ranked in previous months. The Raspberry Lemonade Distillate Cartridge (0.84g) dropped from second in October to fourth in November. Lastly, the Sativa RSO Syringe (0.84g) in the Concentrates category maintained a consistent presence, ranking fifth in November after being fourth and fifth in August and September, respectively.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.