Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

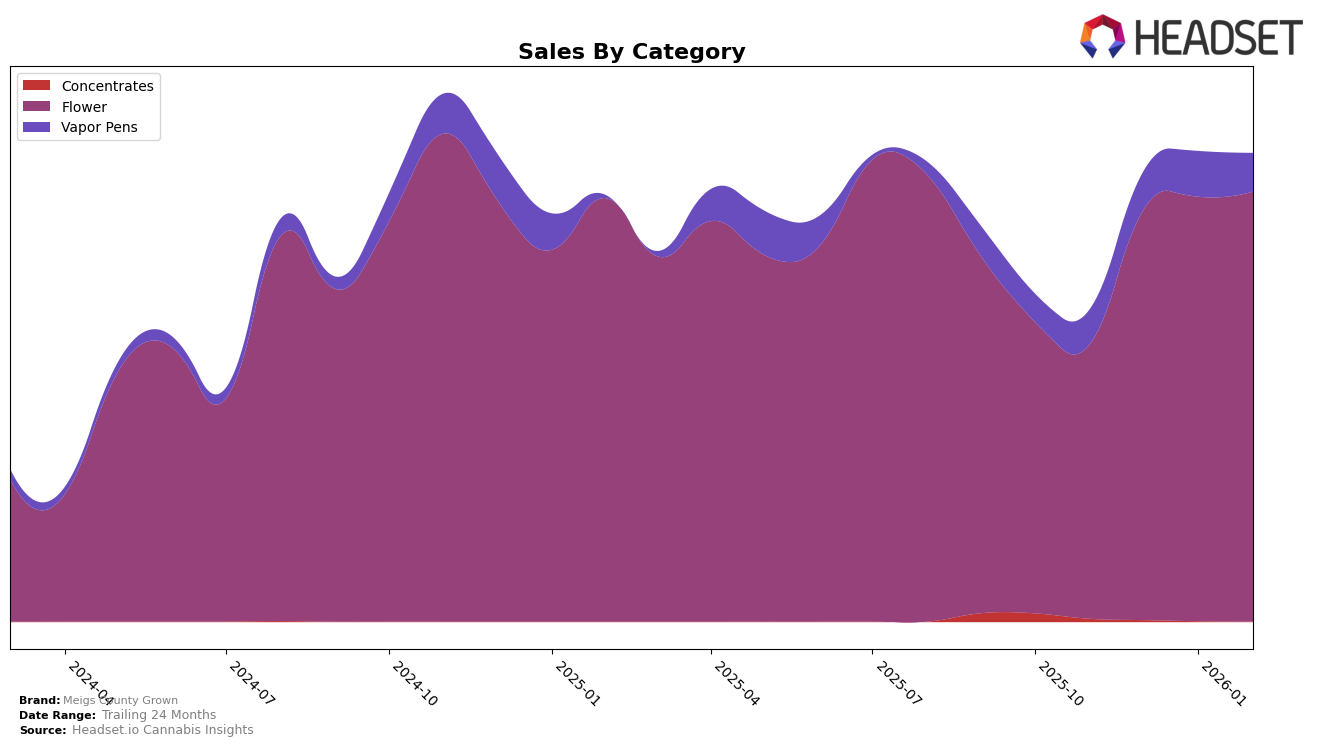

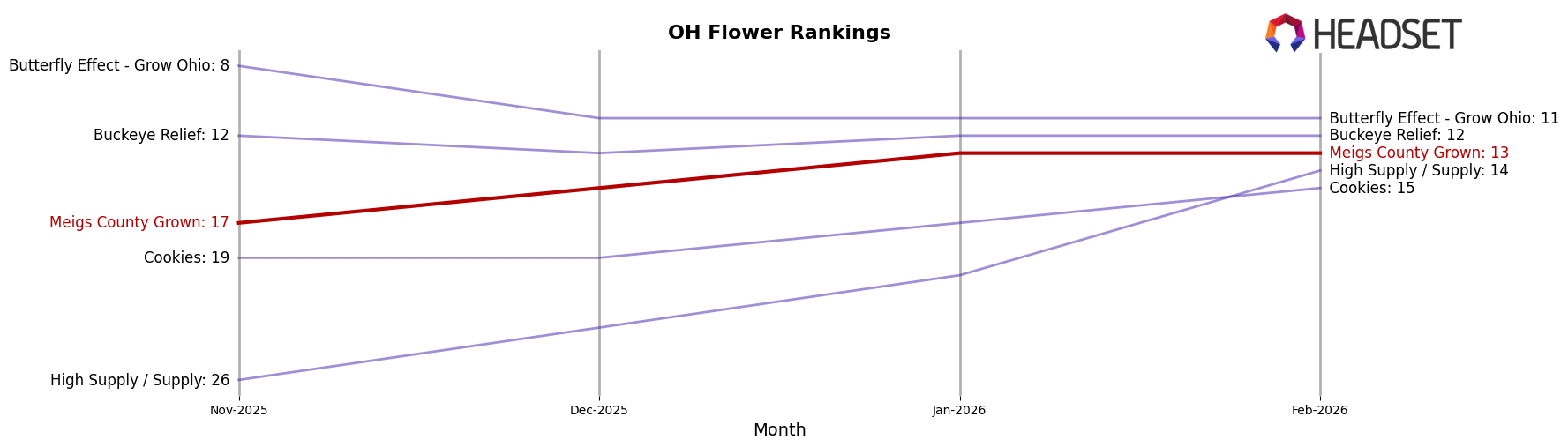

Meigs County Grown has shown a notable upward trajectory in the Ohio cannabis market, particularly in the Flower category. From November 2025 to February 2026, the brand has improved its ranking from 17th to 13th, indicating a strong performance and growing consumer preference. This steady climb is supported by a significant increase in sales, showcasing the brand's ability to capture market share and resonate with consumers. Such performance highlights Meigs County Grown's strategic positioning and potential for further growth within the state.

In contrast, the brand's performance in the Vapor Pens category within Ohio tells a different story. While there was a slight improvement from 38th in November 2025 to 32nd in January 2026, the brand did not maintain this momentum, slipping to 33rd in February 2026. This fluctuation suggests challenges in achieving consistent market penetration in this category. The absence of a top 30 ranking for several months indicates a need for strategic adjustments to better compete in the Vapor Pens space. Understanding these dynamics could be crucial for stakeholders looking to leverage Meigs County Grown's strengths while addressing areas of potential growth.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Meigs County Grown has shown a consistent upward trajectory in rankings, maintaining its position at 13th place from January to February 2026. This stability is noteworthy, especially when compared to Cookies, which improved its rank from 19th to 15th over the same period, and High Supply / Supply, which made a significant leap from 20th to 14th. Despite these competitors' gains, Meigs County Grown's sales have continued to grow, indicating strong consumer loyalty and market presence. Meanwhile, Buckeye Relief and Butterfly Effect - Grow Ohio have maintained higher ranks at 12th and 11th, respectively, but Meigs County Grown's sales growth suggests it is closing the gap in market share. This trend highlights Meigs County Grown's potential to further ascend the ranks if it continues its current trajectory.

Notable Products

In February 2026, the top-performing product for Meigs County Grown was Strawberry Guava (2.83g) in the Flower category, regaining its top rank after slipping to third place in January. It achieved sales of 2798 units, marking a significant increase from previous months. Garlic Drip (2.83g) also made a notable entry, securing the second position in its debut month. Cactus Cookies (2.83g) climbed to the third spot from fifth in January, showing a strong upward trend. Melted Strawberries (2.83g) and Pure Appalachia Cured Resin Cartridge (1g) rounded out the top five, with the latter maintaining its fifth-place ranking since its introduction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.