Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

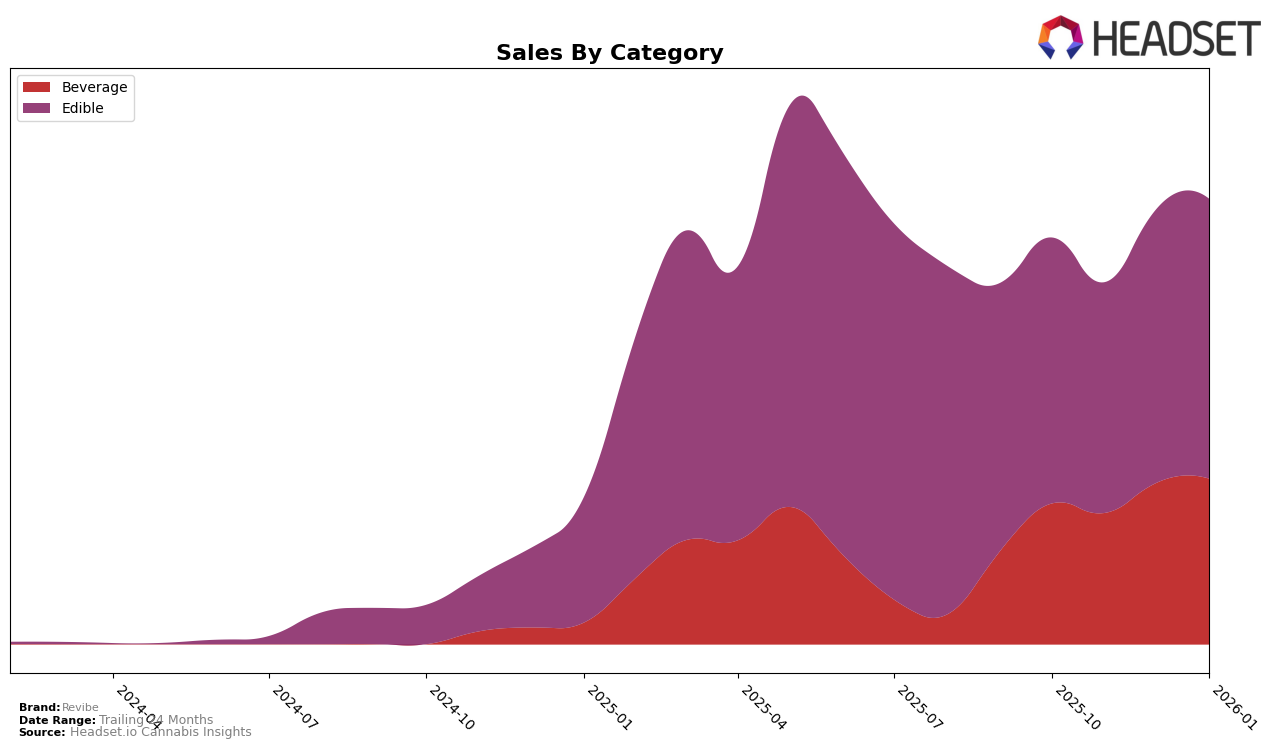

Revibe has demonstrated consistent performance in the Ohio market, particularly in the Beverage category where it has maintained a steady rank of 4th place from October 2025 to January 2026. This stability suggests a strong foothold and brand loyalty within the Ohio beverage market, despite fluctuations in monthly sales figures. The sales trajectory shows an upward trend, with a notable increase from November to January, indicating potential growth opportunities within this category. However, the Edible category presents a different picture, where Revibe's ranking has fluctuated between 15th and 19th over the same period. While the brand has managed to climb to 16th place by January 2026, the movement within these ranks highlights a more competitive landscape and potential challenges in gaining a stronger position.

In the Edible category, Revibe's sales have shown a positive trend, with a gradual increase from October 2025 to January 2026, suggesting that despite ranking challenges, there is a growing consumer interest or acceptance of their products. It's important to note that while Revibe has secured a position in the top 20, it has not yet broken into the top 10, which could be a strategic target for future growth. The absence of Revibe from the top 30 in other states or categories may indicate areas where the brand is either not present or not competitive enough, presenting both a challenge and an opportunity for expansion. Understanding these dynamics can offer insights into potential market strategies and areas for improvement.

Competitive Landscape

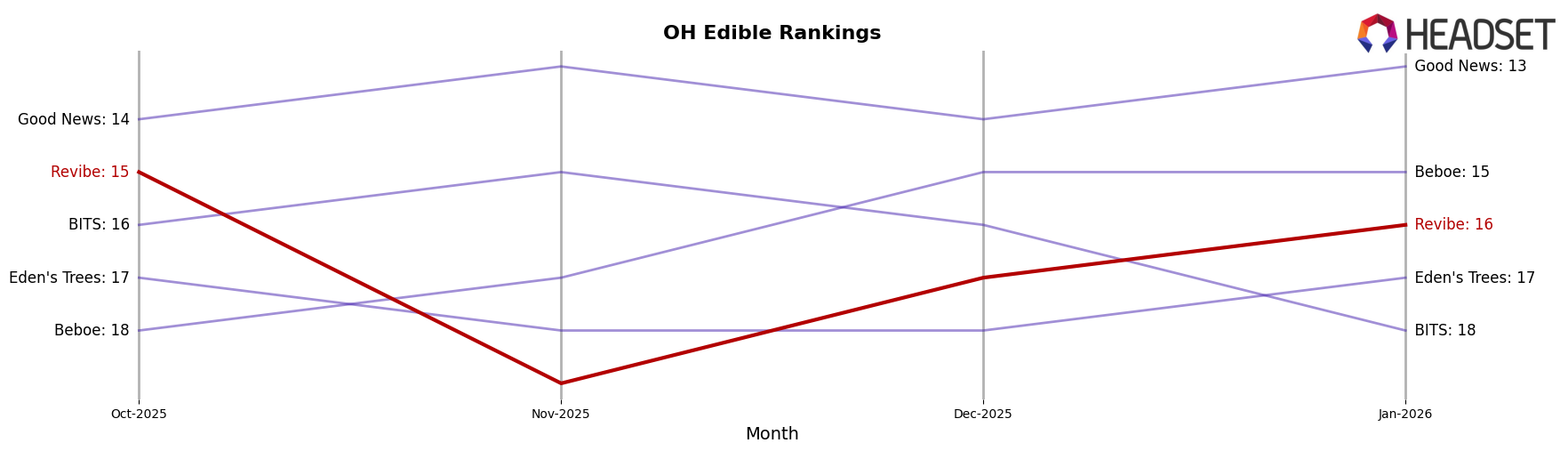

In the competitive landscape of the edible category in Ohio, Revibe has experienced fluctuations in its ranking and sales performance from October 2025 to January 2026. Notably, Revibe's rank dropped from 15th in October to 19th in November, before recovering to 16th by January. This volatility in rank suggests a competitive pressure from brands like Good News, which maintained a consistent presence in the top 14, and Beboe, which improved its rank from 18th to 15th over the same period. Despite these challenges, Revibe's sales showed a positive trend, rebounding from a dip in November to reach a higher level in January, indicating a resilience in consumer demand. Meanwhile, BITS and Eden's Trees also displayed competitive dynamics, with BITS experiencing a decline in rank and sales in January, which may provide an opportunity for Revibe to capitalize on shifting consumer preferences in the Ohio market.

Notable Products

In January 2026, Blue Razzberry Drink reclaimed its top position among Revibe products, achieving the highest sales figure of 1721 units, a significant increase from its previous rankings in November and December. Tropical Mango Drink followed closely in second place, marking a consistent rise from its fourth position in October 2025. Watermelon Drink, which held the first position in December, dropped to third place in January, indicating a slight dip in its sales momentum. Summer Melon High Dose Gummies made an impressive entry into the rankings at fourth place, having not been ranked in the previous months. Sour Blue Razzberry Gummies also appeared for the first time, securing the fifth position, showcasing a growing interest in Revibe's edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.