Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

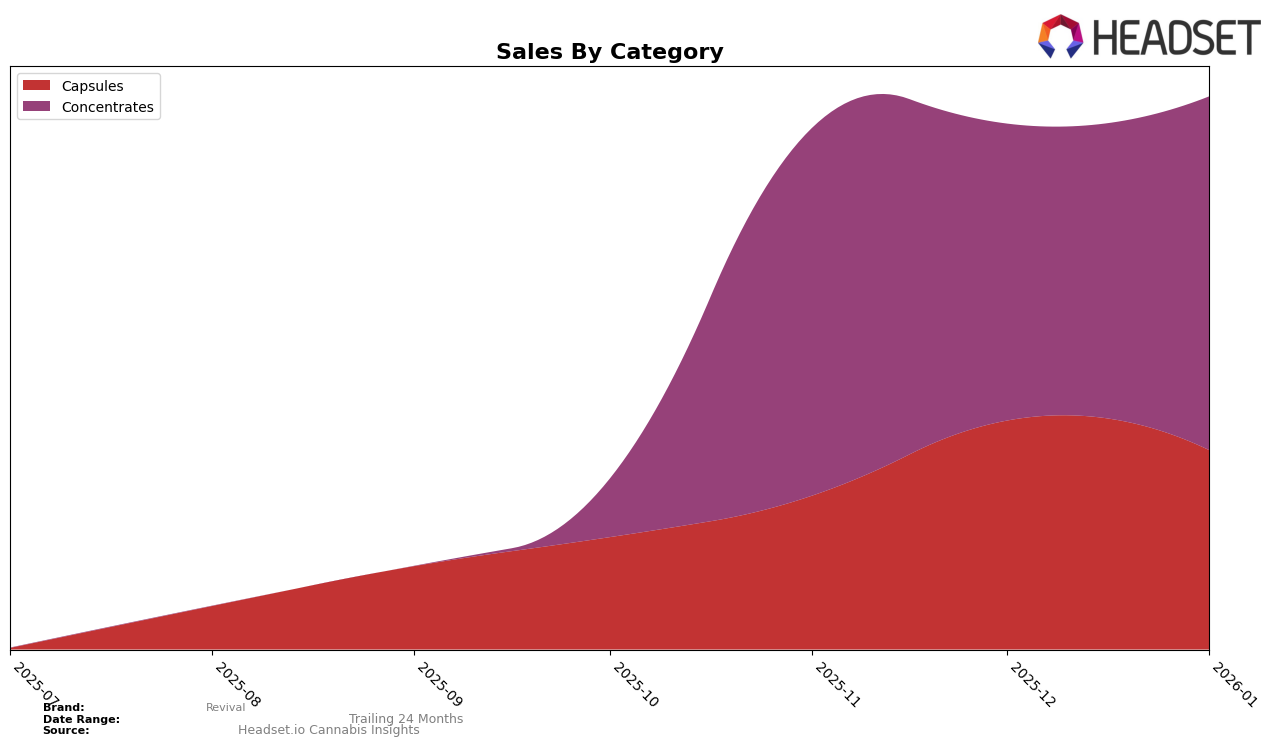

Revival's performance in the Concentrates category in New York has shown some fluctuations over the recent months. Notably, the brand did not make it into the top 30 rankings in October 2025, which suggests a challenging market presence during that period. However, Revival's subsequent rankings, although outside the top 30, indicate a slight but consistent presence, with positions at 37, 39, and 38 from November 2025 to January 2026. This consistency outside the top 30 may point to a stable niche market or a slow but steady recovery in the New York Concentrates sector.

Examining the sales figures, there was a noticeable decline from October to November 2025, but an upward trend was observed in December 2025 and January 2026. This suggests a potential rebound in consumer interest or strategic adjustments by the brand that are beginning to pay off. Despite not breaking into the top 30, the increase in sales towards the end of the period could be indicative of effective marketing strategies or product improvements that are resonating with consumers. Overall, while Revival faces challenges in achieving top-tier status, its recent sales trajectory provides a glimmer of optimism for its future performance in the New York market.

Competitive Landscape

In the New York concentrates market, Revival has shown a fluctuating performance in the rankings from November 2025 to January 2026. Starting at 37th place in November, Revival dropped to 39th in December before slightly improving to 38th in January. This indicates a competitive struggle, especially when compared to brands like Veterans Choice Creations (VCC), which maintained a stronger presence with a peak at 27th in October and a consistent performance around the 30th rank. Meanwhile, High Peaks and Vireo also pose significant competition, with Vireo showing a steady climb from 42nd to 40th place. Despite these challenges, Revival's sales figures show resilience, with a notable recovery in January after a dip in December, suggesting potential for growth if strategic adjustments are made to enhance market positioning.

Notable Products

In January 2026, Revival's top-performing product was Papaya Bomb Live Rosin (1g) in the Concentrates category, maintaining its first-place ranking from the previous months with sales of 217 units. The CBD/THC 1:1 Charge Tablets 20-Pack (100mg CBD, 100mg THC) in the Capsules category held the second position, moving up from its third-place ranking in December 2025 with notable sales figures of 110 units. The CBN/CBD/THC 2:1:1 Drift Tablet 20-Pack (200mg CBN, 100mg CBD, 100mg THC) dropped to third place from second in the previous month, with 88 units sold. The CBD/THC 4:1 Ignite Tablets 20-Pack (400mg CBD, 100mg THC) consistently remained in fourth place across the months. A new entry, Papaya Bomb Live Hash Rosin (1g), debuted at fifth place in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.