Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

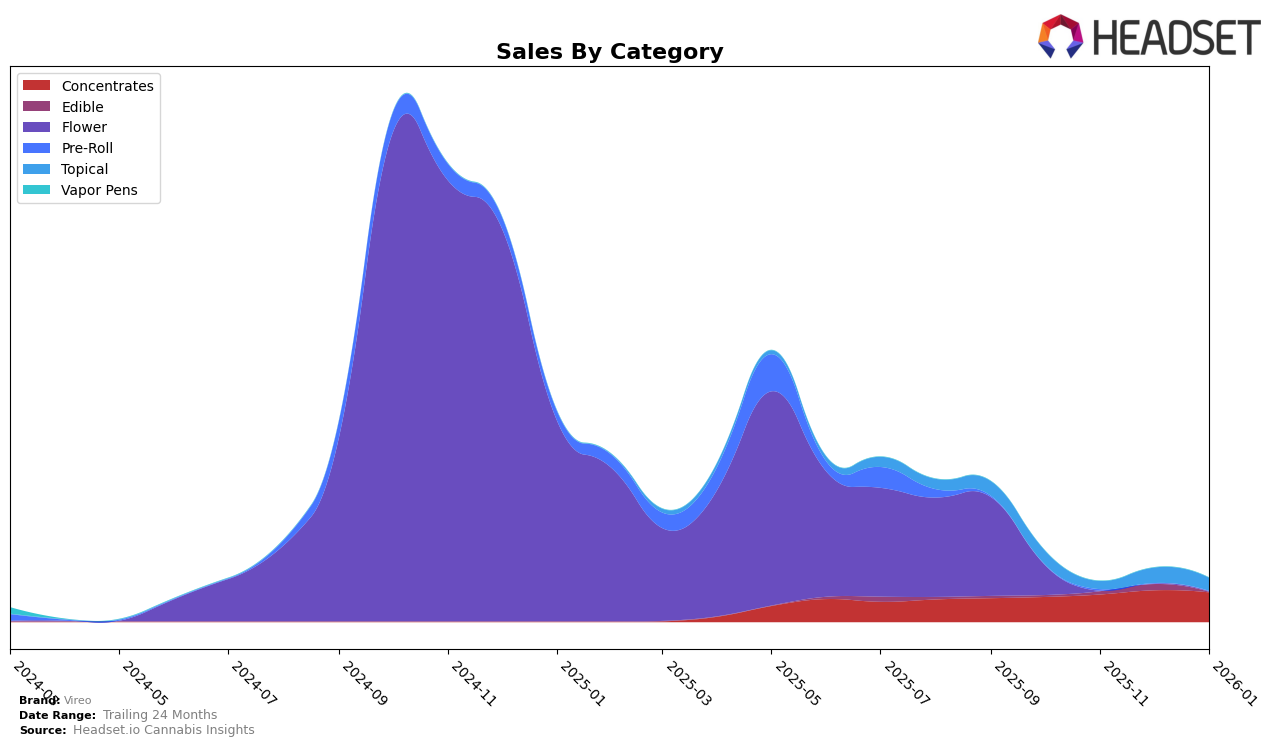

Vireo's performance in the New York market, specifically within the concentrates category, has shown a gradual upward trend over the recent months. While the brand was not ranked in the top 30 in October 2025, it managed to climb to the 42nd position in November, improving slightly to 41st in December, and further to 40th by January 2026. This consistent improvement suggests a positive reception and growing market presence for Vireo's concentrates in New York. However, the absence from the top 30 highlights the competitive nature of the market, indicating that while there is progress, significant strides are still needed to break into the leading ranks.

The sales figures for Vireo's concentrates in New York reflect this upward trajectory, with a notable increase from $10,071 in November to $11,605 in December, before slightly dipping to $10,834 in January. This fluctuation in sales aligns with the brand's gradual ranking improvement, suggesting that while there is growing interest, market volatility remains a challenge. The absence from the top 30 in October underscores the initial hurdles Vireo faced, but the subsequent months' data indicates a strategic push towards capturing a larger market share. The incremental progress in rankings and sales points to a developing momentum that could potentially position Vireo more competitively in the coming months.

```Competitive Landscape

In the competitive landscape of the New York concentrates market, Vireo has shown a steady climb in rankings from November 2025 to January 2026, moving from 42nd to 40th position. This upward trend is noteworthy, especially when compared to competitors like Revival, which maintained a slightly better but stable ranking in the high 30s during the same period. Despite Vireo's lower sales figures, the brand's consistent improvement in rank suggests a positive reception and growing market presence. Meanwhile, High Peaks experienced a decline from 30th to 37th, indicating potential challenges in maintaining its earlier market position. Vireo's strategic movements in the market could be capitalizing on the fluctuations of its competitors, positioning itself for further growth in the coming months.

Notable Products

In January 2026, the Sativa RSO Syringe (1g) emerged as the top-performing product for Vireo, maintaining its number one rank from November 2025 and showing strong sales of 112 units. The CBD/THC 1:19 Red Balm (5mg CBD, 95mg THC, 1.5oz) climbed to second place, a notable rise from its fourth rank in November, with a significant increase in sales. The Indica RSO Syringe (1g) entered the rankings in third place, despite not being ranked in the previous two months, indicating a resurgence in popularity. The Hybrid RSO Syringe (1g) saw a decline, dropping to fourth place after previously holding the second rank in November. Finally, the CBD/THC 1:1 Green Balm (25mg CBD, 25mg THC) remained stable in fifth place, consistent with its ranking in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.