Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

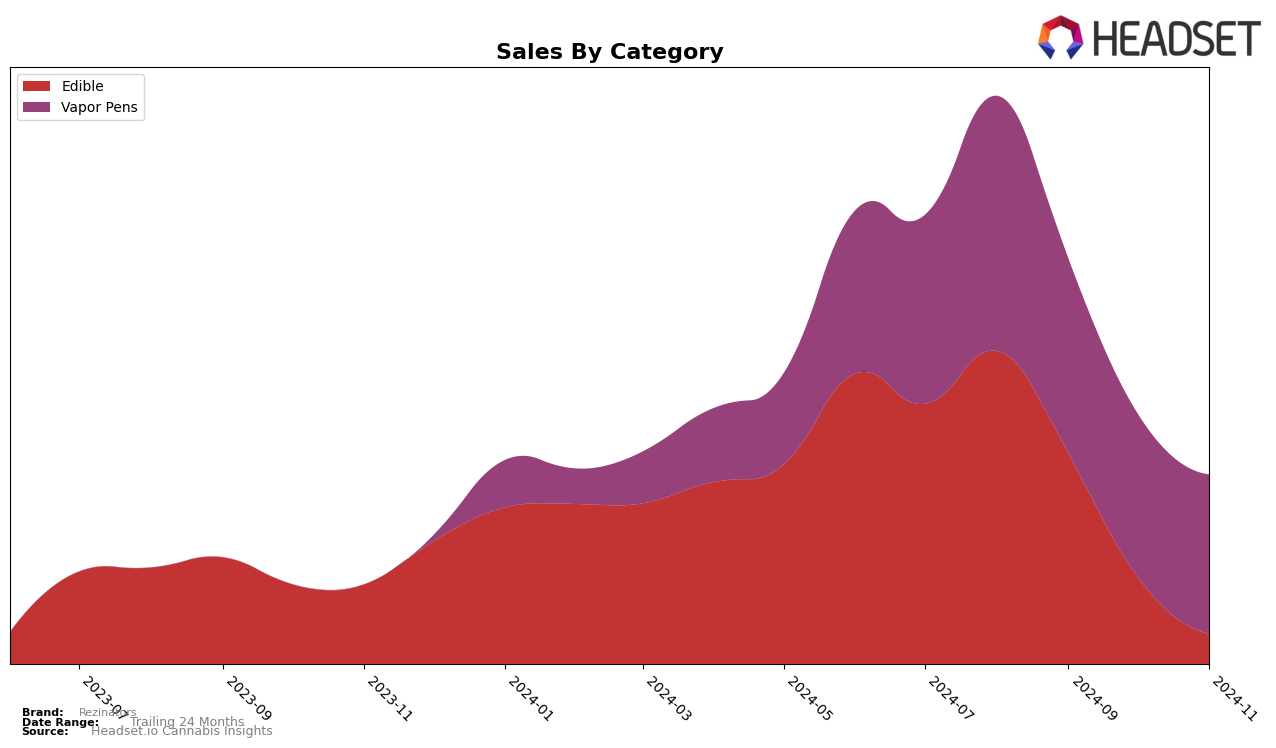

Rezinators experienced a noticeable shift in their performance across categories in New York over recent months. In the Edible category, their ranking declined from 11th in August 2024 to 36th by November 2024, indicating a significant drop in their market position. This decline is mirrored by a decrease in sales, with a notable drop from August's figures to November's. On the other hand, the Vapor Pens category showed more stability, with Rezinators maintaining a presence within the top 30, albeit with a slight decline from 25th to 30th over the same period. This suggests that while they are struggling to maintain a strong foothold in Edibles, they are managing to hold their ground in Vapor Pens, albeit at the lower end of the rankings.

The performance of Rezinators in New York highlights the challenges they face in sustaining their market presence across different categories. Their drop out of the top 30 in the Edibles category by November is a significant setback, suggesting a need for strategic adjustments to regain competitiveness. Meanwhile, their ability to remain within the top 30 in Vapor Pens, despite a slight downward trend, indicates potential for stability or growth if they can address underlying issues. The contrasting performances across these categories underscore the importance of targeted strategies tailored to the unique dynamics of each market segment.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Rezinators has experienced a notable shift in its market position from August to November 2024. Initially ranked 25th in August, Rezinators saw a gradual decline to 30th by November. This downward trend in ranking is mirrored by a consistent decrease in sales over the same period. In contrast, Jetty Extracts and OMO - Open Minded Organics have shown resilience, with Jetty Extracts improving its rank from 31st in August to 28th in November, and OMO - Open Minded Organics climbing from 36th to 29th. These competitors have managed to either maintain or slightly increase their sales, indicating a potential shift in consumer preference that Rezinators may need to address. Additionally, Cookies has maintained a relatively stable position, fluctuating slightly but remaining close to Rezinators in rank, suggesting a tightly contested market segment. This competitive analysis highlights the need for Rezinators to reassess its market strategies to regain its earlier momentum and address the challenges posed by these competing brands.

Notable Products

In November 2024, Rezinators' Rated R Live Rosin Cartridge (0.5g) emerged as the top-performing product, maintaining its number one rank from October with sales reaching 1598 units. The Banana Ghost Live Rosin Cartridge (0.5g) climbed to the second position, improving from its third-place ranking in October. Agent Orange Live Rosin Cartridge (0.5g) made a notable entry into the rankings, securing the third spot. Lemosa Live Rosin Cartridge (0.5g) advanced to fourth place, up from fifth in October. Meanwhile, the Fruit Punch Gummies 10-Pack (100mg) experienced a significant drop, falling to fifth place from second in the previous month, indicating a shift in consumer preference towards vapor pens.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.