Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

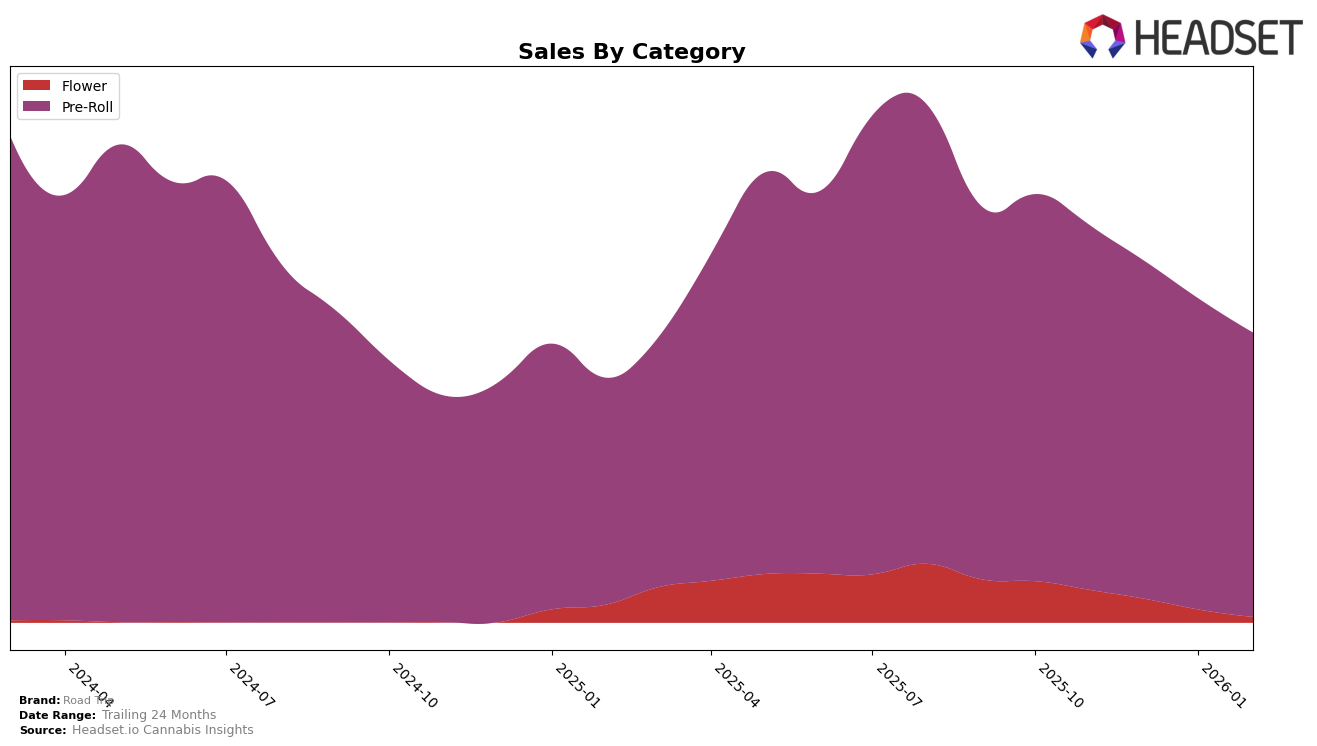

In the Michigan market, Road Trip's performance in the Pre-Roll category has experienced some fluctuations over the past few months. Starting at rank 19 in November 2025, the brand saw a minor improvement to rank 17 by December, before slipping back to rank 19 in January and further down to rank 21 in February 2026. This downward trend is accompanied by a decline in sales from $484,246 in November to $318,722 by February. Such a descent in rankings and sales could indicate increased competition or shifting consumer preferences in Michigan's Pre-Roll segment.

Conversely, in New Jersey, Road Trip has made significant strides in the Pre-Roll category, moving from rank 68 in November to a more favorable rank 35 by February 2026. This upward trajectory is notable, especially considering the brand was not in the top 30 for the initial months, signaling a substantial improvement in market presence. The sales figures mirror this positive movement, with an increase from $27,907 in November to $82,072 in February, suggesting a successful strategy or product reception in New Jersey. This contrast between Michigan and New Jersey highlights the varying market dynamics and opportunities across different states for Road Trip.

Competitive Landscape

In the competitive landscape of Michigan's Pre-Roll category, Road Trip has experienced fluctuations in its market position, notably dropping from 19th in November 2025 to 21st by February 2026. This decline in rank is indicative of a challenging market environment, where competitors like Goldkine and Giggles have shown more resilience. Goldkine, for instance, improved its rank from 16th to 19th over the same period, while Giggles made a significant leap from 34th to 20th. Meanwhile, Canapa Valley Farms and My Friend have also been climbing the ranks, suggesting a dynamic and competitive market. These shifts highlight the importance for Road Trip to innovate and adapt its strategies to regain its footing and boost sales, as competitors are not only maintaining but enhancing their market positions.

Notable Products

In February 2026, the top-performing product for Road Trip was Crunch Berries Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position from previous months with sales reaching 9,672 units. Grape Sherb Pre-Roll (1g) entered the rankings for the first time, securing the second position. Moonbow #112 Pre-Roll (1g) also made its debut, ranking third. Sour Tangy Phoenix Pre-Roll (1g) dropped from second place in January to fourth in February, with sales declining to 5,878 units. Don Mega Pre-Roll (1g) completed the top five, appearing in the rankings for the first time this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.