Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

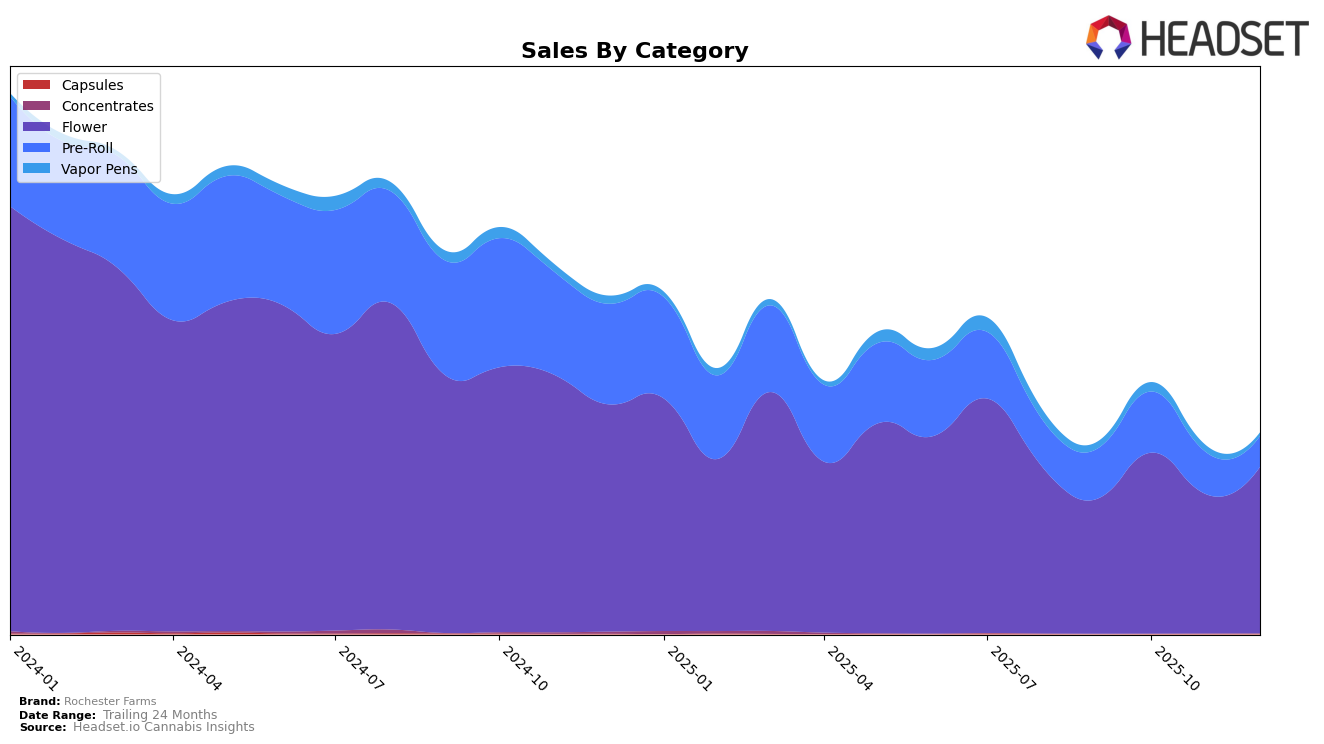

Rochester Farms has shown a dynamic performance across different categories and states. In the Washington market, their presence in the Flower category has seen some fluctuations over the last few months of 2025. Notably, Rochester Farms improved their ranking from 94th in September to 65th in October, indicating a significant upward movement. However, the brand experienced a slight dip in November, dropping to 86th, before recovering to 76th in December. This variability suggests that while Rochester Farms has the potential to climb the ranks, maintaining a consistent position in the top 30 remains a challenge, as they have not yet broken into that upper echelon.

The sales figures for Rochester Farms in the Washington market reflect a similar trend of fluctuation. For instance, their sales peaked in October before experiencing a decrease in November, only to rise again in December. This pattern suggests that while there is a positive trajectory overall, the brand's performance is subject to market dynamics and consumer preferences that may vary month-to-month. Not being listed in the top 30 for any month highlights the competitive nature of the market and the need for strategic adjustments to secure a more stable and prominent position.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Rochester Farms has experienced notable fluctuations in its rank over the last few months of 2025. Starting from a rank of 94 in September, Rochester Farms improved significantly to 65 in October, before dropping to 86 in November and then slightly recovering to 76 in December. This volatility indicates a dynamic market environment where Rochester Farms is striving to maintain its position amidst strong competition. Brands like Dog House and O'Geez (WA) have shown more consistent performance, with O'Geez (WA) notably climbing to a rank of 64 in December. Meanwhile, Zen Cannabis saw a decline from 62 in October to 85 in December, suggesting potential opportunities for Rochester Farms to capitalize on shifting consumer preferences. Despite these challenges, Rochester Farms' sales figures reflect a resilient demand, particularly with a substantial increase in October, indicating that strategic adjustments could further enhance its competitive standing.

Notable Products

In December 2025, Rochester Farms' top-performing product was Purple Punch (3.5g) in the Flower category, which climbed to the number one spot with sales reaching 297 units. Purple Pineapple Express (3.5g) followed closely, securing the second position. Purple Punch (7g) also showed a strong performance, moving up to third place from its previous absence in the top ranks. Forbidden Fruit (3.5g) experienced a slight drop, falling to fourth place from its second position in November. Kong Glue (3.5g) maintained its presence in the rankings, reappearing in fifth place after a previous absence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.