Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

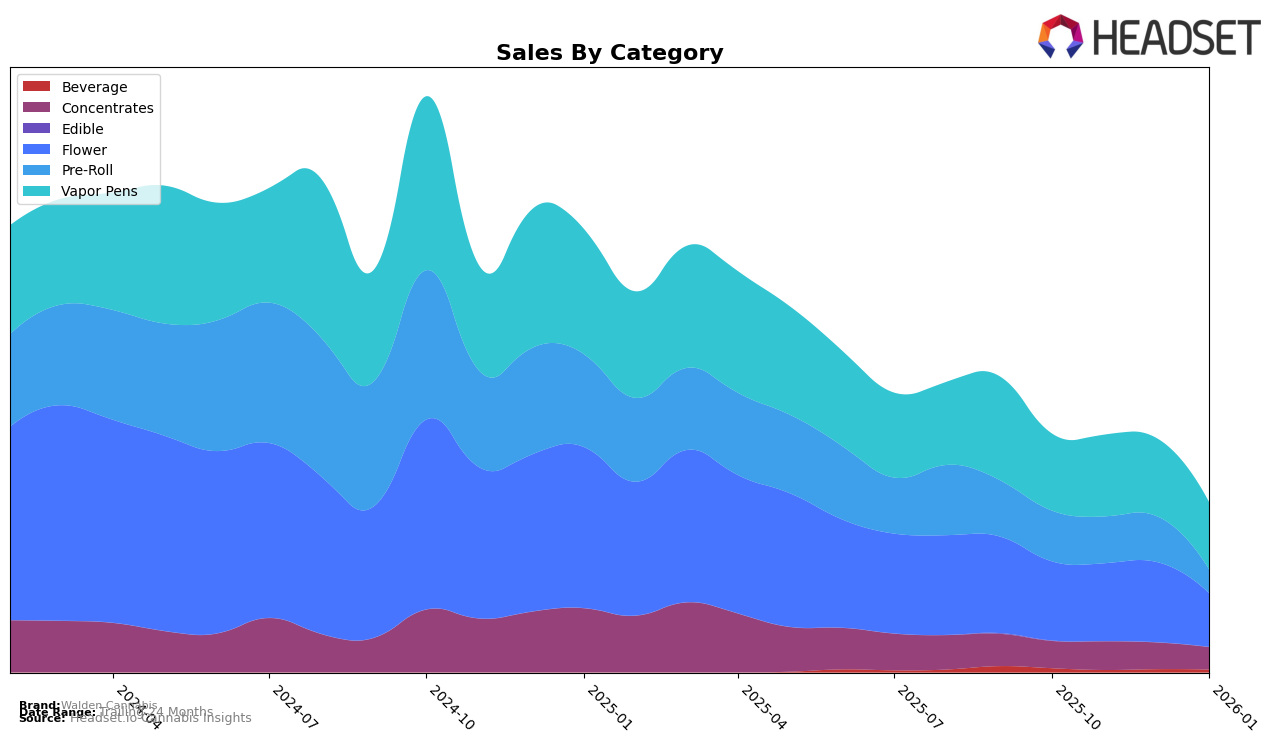

Walden Cannabis has shown varied performance across different product categories within the state of Washington. In the Concentrates category, the brand experienced a gradual decline in rankings from October 2025 to January 2026, moving from 80th to 88th place. This downward trend is coupled with a decrease in sales, highlighting potential challenges in maintaining market share. On the other hand, the Vapor Pens category displayed a more stable performance, with rankings fluctuating slightly but remaining within the top 70. The sales trend in this category suggests a stronger foothold compared to Concentrates.

In the Flower category, Walden Cannabis did not secure a position within the top 30 rankings by January 2026, indicating potential difficulties in competing with other brands in this segment. Despite this, the sales figures for October through December 2025 show a slight increase, suggesting that while they are not leading, there is still consumer interest. Similarly, the Pre-Roll category saw consistent rankings in the low 80s up to December 2025, yet the absence of a ranking in January 2026 could point to increased competition or shifting consumer preferences. These insights underscore the dynamic nature of the cannabis market in Washington and the need for brands like Walden Cannabis to adapt to changing market conditions.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Walden Cannabis has shown a steady presence, maintaining a rank within the top 70 brands over the past few months. Notably, Walden Cannabis improved its rank from 63rd in October 2025 to 64th by January 2026, indicating a slight upward trend in market performance. This is significant when compared to SubX, which saw a decline from 60th to 69th in the same period, suggesting a potential opportunity for Walden Cannabis to capture market share from competitors experiencing a downturn. Meanwhile, Heylo demonstrated a more volatile trajectory, climbing from 71st to 61st, which could pose a competitive challenge if their upward trend continues. Additionally, Stingers consistently outperformed Walden Cannabis, maintaining a rank in the high 50s, which highlights the need for strategic initiatives to close the gap with higher-ranked competitors. Overall, while Walden Cannabis has shown resilience, the dynamic shifts among competitors underscore the importance of strategic positioning to enhance its market standing in the vapor pen category.

Notable Products

In January 2026, Walden Cannabis's top-performing product was Northern Lights #5 Distillate Cartridge (1g) in the Vapor Pens category, maintaining its position as the best-seller for four consecutive months despite a drop to 389 units sold. Jack Herer Distillate Cartridge (1g) consistently held the second rank throughout the same period, showing stable sales performance. White Widow Distillate Cartridge (1g) rose from fourth place in December 2025 to third place in January 2026, indicating a positive sales trend. Gelato Distillate Cartridge (1g) reappeared in the rankings at fourth place after not being ranked in December. Maui Wowie Distillate Cartridge (1g) maintained its fifth position, showcasing steady demand despite fluctuating sales in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.