Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

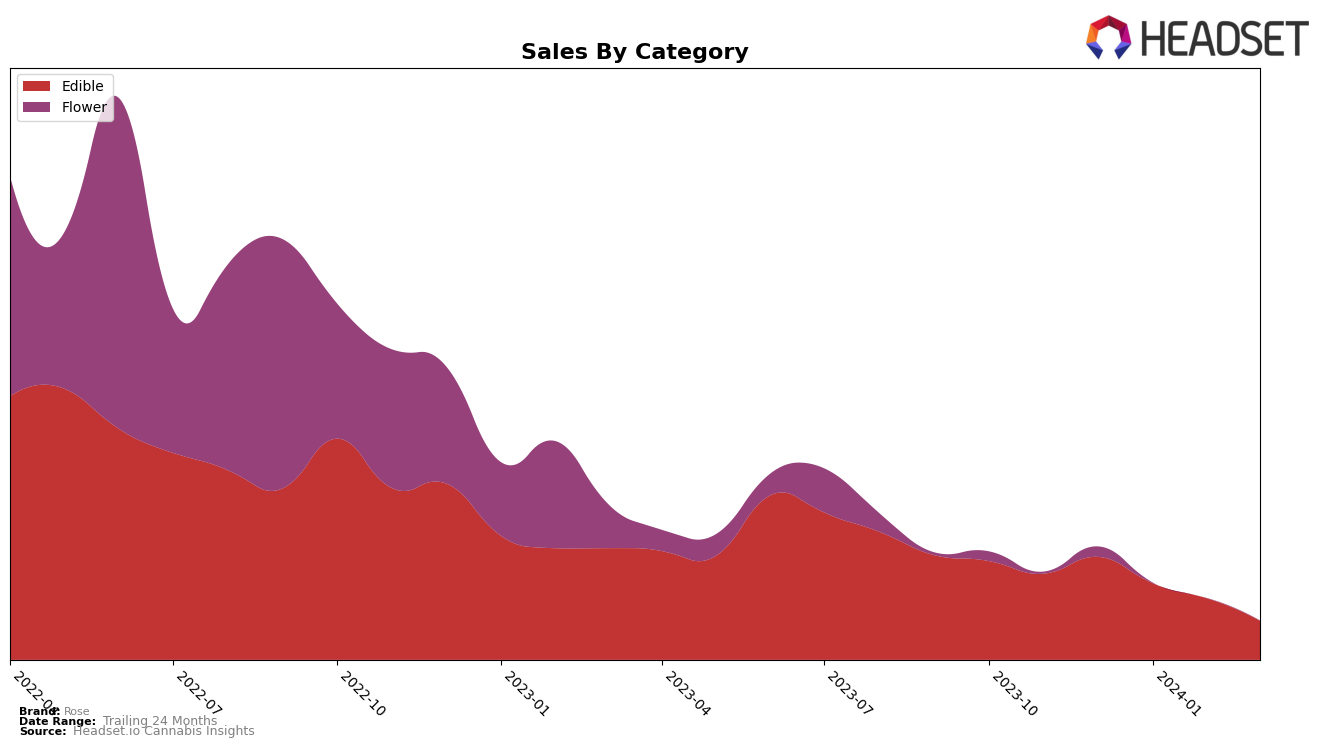

In the edible category, Rose's performance demonstrates a notable trend across two major markets, California and New York. In California, the brand has experienced a gradual decline in its ranking from December 2023 to March 2024, moving from the 53rd to the 60th position. This downward trajectory is mirrored in its sales figures which saw a significant drop from $54,880 in December 2023 to $22,568 by March 2024. Conversely, in New York, while the brand also saw a decline in rankings from 17th to 30th place over the same period, the movement indicates a competitive but challenging market presence. The decline in rankings in both states suggests a need for strategic adjustments to counteract market pressures and consumer preferences shifting away from Rose's edible offerings.

The contrasting performance of Rose in these states offers valuable insights into its market dynamics and consumer appeal. The steeper ranking decline in the highly competitive California market could indicate more intense competition or possibly a shift in consumer preferences within the edibles category. In New York, despite the decline, maintaining a position within the top 30 highlights a consistent market presence, albeit with room for improvement. The sales data, particularly the notable decrease in California, underscores the urgency for Rose to innovate or reposition its edibles to regain traction and consumer interest. These trends point towards the importance of market-specific strategies for Rose, suggesting that what may work in one state may not necessarily translate to success in another, underscoring the nuanced nature of consumer behavior across different regions.

Competitive Landscape

In the competitive landscape of the edible cannabis market in California, Rose has shown a notable performance amidst its competitors. Despite a slight decline in rank from 53 in December 2023 to 60 in March 2024, Rose has maintained a significant lead in sales over other brands like Korova, Raw Garden, Cookies, and Habit. Notably, Rose's sales in December 2023 were substantially higher than those of its closest competitors, showcasing its strong market presence. However, there has been a downward trend in sales from December 2023 to March 2024, indicating potential challenges in maintaining its lead. This trend is crucial for Rose as it navigates the competitive dynamics of the market, with competitors like Cookies and Raw Garden showing resilience in rankings and sales over the same period. The fluctuating ranks and sales of these brands highlight the competitive nature of California's edible cannabis market, emphasizing the importance of strategic positioning and innovation for Rose to sustain and enhance its market share.

Notable Products

In March 2024, Rose's top-selling product was the CBD/THC 1:4 Deep Sleep Holy Tonic Gummies 20-Pack (20mg CBD, 100mg THC) from the Edible category, maintaining its number one rank from previous months with sales figures reaching 313 units. The second-place product was the Apple Ume Ginger Gummies 20-Pack (100mg), which saw a significant rise from the 5th position in February to 2nd in March. The Apple Ume Ginger Flower Rosin Delights 20-Pack (200mg CBD) held steady in the third rank across January, February, and March, showcasing consistent consumer preference. The Deep Sleep Rose Farm Holy Tonic Flower Rosin Delights 20-Pack (100mg) also maintained a consistent rank, staying in 4th place throughout the first quarter of 2024. Notably, the CBD/THC 1:1 California Mango Delights Gummies 20-Pack (50mg CBD, 50mg THC) experienced a decline, dropping from second to fifth place in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.