Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

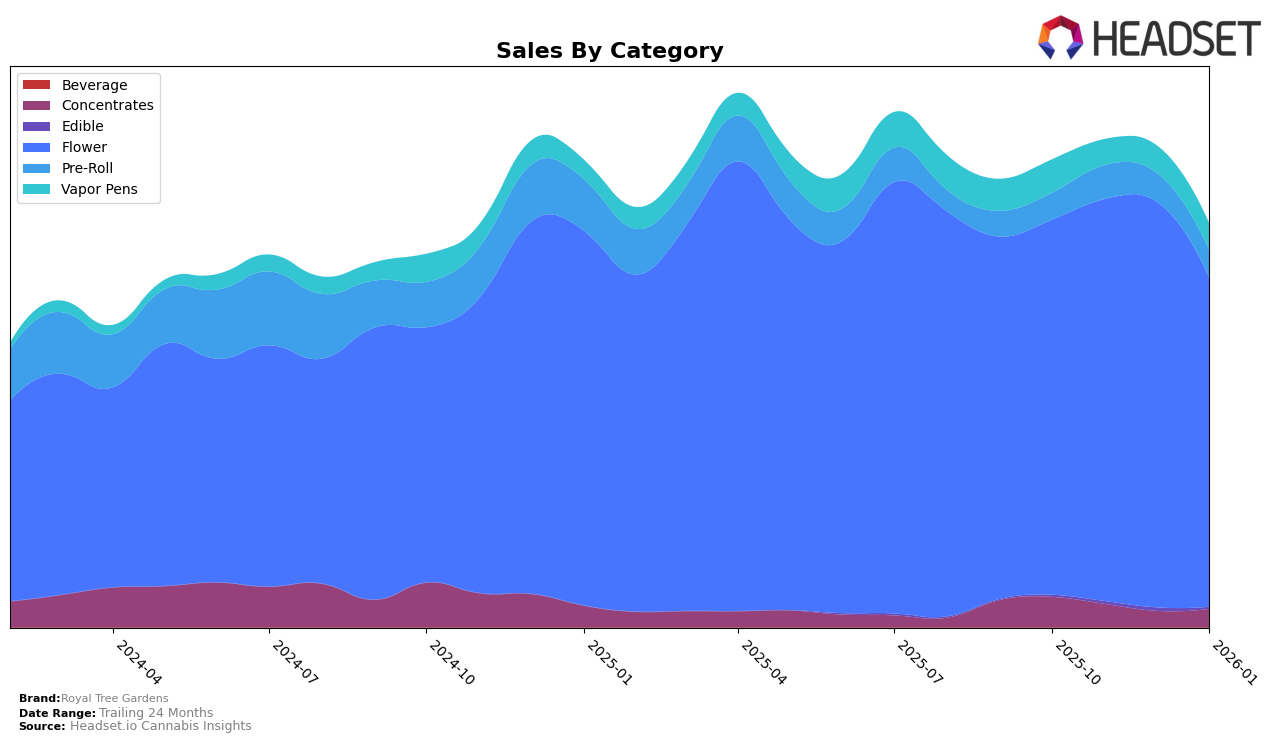

Royal Tree Gardens has shown varying performance across different categories in Washington. In the Concentrates category, the brand has struggled to break into the top 30, with rankings hovering around the 90s in recent months. This indicates a challenging position in a competitive market segment, as they have not managed to secure a top spot over the past few months. Conversely, in the Flower category, Royal Tree Gardens has demonstrated more robust performance, consistently ranking in the top 20. This suggests a stronger foothold in the Flower segment, with a noticeable peak in December 2025, where they reached the 13th position.

In the Pre-Roll category, Royal Tree Gardens has faced difficulties maintaining a consistent ranking. They were not in the top 30 for October and December 2025, and only appeared at the 99th position in November 2025, dropping back to 100th in January 2026. This inconsistency might suggest a need for strategic adjustments to enhance their presence in this category. Overall, while Royal Tree Gardens exhibits strength in the Flower category, their performance in Concentrates and Pre-Rolls indicates room for growth and improvement to achieve a more balanced market presence across categories.

Competitive Landscape

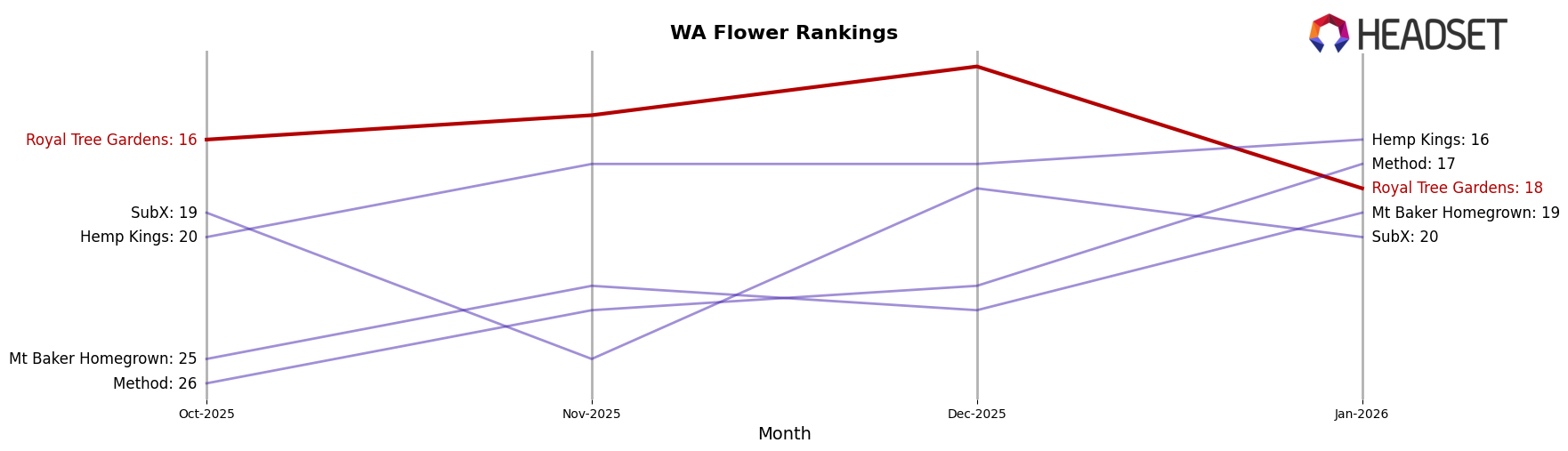

In the Washington Flower category, Royal Tree Gardens has experienced fluctuating rankings over the past few months, indicating a dynamic competitive landscape. Starting from October 2025, Royal Tree Gardens held the 16th position, improving to 15th in November, and further to 13th in December, before dropping to 18th in January 2026. This decline in January could be attributed to the rising performance of competitors like Method, which jumped from 26th in October to 17th in January, showcasing a significant upward trend. Meanwhile, Hemp Kings consistently improved its position, reaching 16th in January, directly impacting Royal Tree Gardens' rank. Despite these challenges, Royal Tree Gardens' sales peaked in December, suggesting strong consumer demand during that period, although the subsequent drop in January highlights the need for strategic adjustments to regain momentum. Competitors such as SubX and Mt Baker Homegrown also show varied performance, with SubX experiencing a decline in rank and sales, while Mt Baker Homegrown shows a steady increase, potentially indicating shifts in consumer preferences within the market.

Notable Products

In January 2026, Middlefork (3.5g) continued its reign as the top-performing product for Royal Tree Gardens, maintaining its number one rank from December 2025 and achieving sales of 1167 units. Cheetah Piss (3.5g) surged to the second position, marking a significant improvement from its fifth rank in November 2025. Khalifa Mints (3.5g) entered the rankings for the first time, securing the third position. Mojito (3.5g) remained steady in fourth place, consistent with its December 2025 ranking. Wedding Pie (3.5g) debuted in the rankings at fifth place, rounding out the top performers for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.