Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

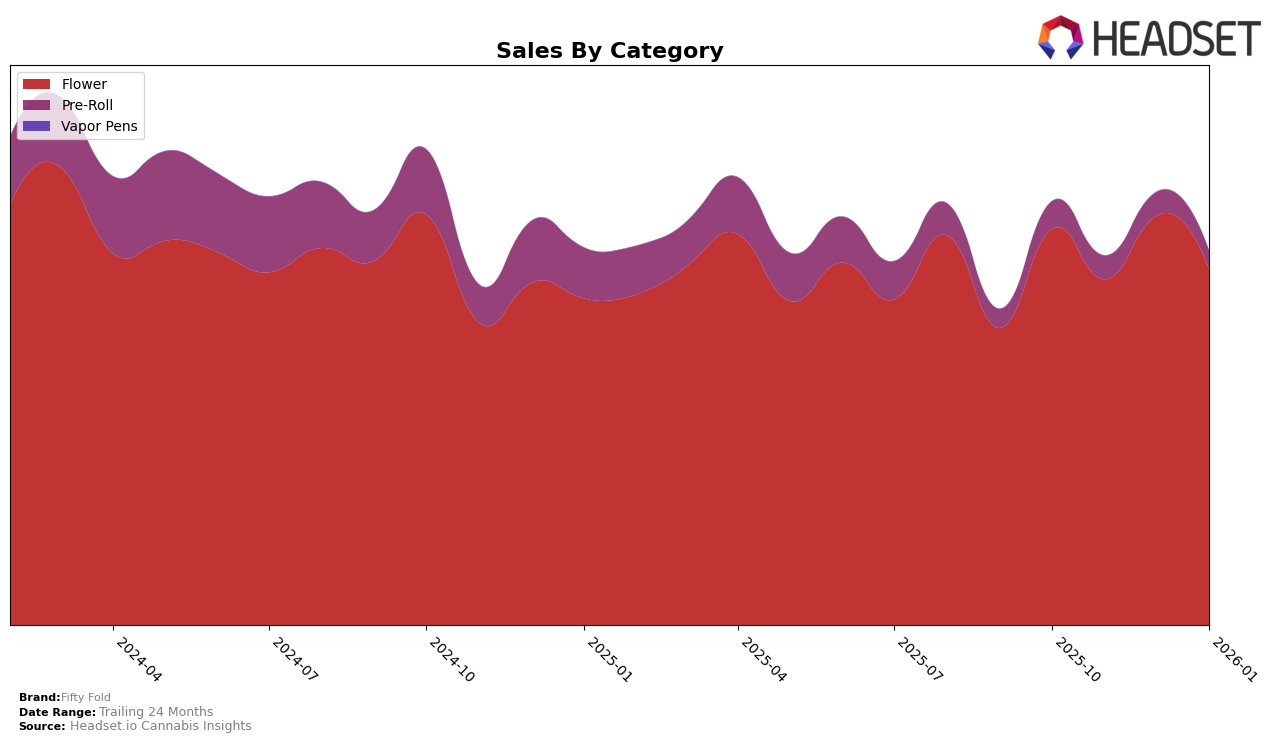

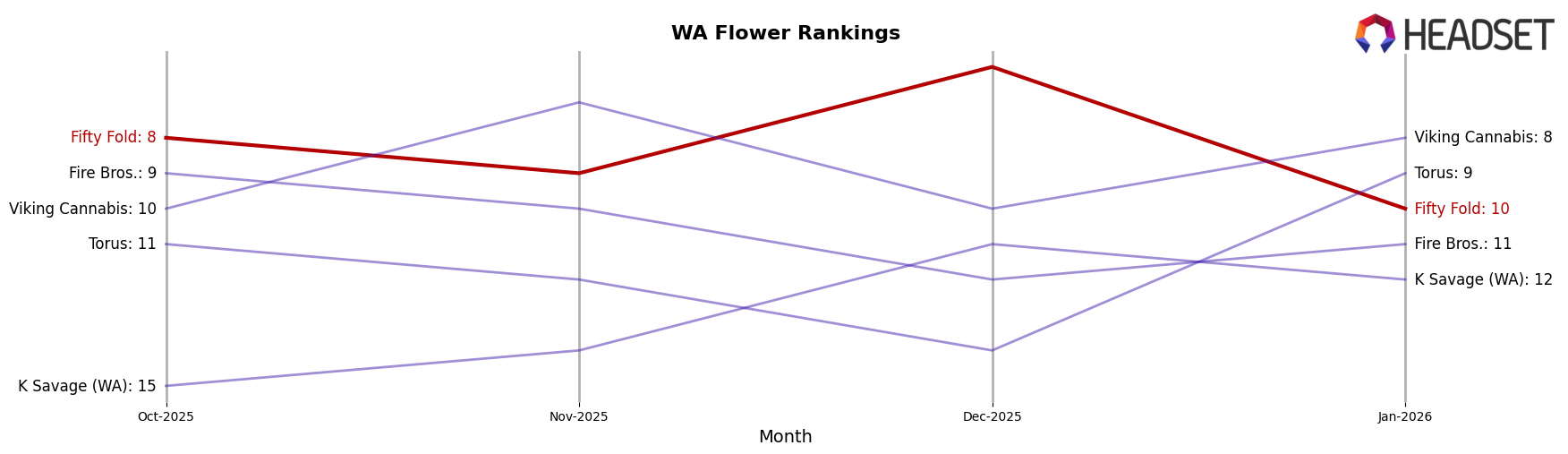

Fifty Fold has shown a dynamic performance across different categories and states, with notable fluctuations in its rankings. In the state of Washington, the brand's presence in the Flower category has been quite variable over the last few months. Starting in October 2025, Fifty Fold was ranked 8th, then slipped to 9th in November before climbing to 6th in December. However, by January 2026, it had dropped back to the 10th position. This movement suggests a competitive landscape in Washington's Flower category, where Fifty Fold is maintaining a strong, albeit fluctuating, presence.

Interestingly, the sales figures for Fifty Fold in Washington reflect these ranking changes, with a peak in December 2025 at $539,151, which coincided with their highest ranking of 6th. Despite the drop in January 2026 to the 10th rank, the brand's ability to remain within the top 10 is indicative of its resilience and potential in the market. It's also worth noting that Fifty Fold did not appear in the top 30 for certain categories or states, which could either signal areas for growth or reflect strategic focus on specific markets. The absence from the top 30 in other states or categories could be seen as a gap or an opportunity, depending on the brand's strategic goals.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Fifty Fold has demonstrated notable fluctuations in its market position over the past months. Starting from October 2025, Fifty Fold held the 8th rank, but experienced a slight dip to 9th in November, before climbing to 6th in December, and then dropping to 10th by January 2026. This variability in rank reflects a dynamic market environment, where competitors like Viking Cannabis and Torus have also shown shifts in their standings. Viking Cannabis, for instance, improved from 10th to 7th in November, surpassing Fifty Fold, but eventually settled at 8th by January. Meanwhile, Torus, which was initially ranked 11th, managed to surpass Fifty Fold in January by securing the 9th position. These movements indicate a competitive push among brands, with Fifty Fold needing to strategize effectively to maintain and improve its market share amidst such dynamic shifts.

Notable Products

In January 2026, Copper River (3.5g) emerged as the top-performing product for Fifty Fold, climbing from its fifth position in December 2025 to secure the number one spot with impressive sales of 2048 units. Snickerdoobie - Copper River Infused Pre-Roll (0.75g) also showed significant improvement, advancing from an unranked position in December to second place in January. Lemon Cherry Belts (3.5g) entered the rankings at third place, marking a notable debut. Dolato (3.5g) and Gary Berry (3.5g) followed closely, debuting in fourth and fifth positions, respectively. This shift in rankings highlights a dynamic change in consumer preferences towards these products in the new year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.