Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

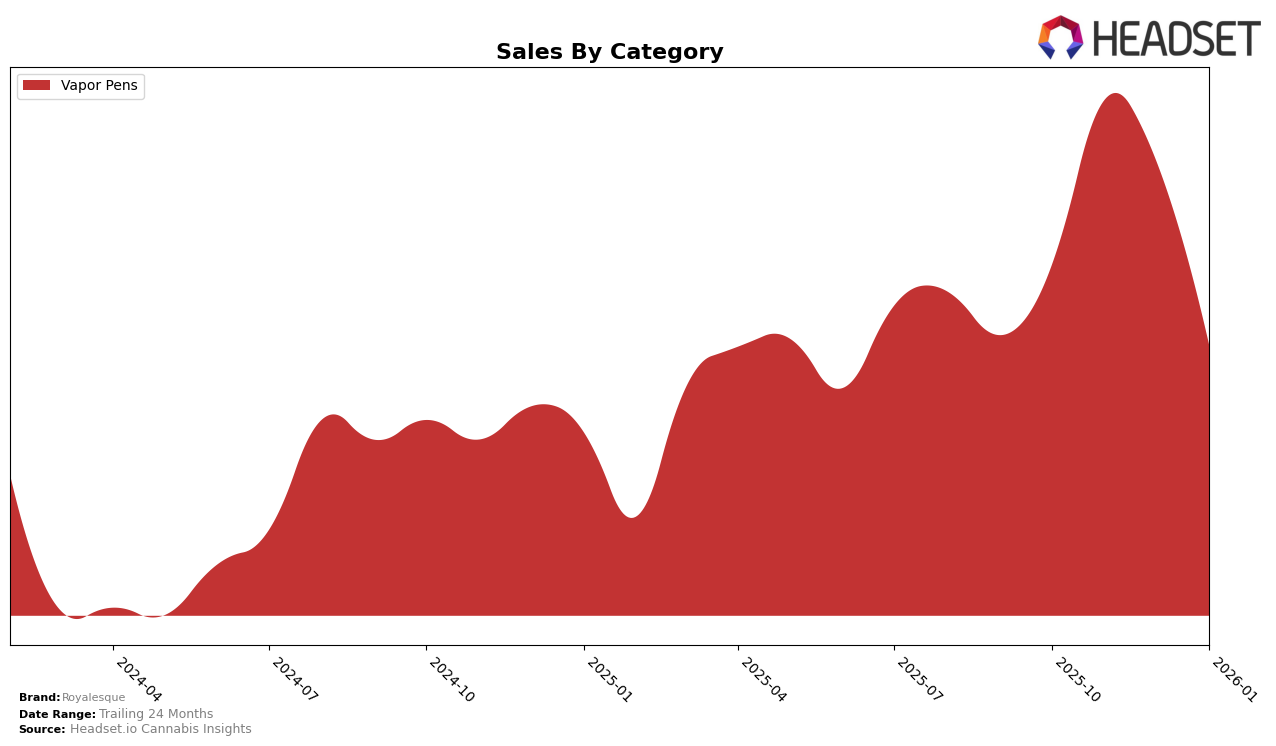

Royalesque has shown notable fluctuations in its performance across various categories and states, particularly in the Vapor Pens category in Nevada. Between October 2025 and January 2026, the brand's ranking in this category experienced both upward and downward shifts. Starting at 13th place in October, Royalesque climbed to 9th place by December, indicating a positive trajectory and increased consumer interest during the holiday season. However, by January 2026, the brand's rank slipped to 15th, suggesting potential challenges in maintaining momentum post-holiday. This decline in rank was accompanied by a decrease in sales from November to January, reflecting the broader trend of fluctuating consumer preferences in the vapor pen market.

It's worth noting that while Royalesque was consistently present in the top 30 brands for Vapor Pens in Nevada, the absence of rankings in other states or categories may indicate areas where the brand has yet to establish a strong foothold. The performance in Nevada could serve as a benchmark for expansion strategies, particularly focusing on sustaining and enhancing market presence in other regions. The brand's ability to navigate these shifts and leverage its strengths in Nevada could be crucial for future growth and stability across different markets and product categories.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Royalesque has experienced significant fluctuations in its market position, which could impact its strategic planning and sales focus. In October 2025, Royalesque ranked 13th, but by November, it climbed to 10th, indicating a positive trend likely driven by increased sales. However, this upward momentum was short-lived as the brand reached its peak rank of 9th in December, only to drop to 15th by January 2026. This decline suggests a need for Royalesque to reassess its competitive strategies, especially as competitors like INDO maintained a relatively stable position, ranking between 11th and 13th, and Bad Batch Extracts improved from 26th to 14th. Meanwhile, Panna Extracts and Hustler's Ambition showed varied performance, with Panna Extracts consistently ranking lower than Royalesque, and Hustler's Ambition making a notable leap from 29th to 16th by January. These dynamics highlight the competitive pressures Royalesque faces and the importance of leveraging advanced data insights to regain and sustain a higher market position.

Notable Products

In January 2026, the top-performing product from Royalesque was Ghost Train Haze Distillate Cartridge (1g) in the Vapor Pens category, leading with a sales figure of 1155 units. Following closely was Cherry Zlushie Distillate Cartridge (0.8g), which secured the second position. London Pound Cake Distillate Disposable (1g) and Outer Zen Distillate Cartridge (1g) took the third and fourth ranks, respectively, indicating strong competition within the Vapor Pens category. Animal Mintz Distillate Cartridge (1g) rounded out the top five, maintaining a solid presence. Compared to previous months, these products have consistently climbed the rankings, showing a clear upward trend in popularity and sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.