Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

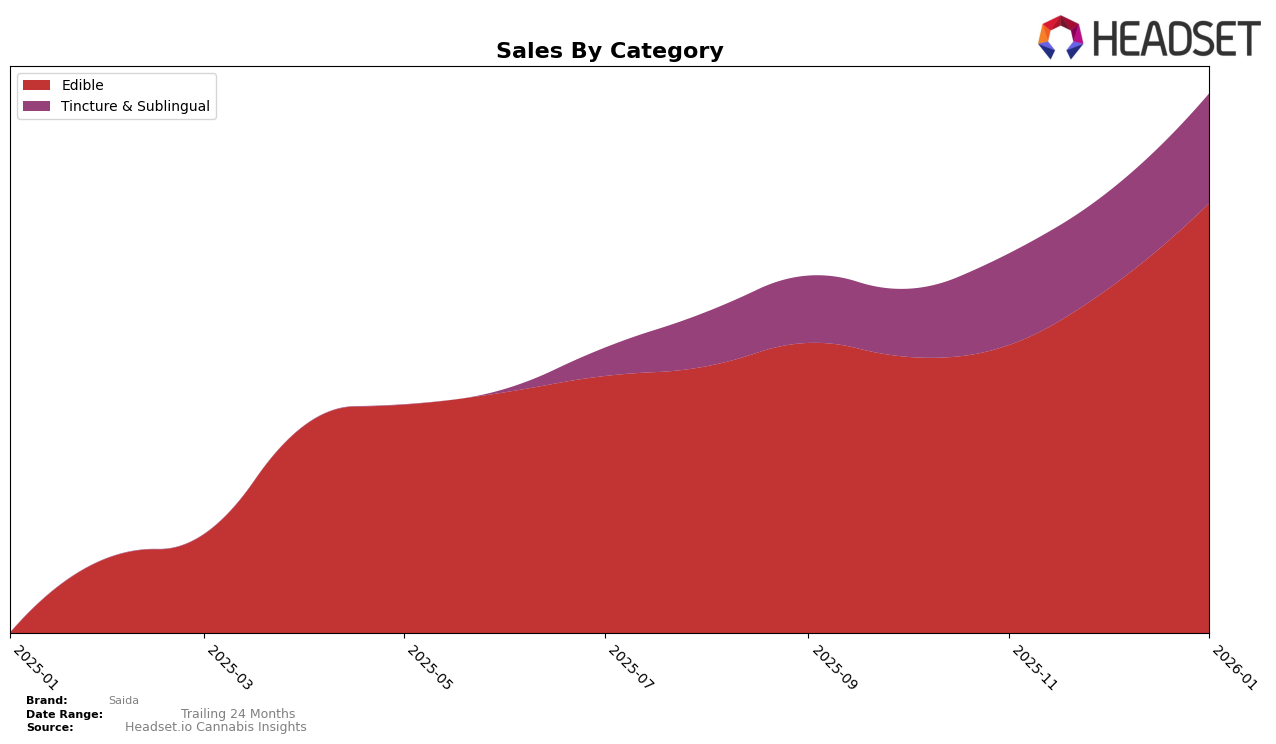

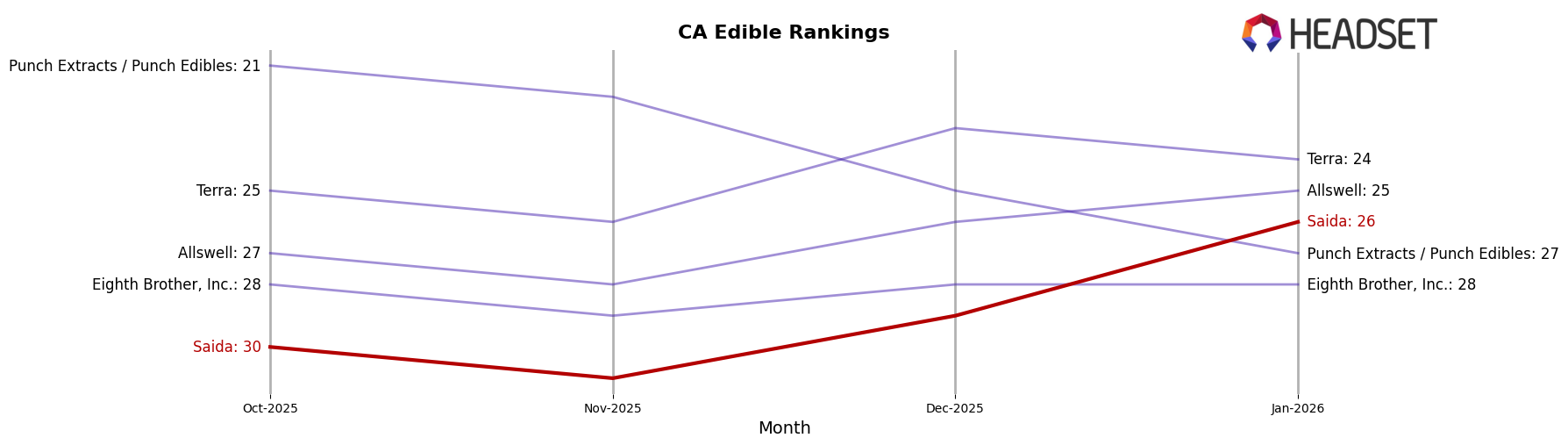

In the California market, Saida has shown notable progress in the Edible category. Starting from a rank of 30 in October 2025, the brand ascended to 26 by January 2026, indicating a positive trajectory in consumer preference and market penetration. This upward movement is underscored by a significant increase in sales, with January 2026 figures reaching over 216,000, which suggests a growing acceptance and popularity of Saida's edible offerings. However, the brand's absence from the top 30 in November 2025 could be interpreted as a temporary setback, making its subsequent rise even more noteworthy.

Saida's performance in the Tincture & Sublingual category within California has been stable, maintaining a consistent rank of 14 from October 2025 through January 2026. This steadfast position reflects a solid foothold in this segment, with a gradual increase in sales over the months, culminating in January 2026. Despite not climbing higher in the rankings, the steady sales growth indicates a loyal customer base and effective brand positioning. The lack of significant movement could suggest either a highly competitive landscape or a strategic focus on maintaining their current market share.

Competitive Landscape

In the competitive landscape of the California edible market, Saida has shown a notable upward trajectory in both rank and sales over the past few months. Starting from a rank of 30 in October 2025, Saida climbed to 26 by January 2026, indicating a positive shift in consumer preference or effective marketing strategies. This improvement is particularly significant when compared to competitors such as Punch Extracts / Punch Edibles, which saw a decline from rank 21 to 27 over the same period, and Terra, which fluctuated but ultimately dropped to 24. Meanwhile, Allswell and Eighth Brother, Inc. maintained relatively stable positions, with Allswell slightly improving its rank. Saida's sales growth is also noteworthy, with a consistent increase each month, contrasting with the declining sales of Punch Extracts / Punch Edibles. This suggests that Saida is gaining traction in the market, potentially due to product innovation or enhanced brand visibility, making it a brand to watch in the California edibles segment.

Notable Products

In January 2026, the top-performing product from Saida was the Wild Blackberry Gummies Bar (100mg) in the Edible category, maintaining its number one rank from December with a notable sales figure of 8002. The Rainbow Sherbet Gummies 10-Pack (100mg) followed closely, ranked second, consistent with its performance in December, with sales reaching 7406. The Tropical Blue Razz Gummies 10-Pack (100mg) held steady in third place across the months from October 2025 to January 2026, showing a gradual increase in sales. The Summer Watermelon Gummy (100mg) also maintained its fourth position throughout these months. Berries & Cream Gummy (100mg) remained in fifth place since December, after an unexplained absence in the November rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.