Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

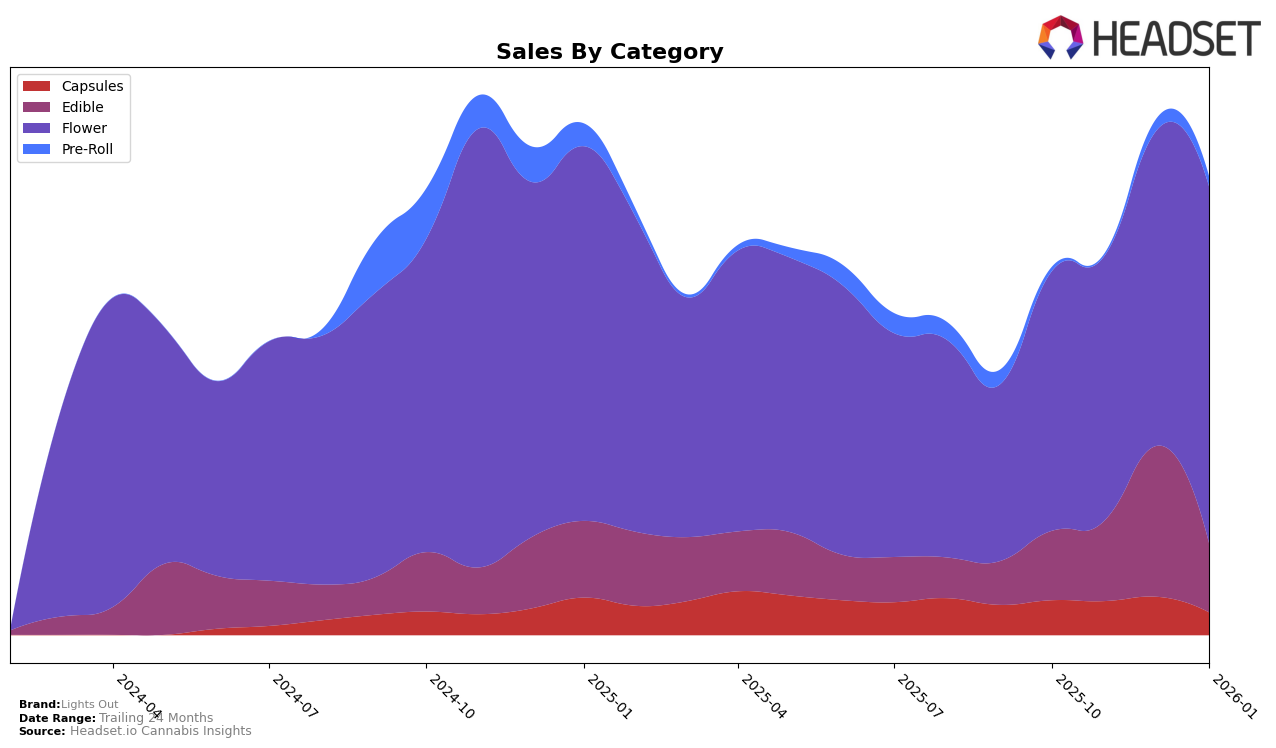

Lights Out has shown varied performance across different categories in California. In the Capsules category, the brand maintained a steady presence, albeit with a slight decline in rankings from 11th in October 2025 to 13th by January 2026. Despite this drop in rank, it's important to note that their sales saw a significant spike in December, before dropping in January. Meanwhile, the Edible category presented a more fluctuating scenario; Lights Out was not in the top 30 in October and November but managed to climb to 27th in December, only to fall back to 32nd in January. This indicates a volatile market presence, where the brand's positioning is not yet stable.

In the Flower category, Lights Out demonstrated a positive trajectory, moving from a rank of 67th in October to 48th by January. This upward movement is accompanied by a consistent increase in sales, suggesting a strengthening position within this highly competitive category. However, the brand's absence from the top 30 in other states or provinces might indicate a limited geographical reach or varying consumer preferences outside of California. The overall performance highlights potential areas for growth and expansion, especially in categories where they are not yet prominent.

Competitive Landscape

In the competitive landscape of the California flower category, Lights Out has demonstrated a notable upward trajectory in rank and sales over the past few months. Starting from a rank of 67 in October 2025, Lights Out climbed to 48 by January 2026, showcasing a consistent improvement. This positive trend suggests a growing consumer preference or effective marketing strategies. In contrast, Lolo experienced a decline, dropping from rank 33 in October to 45 in January, which may indicate challenges in maintaining its market position. Meanwhile, Time Machine showed a steady rise, moving from rank 51 to 43, while Greenline maintained a stable presence around the 50s. Seed Junky Genetics, despite not being in the top 20 initially, made a significant leap to rank 53 by January, highlighting its potential as a formidable competitor. These dynamics indicate that while Lights Out is gaining momentum, it must continue to innovate and adapt to maintain its upward trajectory amidst the shifting competitive landscape.

Notable Products

In January 2026, Saturn OG (3.5g) maintained its position as the top-performing product for Lights Out, continuing its streak as the number one ranked product since October 2025 with a notable sales figure of 8497 units. The THC/CBN/CBD 1:1:1 Wildberry Deep Sleep Gummies 10-Pack held steady at the second rank, consistent with its performance in November and December 2025. Pink Acai (3.5g) experienced a resurgence, climbing to the third position after not being ranked in November and December. Indica Watermelon Live Rosin Gummies 10-Pack, which showed a drop in sales, slipped to fourth place from its previous third place in December. New to the rankings, Sativa Pineapple Live Rosin Gummies 10-Pack emerged in fifth place, indicating a positive reception in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.