Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

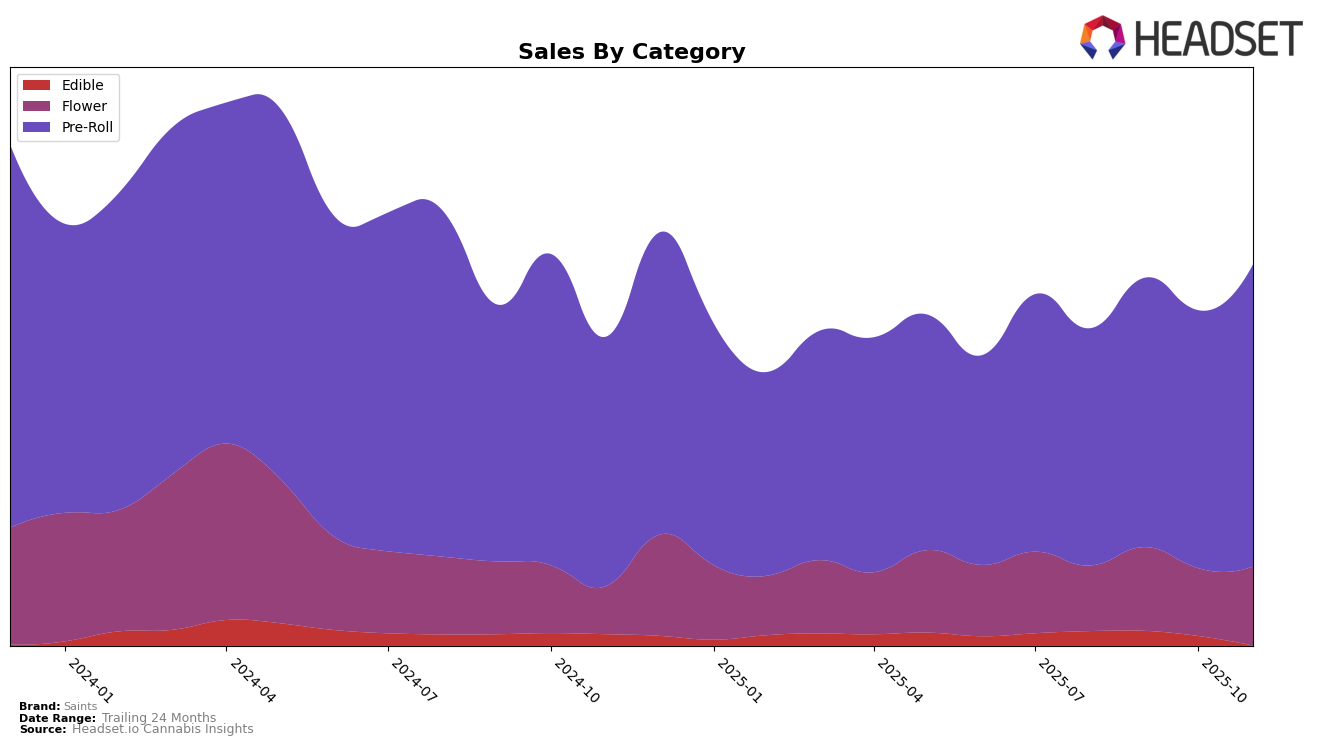

In the state of Washington, the cannabis brand Saints has shown a notable upward trend in the Pre-Roll category. Beginning in August 2025, Saints was ranked 35th, but by November 2025, it climbed to the 26th position. This improvement in ranking is indicative of a positive reception and increased consumer demand for their products in this category. While the brand did not make it into the top 30 in August, its entry and subsequent rise in the rankings demonstrate significant progress and growing market presence in Washington.

Despite not being in the top 30 at the start of the observed period, Saints' sales figures reflect a strong upward trajectory, with November 2025 sales reaching $158,343. This is a clear increase from the previous months, suggesting effective market strategies or product offerings that resonate well with consumers. The steady climb in rankings from September through November indicates a strengthening foothold in the Pre-Roll market, a trend that could potentially continue if the brand maintains its current momentum and strategic initiatives. However, the absence of top 30 rankings in other states or categories suggests that Saints' success might currently be localized or category-specific.

Competitive Landscape

In the Washington Pre-Roll category, Saints has demonstrated a notable upward trajectory in recent months, improving its rank from 35th in August 2025 to 26th by November 2025. This positive trend in rank is accompanied by a steady increase in sales, indicating a strengthening market presence. In comparison, Mt Baker Homegrown has maintained a relatively stable position, showing a slight dip from 24th to 25th, while Bacon Buds experienced a decline in rank from 22nd to 28th over the same period. Meanwhile, Falcanna and Seattle Marijuana Company have shown fluctuations but remain ahead of Saints in terms of rank. Despite this, Saints' consistent sales growth suggests a potential for further advancement in the competitive landscape, making it a brand to watch in the coming months.

Notable Products

In November 2025, the top-performing product from Saints was NYC Diesel Hash Infused Mini Pre-Roll 5-Pack, which secured the number one rank with sales of 399 units. Both Actual Pain Infused Mini Pre-Roll 5-Pack and Lavender Hash Infused Mini Pre-Roll 5-Pack tied for second place, each showing a significant rise from previous months' rankings. Multi Strain Pre-Roll 5-Pack also held the second position, maintaining its strong performance from August. Rozay, categorized under Flower, climbed to the third rank, marking a return to the top three after a brief absence in October. This month saw a reshuffling of top positions, with pre-rolls dominating the upper ranks, indicating a growing consumer preference for this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.