Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

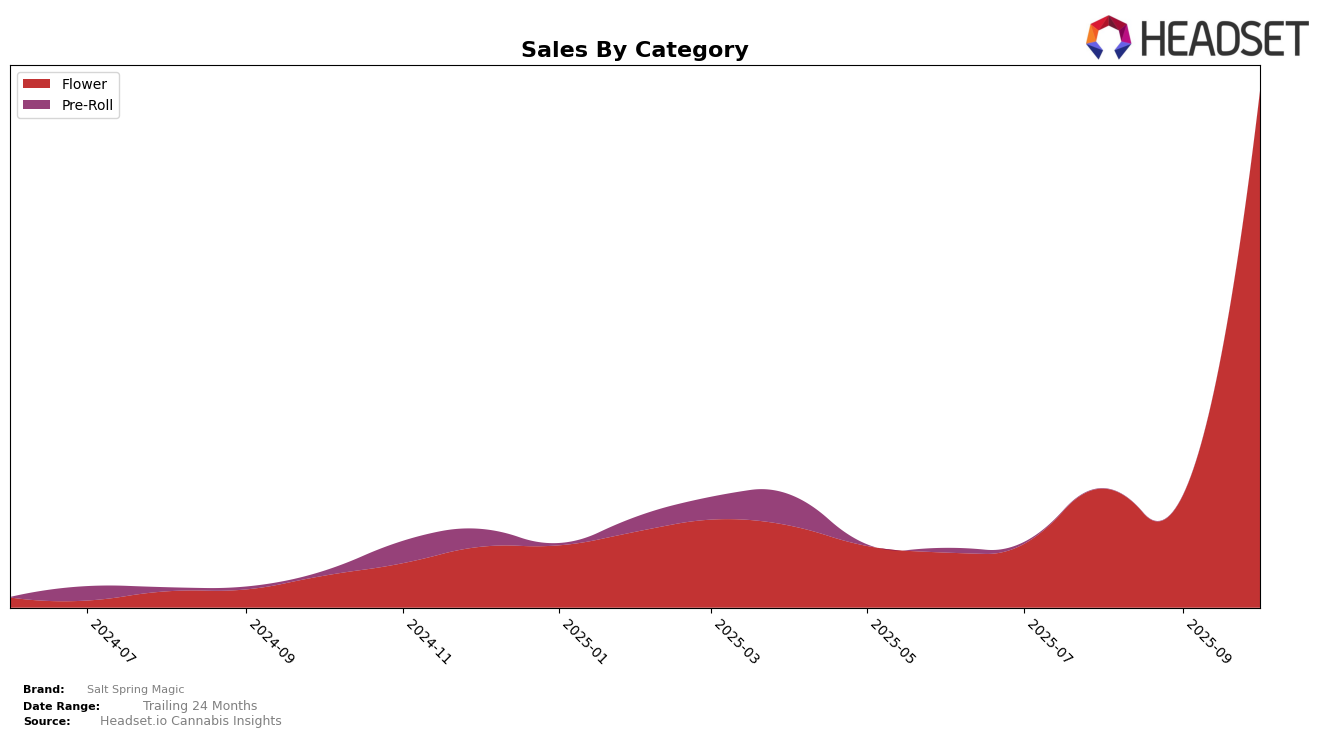

Salt Spring Magic has shown remarkable progress in the British Columbia market, particularly in the Flower category. The brand has made a significant leap in rankings over a span of four months, moving from 84th position in July 2025 to an impressive 23rd position by October 2025. This upward trajectory is indicative of their growing popularity and market penetration in the region. The substantial increase in sales from July to October, with October sales reaching over 300,000, underscores this trend. However, it's important to note that Salt Spring Magic did not feature in the top 30 brands initially, highlighting the competitive nature of the market.

The absence of Salt Spring Magic in the top 30 rankings in other states or provinces during the same period suggests that their primary focus and success have been concentrated within British Columbia. This could be a strategic decision to solidify their presence in a single market before expanding. The data reflects a positive movement within British Columbia, but it also highlights the potential for growth in other regions. The brand's performance in the Flower category could serve as a benchmark for their potential success in other categories and states, should they choose to expand their reach.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Salt Spring Magic has shown a remarkable upward trajectory, moving from a rank of 84 in July 2025 to 23 in October 2025. This significant climb is indicative of a robust increase in market presence and consumer preference. Notably, The Loud Plug, which started at rank 4 in July, experienced a steep decline, falling out of the top 20 by October. This shift suggests a potential opportunity for Salt Spring Magic to capture market share from previously dominant players. Meanwhile, Sweetgrass Organic Cannabis also made a notable leap from rank 49 to 21, indicating a competitive push in the market. Similarly, Choklit Park and West Coast Gas have shown upward trends, but Salt Spring Magic's rise is more pronounced, suggesting effective strategies in capturing consumer interest and driving sales growth.

Notable Products

In October 2025, Salt Spring Magic's top-performing product was Hippie Diesel (3.5g) in the Flower category, maintaining its number 1 rank from September with notable sales of 429 units. Island Zeus (3.5g) rose to the second position, a significant jump from its previous absence in the September rankings, with sales of 402 units. Pine Tar (3.5g) experienced a slight decline, moving from second to third place, with sales figures at 341 units. Bubblegum Kush Mints (7g) entered the rankings at fourth place, followed by Bubblegum Kush Mints (3.5g) in fifth. The introduction of the Bubblegum Kush Mints variants in October indicates a diversification in top product offerings for Salt Spring Magic.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.