Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

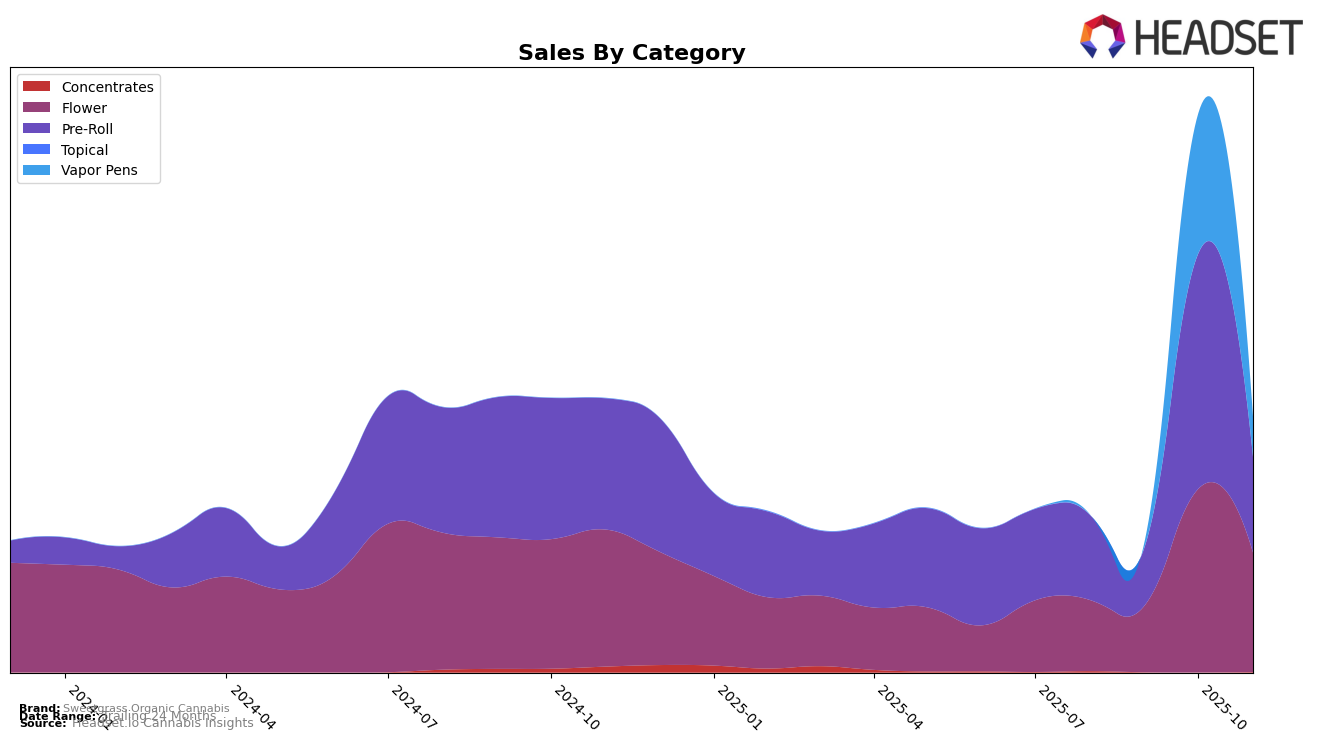

Sweetgrass Organic Cannabis has shown notable performance across various categories in British Columbia. In the Flower category, the brand made a significant leap in October 2025, moving from a rank of 43 in September to 22, before slightly dropping to 25 in November. This suggests a strong, albeit slightly fluctuating, market presence. The Pre-Roll category also saw an impressive surge in October, jumping from 62 to 19, before settling at 42 in November. Such movements indicate a growing recognition and possibly increased consumer preference, although the slight decline in November highlights the competitive nature of the market.

The Vapor Pens category has been particularly interesting for Sweetgrass Organic Cannabis in British Columbia. The brand was not in the top 30 for August and September, but by October, it achieved a commendable rank of 17. However, by November, there was a drop to 36, which could indicate a need for strategic adjustments to maintain their position. The absence from the top 30 in the earlier months could be seen as a missed opportunity, but the rapid climb suggests potential for growth if the brand can stabilize its performance. Overall, the data points to a brand on the rise, with room for improvement in sustaining its rankings across these categories.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Sweetgrass Organic Cannabis has shown a remarkable improvement in its rank, climbing from 45th in August 2025 to a peak of 22nd in October 2025, before slightly dropping to 25th in November 2025. This upward trend indicates a significant increase in consumer interest and market penetration, especially when compared to competitors like Tweed, which fell out of the top 20 by October, and Tribal, which made a notable leap from 54th to 23rd in November. Meanwhile, Potluck and Happy Hour (BC) have also shown competitive movements, with Happy Hour reaching 22nd place in November. Sweetgrass Organic Cannabis's sales trajectory mirrors its rank improvement, suggesting a robust market strategy that has successfully captured consumer demand, despite the fluctuating performances of its competitors.

Notable Products

In November 2025, the top-performing product for Sweetgrass Organic Cannabis was Surreal Dreams Pre-Roll 3-Pack (1.5g), which climbed to the number one spot from fourth place in October. Crunch Berries Pre-Roll 3-Pack (1.5g) maintained its second position from October, with notable sales of 1,374 units. Surreal Dreams Cured Resin Cartridge (1g) dropped from first to third place, indicating a shift in consumer preference within the Vapor Pens category. Mint Chocolate Chip Pre-Roll 3-Pack (1.5g) fell from third to fourth place, continuing its descent from the previous months. Crunch Berries (3.5g) re-entered the rankings at fifth place, showing a resurgence in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.