Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

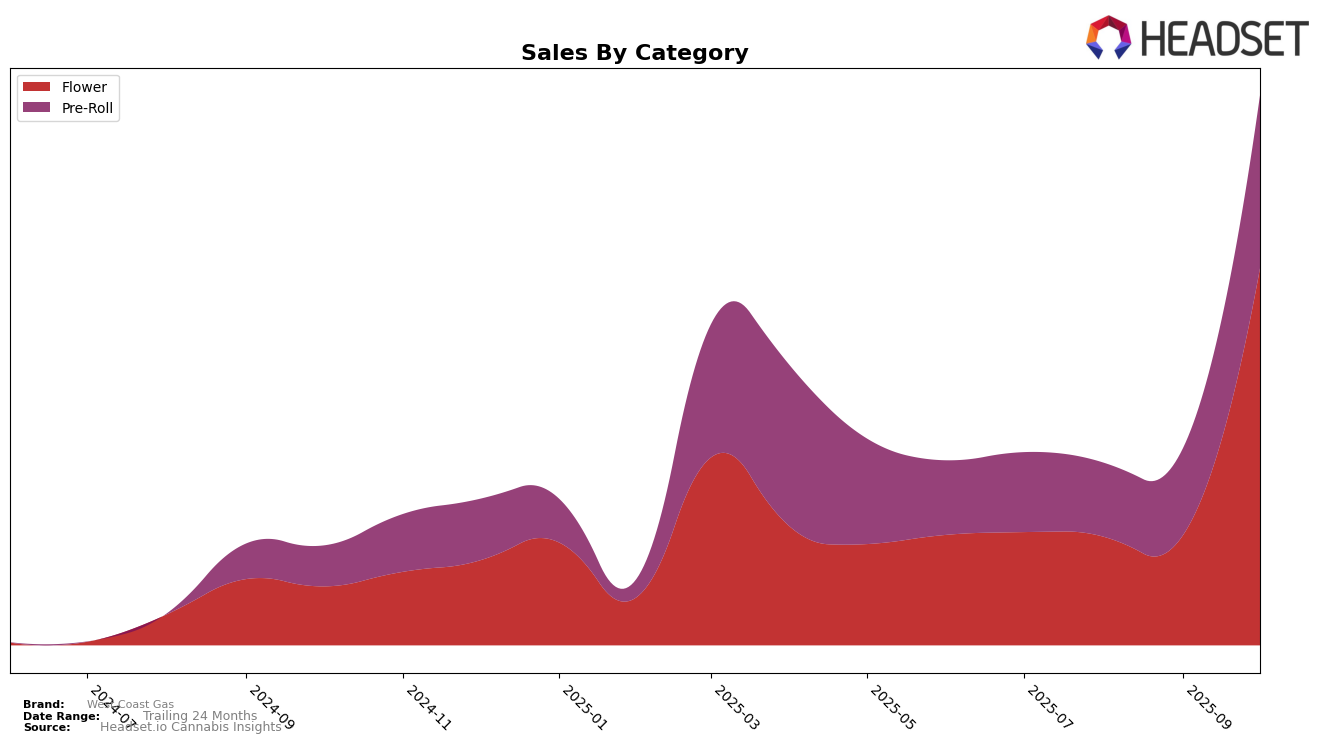

The performance of West Coast Gas in the British Columbia market has shown significant improvement in the Flower category over the past few months. Notably, the brand was not in the top 30 in July, August, or September, but made a remarkable leap to 24th position by October. This indicates a strong upward trend and suggests that the brand's efforts in this category are beginning to pay off. The increase in sales from 68,860 CAD in July to 305,698 CAD in October underscores this positive movement, highlighting a substantial growth trajectory.

In the Pre-Roll category, West Coast Gas also demonstrated progress in British Columbia. Although not ranked within the top 30 for July, August, or September, the brand managed to climb to 51st place by October. This improvement suggests that West Coast Gas is gaining traction and increasing its market presence in this segment as well. The sales figures reflect a similar trend, with steady growth each month. While these rankings are still outside the top 30, the forward momentum is a positive indicator of the brand's potential to break into higher ranks in the future.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, West Coast Gas has demonstrated a notable upward trajectory in its rank, moving from 61st in July 2025 to 24th by October 2025. This improvement is significant when compared to competitors like Tweed, which fell out of the top 20 by October, and The Loud Plug, which also saw a decline from 4th to 22nd place over the same period. Meanwhile, Choklit Park and Salt Spring Magic have shown similar upward trends, with both brands entering the top 25 by October. West Coast Gas's consistent sales growth and rank improvement suggest a strengthening market position, likely driven by effective marketing strategies and product offerings that resonate well with consumers in the region.

Notable Products

In October 2025, West Coast Gas's top-performing product was the Platinum Pink Kush Pre-Roll 5-Pack (3.5g) in the Pre-Roll category, reclaiming its number one position from September with a notable sales figure of 1584 units. Following closely, the Old School Fuel Pre-Roll 5-Pack (3.5g) debuted at rank 2, marking its first appearance in the rankings. The Old School Fuel (7g) in the Flower category secured the 3rd position, demonstrating strong initial sales. The LA Guava Pre-Roll 5-Pack (3.5g) dropped to the 4th position, after leading in September. Lastly, La Guava (14g) in the Flower category entered the rankings at 5th place, showcasing a solid performance in its category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.