Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

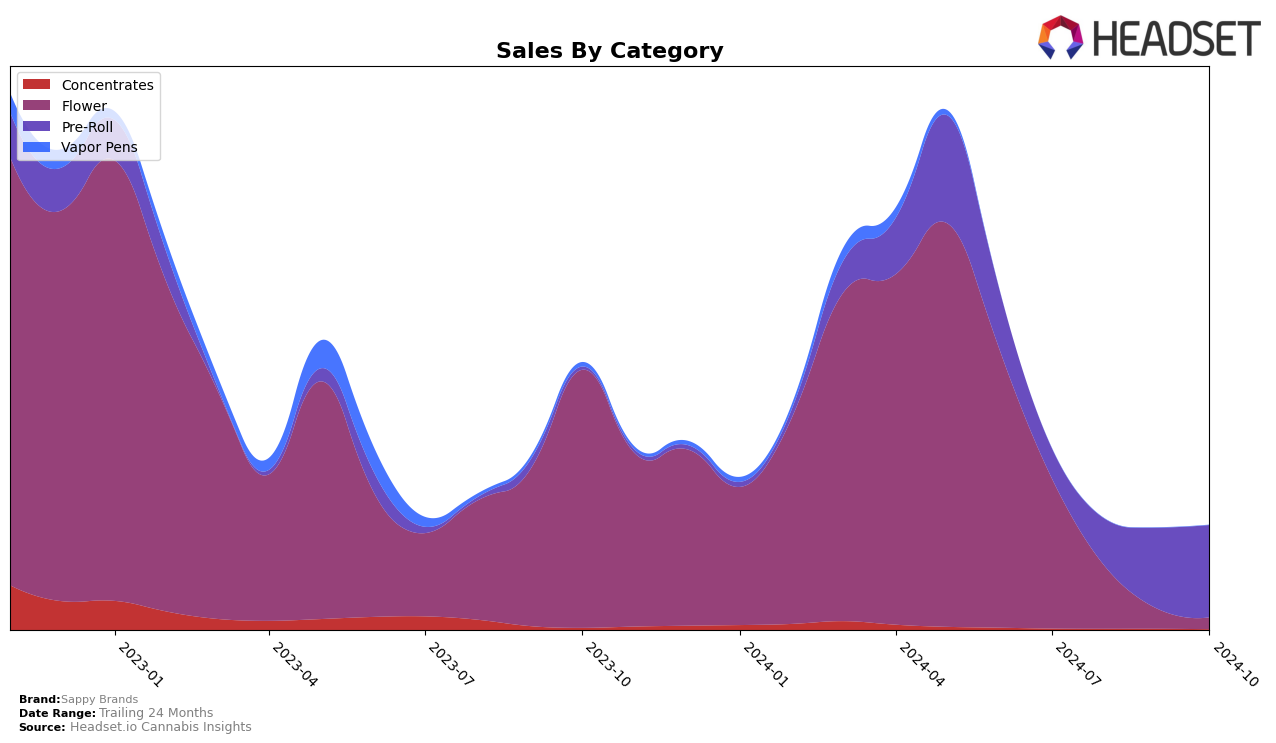

In the state of Colorado, Sappy Brands has shown a varied performance across different cannabis categories. In the Flower category, Sappy Brands experienced a significant drop in rankings, starting at 33rd place in July 2024 and falling out of the top 30 by October 2024, landing at 81st. This decline is mirrored by a substantial decrease in sales, which fell from $226,253 in July to just $17,195 by October. Such a sharp decline indicates a challenging market environment or possible shifts in consumer preferences that Sappy Brands might need to address.

Conversely, Sappy Brands has demonstrated a more positive trend in the Pre-Roll category within Colorado. Starting from a rank of 51 in July, the brand improved its position to 21st by October 2024. This upward movement in rankings is supported by a consistent increase in sales, culminating in $138,716 in October. The contrasting performance between the Flower and Pre-Roll categories suggests that while Sappy Brands may be struggling in some areas, they are gaining traction in others, particularly in the Pre-Roll market. This could indicate a strategic shift or a growing consumer preference for their Pre-Roll products.

Competitive Landscape

In the competitive landscape of the Colorado Pre-Roll category, Sappy Brands has shown a remarkable upward trajectory in rankings from July to October 2024, climbing from a rank of 51 to 21. This significant improvement is indicative of a strong increase in sales, which more than tripled over the period. Notably, Sappy Brands outperformed D's Trees, which also saw a rise in rankings but did not achieve the same sales growth. Meanwhile, Rocky Mountain High maintained a relatively stable position, slightly ahead of Sappy Brands in October, but with less dramatic sales growth. Magic City and Bloom County both experienced fluctuations, with Bloom County dropping out of the top 20 by October, highlighting potential market volatility. This competitive analysis underscores Sappy Brands' successful strategies in gaining market share and improving its position against established competitors in the Colorado Pre-Roll market.

Notable Products

In October 2024, Rainbow Road Pre-Roll (1g) maintained its position as the top-performing product for Sappy Brands, with impressive sales of 41,403 units. Pillow Talk x Wilfunk Pre-Roll (1g) held the second spot consistently from August through October, despite a decrease in sales from the previous month. Gorilla Glue #4 (Bulk) made a notable entry into the rankings, securing the third position. Nitro Headbanger (Bulk) remained steady at fourth place, mirroring its ranking from September. Strawberries and Cream (Bulk) slipped from its top position in July to fifth place in October, indicating a decline in its sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.