Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

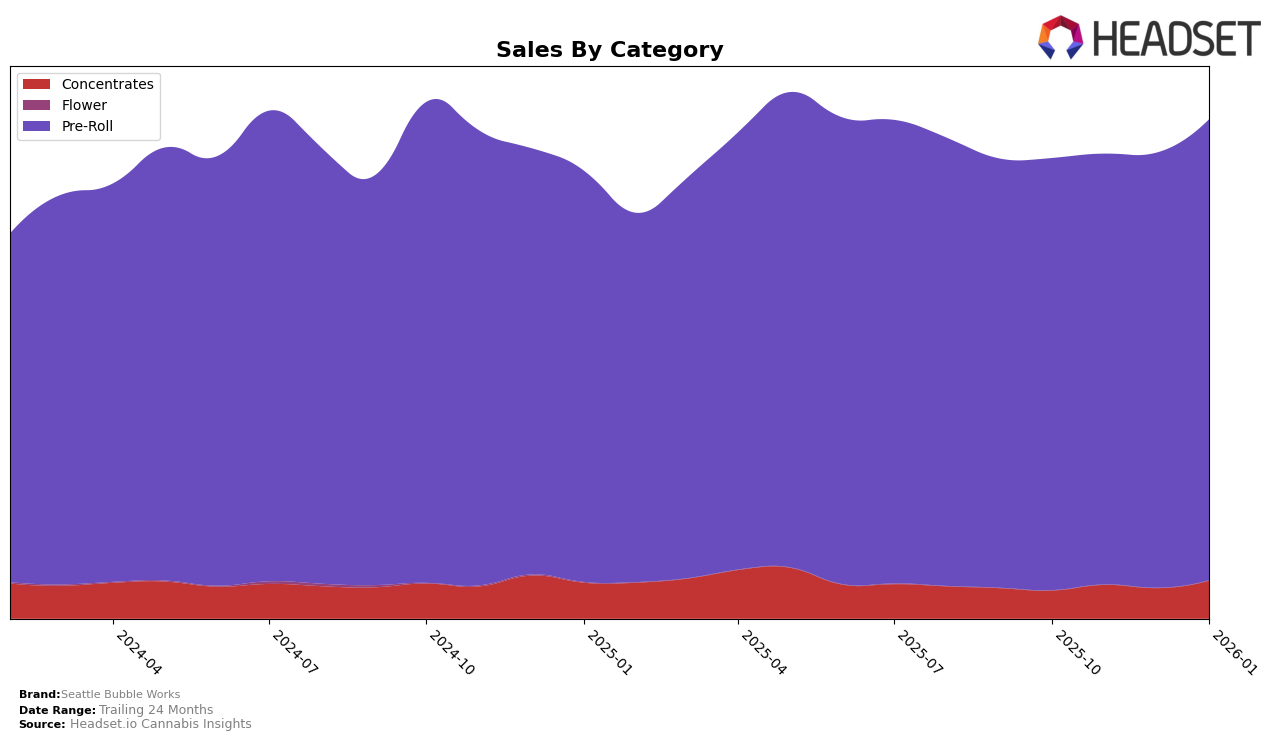

Seattle Bubble Works has demonstrated varying performance across different product categories and regions. In the state of Washington, the brand has shown a notable upward trajectory in the Concentrates category. Starting from a rank of 81 in October 2025, they improved to 57 by January 2026. This movement indicates a positive reception and growing demand for their concentrates, as reflected in the increase in sales from October to January. However, it is important to note that despite this progress, they have not yet broken into the top 30 brands in this category, which suggests room for further growth and market penetration.

In contrast, Seattle Bubble Works has maintained a strong presence in the Pre-Roll category within Washington. Consistently ranking within the top 10, the brand improved from 8th place in October 2025 to 5th place by January 2026, reflecting a robust market position. This stability and slight upward trend indicate a well-established brand reputation and consumer preference in this category. The steady increase in sales over these months further underscores their strong performance, making Pre-Rolls a key area of success for Seattle Bubble Works in the Washington market.

Competitive Landscape

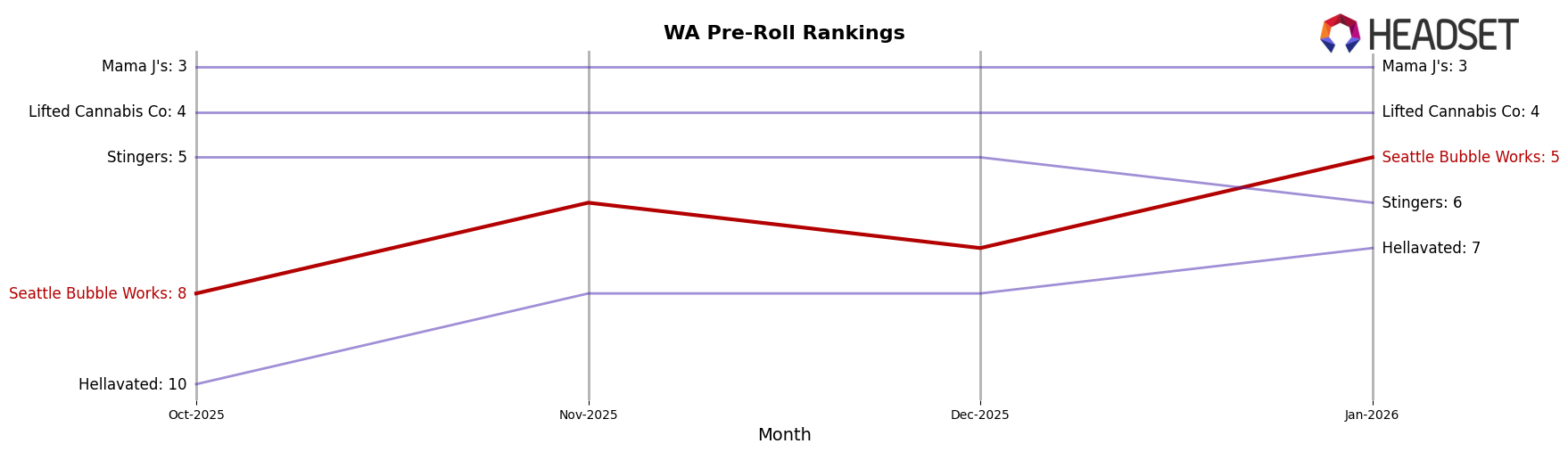

In the competitive landscape of the Washington Pre-Roll market, Seattle Bubble Works has shown a promising upward trajectory in recent months. Starting from an 8th place rank in October 2025, the brand improved to 6th in November, slightly dipped to 7th in December, but then climbed to 5th by January 2026. This positive trend indicates a strengthening market presence, likely driven by strategic marketing or product innovations. In contrast, Lifted Cannabis Co maintained a consistent 4th place rank throughout the same period, suggesting a stable but unchanging competitive edge. Meanwhile, Mama J's consistently held the 3rd position, indicating a strong foothold in the market. Stingers, initially in 5th place, dropped to 6th by January, reflecting a potential decline in consumer preference or market share. Finally, Hellavated improved from 10th to 7th, showing a similar upward momentum as Seattle Bubble Works, albeit from a lower starting point. These dynamics highlight Seattle Bubble Works' competitive gains amidst a fluctuating market landscape.

Notable Products

In January 2026, Seattle Bubble Works saw the Super Lemon Haze Hash Infused Pre-Roll 2-Pack (1g) maintain its top position in the pre-roll category, with sales reaching 3025 units. Trainwreck Hash Infused Pre-Roll 2-Pack (1g) held steady at the second rank, showing a consistent rise in popularity since November 2025. Granddaddy Purple Hash Infused Pre-Roll 10-Pack (5g) climbed back to the third position, recovering from a slight dip in December 2025. Blue Dream Hash Infused Pre-Roll 2-Pack (1g) slipped to fourth place, despite a strong performance in the previous months. Notably, Super Boof Hash Infused Pre-Roll 2-Pack (1g) entered the rankings at fifth place, indicating a promising new entry in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.