Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

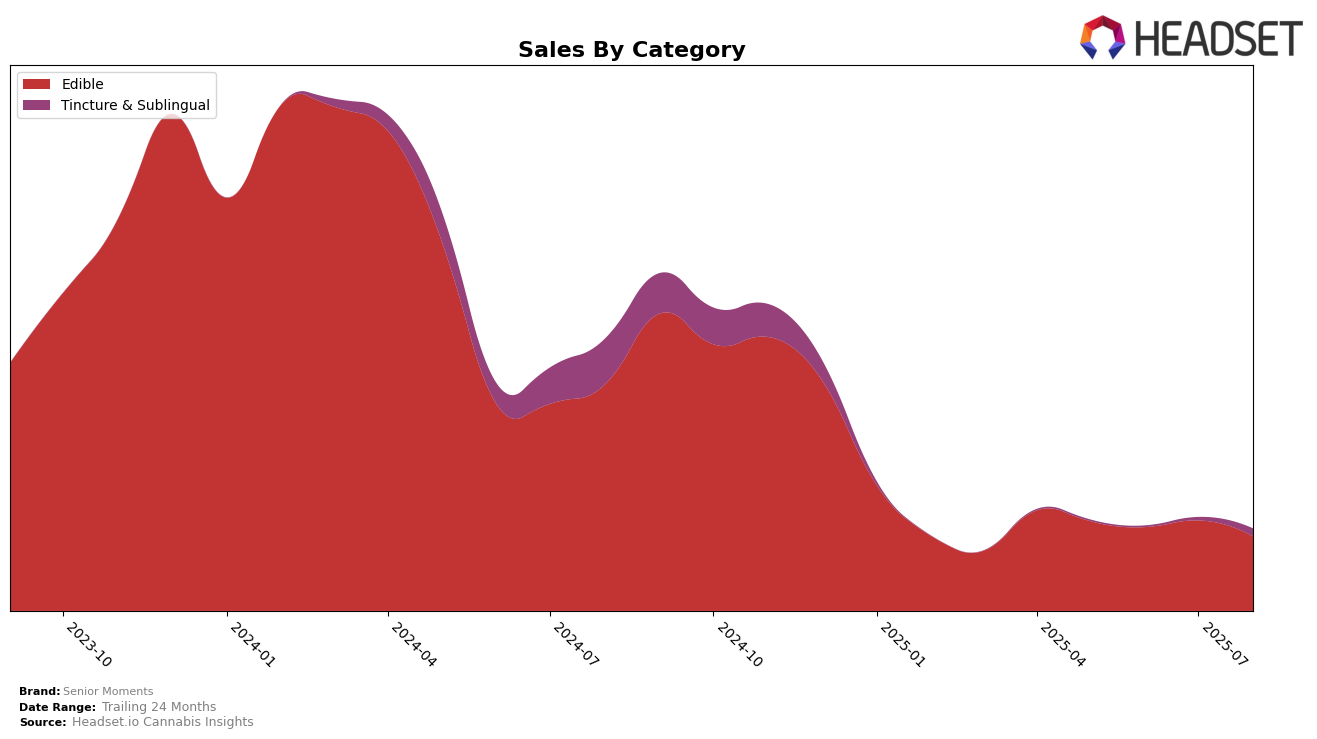

Senior Moments, a cannabis brand focusing on the Edible category, has shown some interesting movements across different states. In New York, the brand was ranked 69th in May 2025 and slipped to 72nd by July, with no ranking in June and August, indicating they were not in the top 30 brands during those months. This inconsistency in rankings suggests a fluctuating presence in the New York market, where they seem to struggle to maintain a steady position among the top competitors. Despite these fluctuations, their sales in May and July were relatively stable, with a slight increase observed in July compared to May.

The absence of Senior Moments from the top 30 in June and August in New York could be seen as a challenge for the brand, indicating potential areas for improvement in market penetration or consumer engagement. This absence might also point to increased competition or shifts in consumer preferences within the Edible category. Understanding the dynamics behind these movements could be crucial for Senior Moments as they strategize to enhance their market presence and climb the rankings in the coming months.

Competitive Landscape

In the competitive landscape of the New York edible cannabis market, Senior Moments has experienced fluctuations in its ranking, notably absent from the top 20 in June and August 2025, while securing the 69th position in May and 72nd in July. This indicates a struggle to maintain a consistent presence among the leading brands. Competitors like Ithaca Organics Cannabis Co. have shown more stability, consistently ranking in the 60s, which could suggest a more loyal customer base or effective marketing strategies. Meanwhile, Happy Hounds CBD made a notable entry into the rankings in July, potentially drawing attention away from Senior Moments. The absence of Nanticoke and Love Oui'd from the top 20 in recent months might provide an opportunity for Senior Moments to capture market share, provided they can address the factors contributing to their inconsistent rankings.

Notable Products

In August 2025, Senior Moments saw its top-performing product as the CBD/THC/CBN 4:1:1 Lemon Ginger Sleep Wellness Gummies 20-Pack, which returned to the number one rank after briefly dropping to second place in July. The Winter Green Mingle Mints 20-Pack also surged to the top rank, sharing the position with the Lemon Ginger Gummies, each achieving sales of 108 units. The CBD/THC 1:1 Florida Citrus Time Machine Gummies, which had previously held the first position in June and July, fell to second place in August. The CBD/THC 1:1 Cinna-Mints Relief Mint maintained a steady presence in third place, showing consistent sales performance. Finally, the CBD/THC/CBN 3:1:2 Snoozer Tincture climbed to fourth place, marking a significant increase in sales from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.