Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

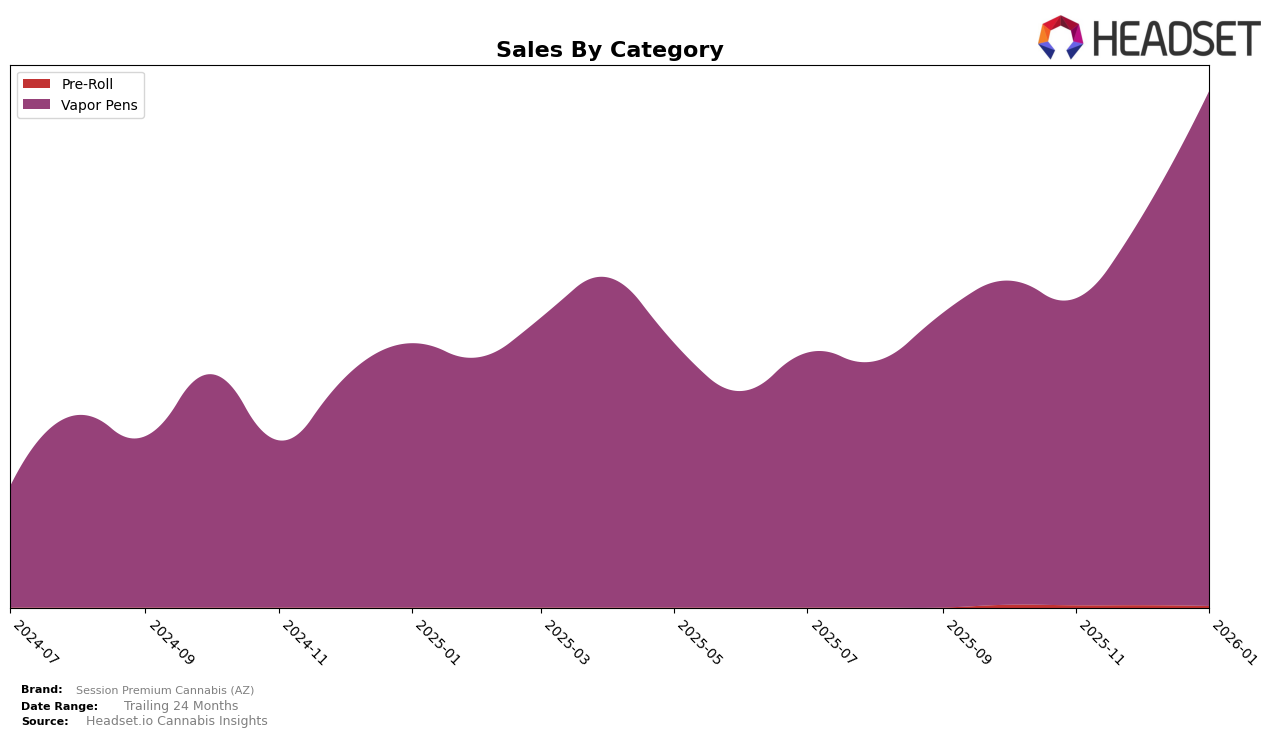

Session Premium Cannabis (AZ) has maintained a consistent presence in the Vapor Pens category within Arizona. Over the months from October 2025 to January 2026, the brand has consistently ranked within the top 10, showing a stable position at 9th place in October, December, and January, with a slight dip to 10th place in November. This consistency suggests a strong foothold in the Arizona market, indicating that their products resonate well with consumers. The brand's ability to maintain its ranking amidst fluctuating sales figures, such as the notable increase from November to January, highlights their resilience in a competitive market.

In terms of sales performance, Session Premium Cannabis (AZ) experienced a noteworthy upward trend in the Vapor Pens category in the Arizona market. Despite a drop in sales from October to November, the brand saw a significant recovery, culminating in a substantial sales increase by January 2026. This upward trajectory in sales, despite the minor ranking fluctuation in November, signals effective market strategies or product offerings that have captured consumer interest. The consistent ranking within the top 10 reinforces their market strength, though further analysis of their performance across other categories and regions could provide additional insights into their overall brand positioning and growth potential.

Competitive Landscape

In the competitive landscape of Vapor Pens in Arizona, Session Premium Cannabis (AZ) has shown a consistent performance, maintaining its rank around the 9th and 10th positions from October 2025 to January 2026. Despite facing strong competition from brands like Jeeter, which consistently ranks higher, Session Premium Cannabis (AZ) has demonstrated resilience with a notable increase in sales, particularly in January 2026. This upward trend in sales suggests a growing consumer preference or effective marketing strategies, even as competitors like WTF Extracts and iLava maintain stable rankings. Meanwhile, Canamo remains a close competitor, often swapping ranks with Session Premium Cannabis (AZ). The ability of Session Premium Cannabis (AZ) to increase sales despite fluctuating ranks highlights its potential to climb higher in the competitive hierarchy if it continues to capitalize on its current momentum.

Notable Products

In January 2026, the top-performing product for Session Premium Cannabis (AZ) was GMO Live Resin Disposable (1g) in the Vapor Pens category, climbing to the number one spot with sales of 2128 units. This product showed a significant increase from previous months, where it was ranked fourth in October 2025. Ice Cream Cake x Lemon Cherry Gelato Live Resin Disposable (1g) secured the second position, while Lemon Fresh Live Resin Disposable (1g) followed closely in third place, both making their debut in the rankings. Pink Lemonade Distillate Disposable (2g) moved up to fourth place from its previous third position in December 2025, continuing its upward trend. Finally, GMO x Fatso Live Resin Disposable (1g) maintained a consistent presence in the top five, though it dropped slightly from fourth to fifth place compared to December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.