Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

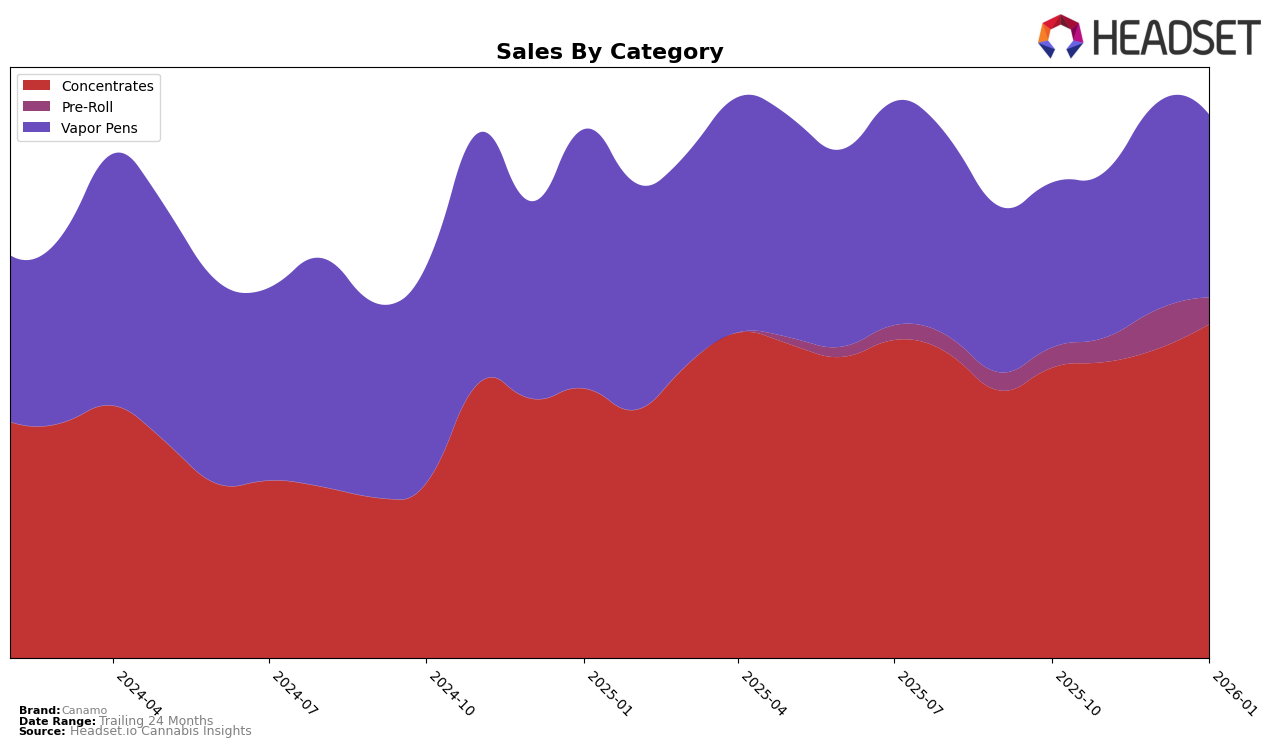

In the state of Arizona, Canamo has shown a strong and consistent performance in the Concentrates category, maintaining a steady rank of 2nd place from October 2025 through January 2026. This stability in ranking suggests a robust market presence and consumer loyalty in this category. Additionally, Canamo's sales figures for Concentrates have shown a positive trend, with a notable increase from $911,367 in October 2025 to $1,049,015 in January 2026, indicating a growing demand for their products. In the Vapor Pens category, Canamo has also performed well, consistently ranking around the 10th position, which highlights their competitive edge in this segment as well.

However, the performance of Canamo in the Pre-Roll category presents a more fluctuating picture. Starting at the 40th rank in October 2025, Canamo improved its position to 27th by December, before slipping back to 33rd in January 2026. This movement suggests potential challenges in capturing market share or maintaining consistent consumer interest in their Pre-Roll offerings. Despite the fluctuations in ranking, sales in this category did see a peak in December 2025, indicating that there might be opportunities for growth if Canamo can address the factors affecting their ranking. The absence of Canamo in the top 30 for some months in the Pre-Roll category highlights areas for potential improvement and strategic focus.

Competitive Landscape

In the competitive landscape of the concentrates category in Arizona, Canamo has consistently maintained its position as the second-ranked brand from October 2025 through January 2026. This stability in rank suggests a strong market presence and customer loyalty, despite the intense competition. The leading brand, Mohave Cannabis Co., has held the top spot consistently, indicating a significant gap in market dominance. However, Canamo's sales figures show a positive upward trend, narrowing the gap with the leader over the months. Meanwhile, WTF Extracts and Drip Oils + Extracts have fluctuated between third and fourth positions, with their sales figures trailing behind Canamo's. This competitive analysis highlights Canamo's robust performance and potential for further growth in the Arizona concentrates market.

Notable Products

In January 2026, the top-performing product for Canamo was Alien Marmalade Shatter (1g) in the Concentrates category, securing the first rank with sales reaching 2720. Bananaconda #4 x Grape Milkshake Infused Pre-Roll (1g) maintained its second position from December 2025 with sales slightly decreasing to 2677. Blue Jam x Garys Ghost Infused Pre-Roll (1g) entered the top rankings at third place, indicating a strong market entry for January. Grateful Breath Live Resin Disposable (1g) ranked fourth in the Vapor Pens category, showcasing consistent demand. Highschool Sweetheart Shatter (1g) rounded out the top five, marking its debut in the rankings for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.