Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

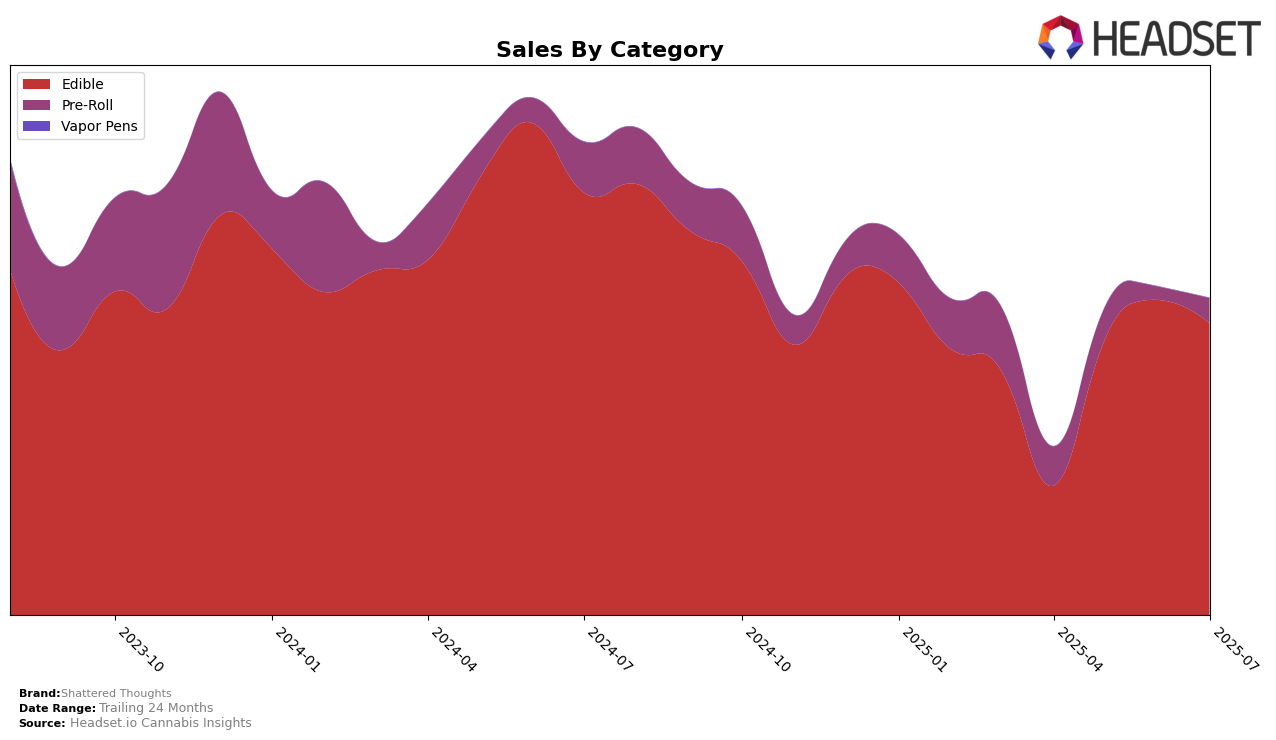

Shattered Thoughts has shown notable improvement in the Edible category in Michigan. Starting from April 2025, the brand was not even in the top 30, ranking at 43rd. However, by May, it jumped to the 29th position, and it maintained a steady climb to 26th in both June and July. This upward trajectory indicates a growing consumer interest and possibly an effective marketing strategy or product launch that resonated with Michigan consumers. The absence of a top 30 ranking in April highlights the brand's significant progress over just a few months, suggesting that Shattered Thoughts is gaining traction in a competitive market.

The sales figures support this positive movement, with a substantial increase from April to May, where sales more than doubled. Although there was a slight dip in July compared to June, the sales remained robust, indicating that the brand is managing to sustain its market presence. While Shattered Thoughts is making headway in Michigan, it is essential to consider how the brand is performing in other states and categories. The absence of rankings in other states or categories could suggest either a strategic focus on Michigan or potential areas for growth. The brand's ability to maintain its position in the top 30 in Michigan's Edible category is a promising sign of its potential to expand and capture more market share.

Competitive Landscape

In the competitive landscape of the Michigan edible cannabis market, Shattered Thoughts has demonstrated a notable upward trajectory in rankings from April to July 2025. Initially ranked 43rd in April, Shattered Thoughts surged to 29th in May and maintained a steady position at 26th through June and July. This improvement in rank is indicative of a significant increase in sales, particularly from April to May, where sales more than doubled. Despite this progress, Shattered Thoughts faces stiff competition from brands like Magic Edibles, which consistently held a top 30 position and even ranked 24th in July. Similarly, Thunder Canna and Mitten Extracts have maintained competitive sales figures, with Thunder Canna experiencing a slight dip in July. Meanwhile, Fresh Coast made a notable leap from 38th in April to 21st in June, although it slightly declined to 25th in July. These dynamics suggest that while Shattered Thoughts is gaining ground, the brand must continue to innovate and strategize to climb higher amidst strong competitors.

Notable Products

In July 2025, Blueberry Lemonade Gummies 10-Pack (200mg) maintained its top position as the best-selling product from Shattered Thoughts, with sales reaching 8,978 units. Blue Bahama Gummies (200mg) continued to hold the second spot, demonstrating consistent performance over the past three months. Cherry Berry Gummies 10-Pack (200mg) climbed to the third rank, showing a slight improvement from its fourth position in the previous two months. The THC/CBG 2:1 Daytime Pina Orange Fuzion Gummies debuted at fourth place, indicating a strong entry into the market. Ruby Limeapple Gummies 10-Pack (200mg) completed the top five, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.