Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

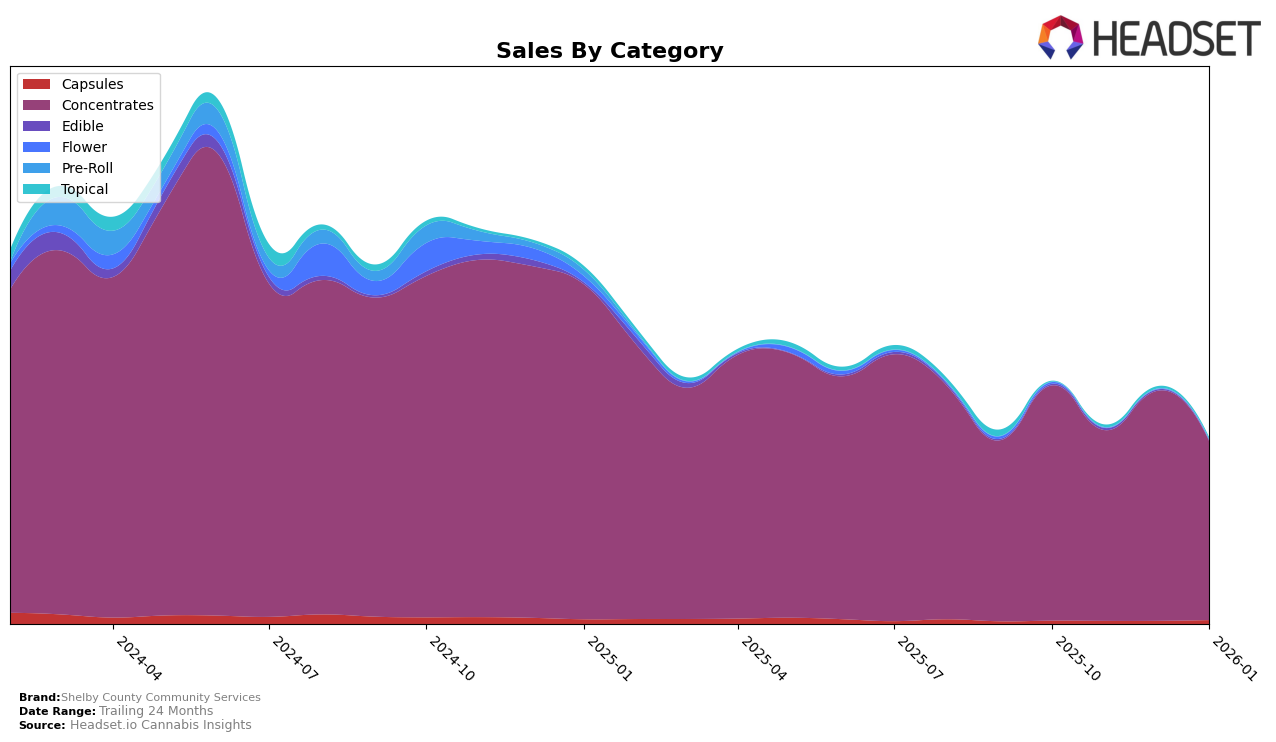

In the state of Illinois, Shelby County Community Services has shown a fluctuating performance in the Concentrates category over the past few months. Starting from a ranking of 14th place in October 2025, the brand experienced a slight dip to 16th in November, before recovering back to 14th in December. However, January 2026 saw another decline, dropping to 18th place. This indicates a variable market presence that could be influenced by numerous factors, including competitive dynamics and consumer preferences. Despite these shifts, the ability to remain within the top 20 suggests a consistent level of market engagement, although the decline in January should be a point of consideration for future strategies.

Sales figures for Shelby County Community Services in Illinois also reflect these ranking fluctuations, with a noticeable decrease from October to November, followed by a rebound in December. However, January's figures again showed a decline, aligning with the drop in rankings. The brand's absence from the top 30 in any other state or category could be seen as a limitation in their market reach, or it might indicate a strategic focus on Illinois's Concentrates segment. This concentrated effort could be a deliberate move to strengthen their position in a specific market, although it also highlights potential areas for expansion and diversification.

Competitive Landscape

In the Illinois concentrates market, Shelby County Community Services has experienced notable fluctuations in its ranking over recent months. Starting at 14th place in October 2025, the brand saw a dip to 16th in November, regained its 14th position in December, but then fell to 18th by January 2026. This downward trend in rank is mirrored by a decline in sales, with January 2026 figures showing a significant drop compared to October 2025. In contrast, FloraCal Farms has shown a more stable trajectory, maintaining a close competition with Shelby County Community Services, even surpassing it in January 2026. Meanwhile, Legacy Cannabis (IL) has demonstrated a positive trend, climbing from 20th in October to 15th by January, suggesting a growing market presence. Interestingly, Redemption Botanicals has also seen a fluctuating rank, peaking at 13th in December before dropping to 19th in January, indicating potential volatility. These dynamics highlight the competitive pressures faced by Shelby County Community Services, emphasizing the need for strategic adjustments to regain and sustain a higher market position.

Notable Products

In January 2026, the top-performing product for Shelby County Community Services was Lemon Lime Einstein CO2 RSO Oil Syringe (1g) in the Concentrates category, securing the first rank with notable sales of 259 units. The CBD/THC 10:1 Sweet Pea High CBD CO2 RSO Oil Syringe (1g) maintained a strong presence, ranking second, consistent with its position in November 2025. The 9lb Hammer CO2 Oil RSO Syringe (1g) experienced a drop from its consistent first position in the previous months to third place in January. Galactic Jack CO2 Oil RSO Syringe (1g) retained a stable ranking at fourth, mirroring its position in October 2025. Blue Dream CO2 RSO Oil Syringe (1g) rounded out the top five, showing a slight decline from its earlier higher ranks in October and December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.