Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

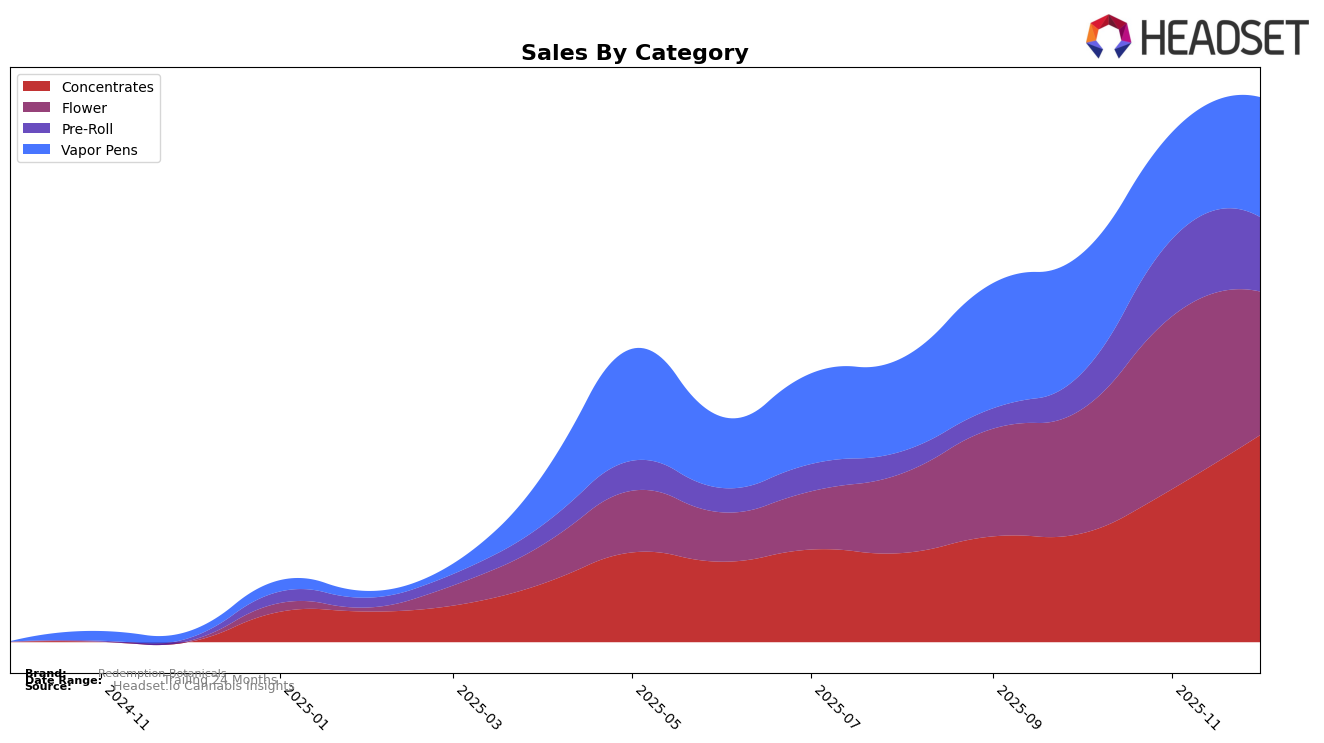

Redemption Botanicals has shown a notable performance in the Illinois market, particularly in the Concentrates category. Over the last quarter of 2025, the brand improved its ranking from 17th in October to 13th in December, indicating a positive trend in consumer preference and market penetration. This upward trajectory in Concentrates is complemented by a significant increase in sales, with December figures reaching over 161,000, a substantial rise from October's figures. However, the brand's presence in the Vapor Pens category remains relatively stable, with rankings fluctuating slightly but not breaking into the top 50, which suggests a potential area for strategic focus and improvement.

In contrast, Redemption Botanicals' performance in the Flower and Pre-Roll categories in Illinois presents a mixed picture. The Flower category saw the brand improve its ranking from 62nd in September to 57th in December, but it still remains outside the top 30, highlighting a competitive challenge in this segment. The Pre-Roll category showed more promise, with the brand breaking into the top 50 by November and maintaining its position through December. This suggests a growing consumer interest in their Pre-Roll offerings, although the brand has yet to significantly disrupt the top ranks. Overall, while Redemption Botanicals is making strides in certain categories, there is room for growth and opportunity in others to enhance their market position in Illinois.

Competitive Landscape

In the competitive landscape of concentrates in Illinois, Redemption Botanicals has shown a notable upward trend in rankings and sales from September to December 2025. Starting at rank 15 in September, Redemption Botanicals improved to rank 13 by December, indicating a positive trajectory in market presence. This improvement is particularly significant when compared to competitors like Shelby County Community Services, which maintained a relatively stable position around rank 13-14, and FloraCal Farms, which also improved from rank 19 to 15 over the same period. Meanwhile, Mozey Extracts held a consistent rank around 10-12, and Lula's experienced a decline from rank 3 to 11. Redemption Botanicals' sales growth, particularly the significant increase in December, suggests a strengthening market position and potential for continued growth amidst a competitive field.

Notable Products

In December 2025, Biscotti Sundae Live Rosin Disposable (0.5g) emerged as the top-performing product for Redemption Botanicals, reclaiming the number one rank with impressive sales of 359 units. Pomelo Fruit Snax Live Rosin Disposable (0.5g) closely followed, maintaining its second-place position from the previous month with strong sales. Super Boof Live Rosin Disposable (0.5g) saw a significant rise, moving up to third place from fifth in November. Pink Melonz Live Resin Badder (1g) entered the rankings for the first time at fourth place, indicating a growing interest in concentrates. Black Maple (3.5g) experienced a drop, falling to fifth place after previously holding the top spot in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.