Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

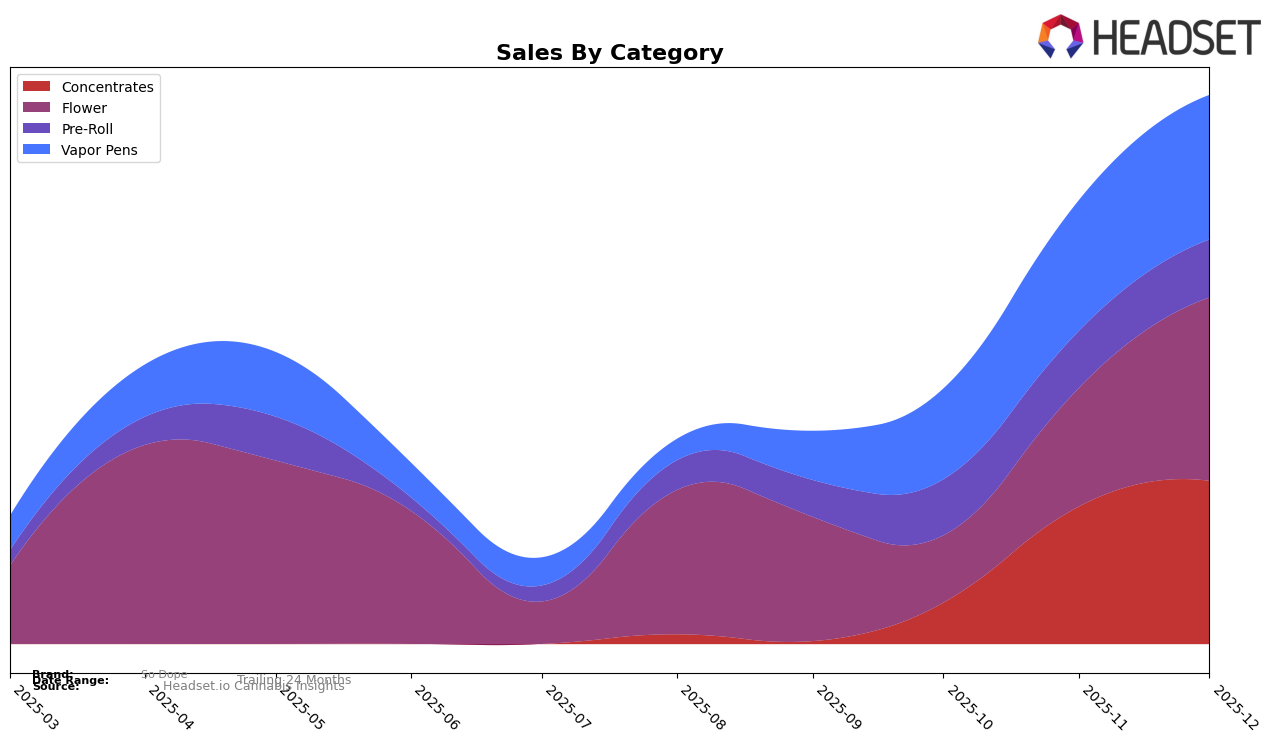

In the New York market, So Dope has shown a noteworthy upward trajectory in the Concentrates category. Starting from a position outside the top 30 brands in September 2025, So Dope climbed to rank 34 by October, subsequently moving up to 20 by November, and then to 19 by December. This steady improvement highlights So Dope's growing presence and acceptance in the Concentrates segment. The brand's sales figures reflect this positive trend, with a significant increase from October to December. Such consistent advancement in rankings suggests a robust strategy or product offering that resonates well with consumers in New York.

Conversely, in the Vapor Pens category within New York, So Dope's performance has been more modest. The brand was not ranked in the top 30 in September, entering the list at rank 89 in October. It then showed a slight improvement, reaching 77 in November, followed by a minor dip to 78 in December. While the rankings indicate a slower pace of growth compared to the Concentrates category, the sales figures still reflect a positive trend, suggesting that there might be potential for further growth if the brand can address the competitive challenges in the Vapor Pens segment.

Competitive Landscape

In the competitive landscape of the New York concentrates market, So Dope has demonstrated a notable upward trajectory in its rankings and sales. After not appearing in the top 20 in September 2025, So Dope climbed to rank 34 in October and continued its ascent to rank 19 by December. This improvement is significant when compared to competitors like Lobo, which also showed a positive trend but started from a lower rank of 29 in September and reached 17 by December. Meanwhile, urbanXtracts and Silly Nice maintained relatively stable positions, with urbanXtracts fluctuating slightly and Silly Nice holding steady around the 18th rank. Pura experienced a more volatile journey, dropping to 28th in October before recovering to 20th by December. So Dope's rapid rise in rankings is mirrored by its sales growth, which saw a substantial increase from October to December, positioning it as a formidable contender in the market.

Notable Products

In December 2025, Sour Diesel (3.5g) from So Dope emerged as the top-performing product, securing the number one rank with notable sales of 486 units. Peaches & Cream Distillate Disposable (1g) closely followed, dropping from its previous top position in October to second place, with sales reaching 480 units. Tangie Banana Distillate Cartridge (1g) maintained a strong presence, moving up from third in November to third again in December with 393 units sold. Trop Cherry Pre-Roll 5-Pack (2.5g) improved its rank from fifth in November to fourth in December, indicating a growing preference. Citrus Guava Live Sugar (2g) entered the top five for the first time in December, highlighting a shift in consumer interest towards concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.