Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

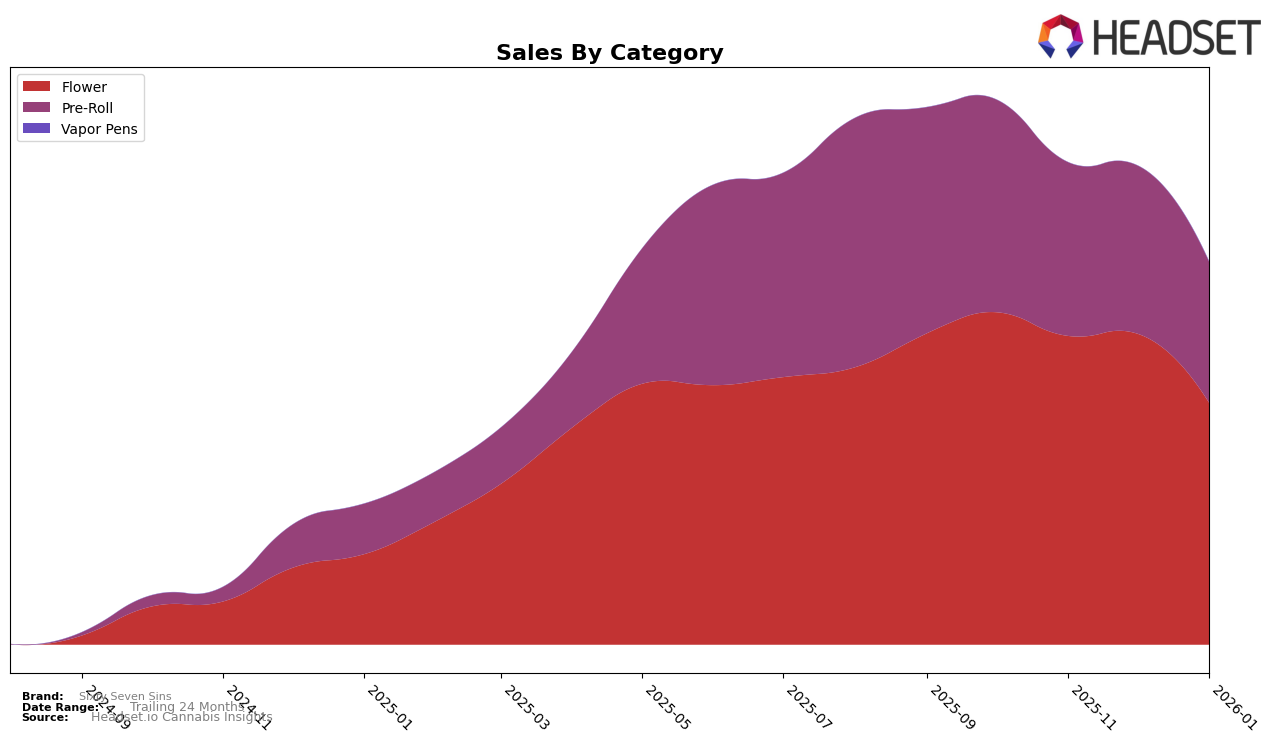

Sixty Seven Sins has displayed a fluctuating performance across different categories in the Canadian province of Ontario. In the Flower category, the brand maintained a consistent presence within the top 30 rankings from October 2025 to January 2026, although there was a noticeable downward trend from rank 22 in October to rank 27 in January. This decline in ranking is mirrored by a decrease in sales, with January 2026 sales figures dropping to approximately 614,941 CAD. While the Flower category saw a steady presence, the Pre-Roll category tells a different story, with Sixty Seven Sins not making it into the top 30 rankings from November 2025 onwards. This suggests a challenging competitive landscape in the Pre-Roll category, possibly indicating the need for strategic adjustments.

The overall performance of Sixty Seven Sins in Ontario highlights both opportunities and challenges. The brand's ability to maintain a top 30 position in the Flower category despite a sales decline suggests a resilient market presence, yet the lack of top 30 rankings in the Pre-Roll category from November 2025 onwards may point to potential areas for improvement. Such trends are crucial for stakeholders to consider, as they provide insights into market dynamics and competitive positioning. While the data offers a glimpse into the brand's trajectory, a deeper analysis could uncover more nuanced factors influencing these movements.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Sixty Seven Sins has experienced notable fluctuations in its market position over recent months. From October 2025 to January 2026, Sixty Seven Sins saw a decline in rank from 22nd to 27th, indicating increased competition and potential challenges in maintaining its market share. Despite this, the brand's sales figures remained relatively robust compared to competitors such as EastCann and Woody Nelson, which consistently ranked lower but showed stable sales performance. Carmel and BC Smalls also trailed behind in terms of sales, despite slight improvements in their rankings. This suggests that while Sixty Seven Sins faces competitive pressures, its sales volume remains a strong point, though the downward trend in ranking highlights the need for strategic adjustments to regain its standing in the market.

Notable Products

In January 2026, the top-performing product from Sixty Seven Sins was 67 Artisan Reserve (3.5g) in the Flower category, maintaining its number one rank from previous months, although sales decreased to 4078 units. Gas Face (3.5g) also held steady at the second rank in the Flower category, with a consistent performance across the months. Gary Satan (3.5g) remained third, reflecting stable consumer interest despite a slight decline in sales figures. The Gas Face Pre-Roll 7-Pack (3.5g) continued to rank fourth in the Pre-Roll category, showing consistent popularity. A new entry, 67 Artisan Reserve Pre-Roll 5-Pack (2.5g), entered the rankings at fifth place, indicating a successful product launch.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.