Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

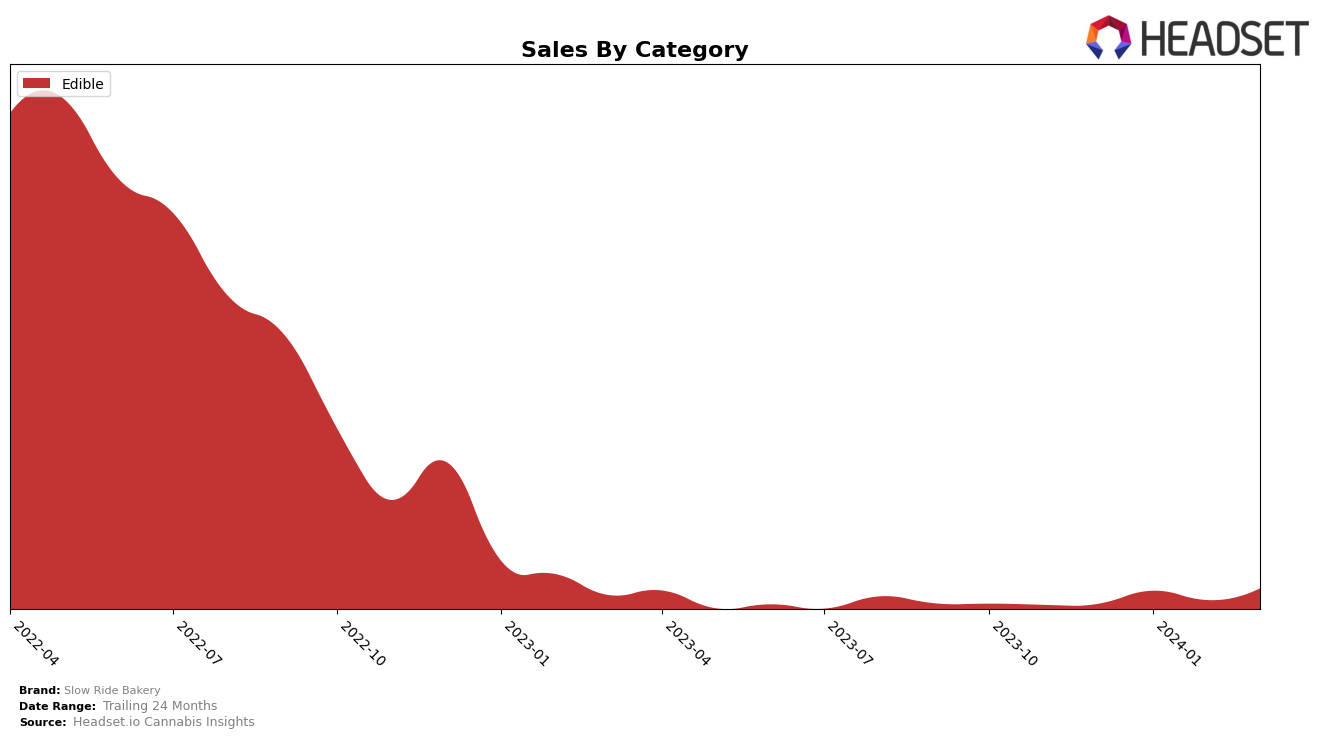

In the edible category, Slow Ride Bakery's performance presents an interesting landscape across different states and provinces, with notable fluctuations in their rankings. In Ontario, the brand has shown a slight but consistent decline in its ranking from December 2023 to March 2024, moving from 73rd to 70th place. This decline comes despite a peak in sales in January 2024, indicating a competitive market environment where even significant sales volumes may not guarantee a top spot in the rankings. Conversely, in Saskatchewan, Slow Ride Bakery has demonstrated a positive trajectory, improving its position from not being in the top 30 in December 2023 to securing the 25th spot by March 2024. This upward movement, coupled with a substantial increase in sales in March 2024, suggests a growing consumer base and increased brand recognition within the province.

However, the brand's journey in Alberta paints a different picture. Starting from not being ranked in December 2023, Slow Ride Bakery managed to enter the rankings in January 2024 at 60th place and improved slightly to 58th by February 2024. Unfortunately, there is no ranking data available for March 2024, which could indicate a potential slip out of the top rankings or simply a lack of available data. This fluctuating presence in the Alberta market highlights the challenges faced by new or expanding brands in establishing a steady foothold amidst fierce competition. Despite these challenges, the initial entry into the rankings suggests a potential for growth, though sustaining and improving that position will require strategic efforts and perhaps an adaptation to consumer preferences and market dynamics in Alberta.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Saskatchewan, Slow Ride Bakery has shown a notable trajectory of improvement in its ranking among competitors from not being in the top 20 in December 2023 to securing the 25th position by March 2024. This upward movement is particularly impressive when considering the sales growth from 648 units in January to 2430 units in March, indicating a strong positive trend. Competitors such as Ace Valley, which has seen a slight decline from 19th to 23rd place, and A-HA!, which experienced fluctuating ranks but notably dropped to 26th place in March, highlight the dynamic nature of the market. Rosin Heads and Voodoo Cannabis have also seen changes in their rankings, maintaining positions in the mid to lower twenties, which suggests a competitive but volatile market space. Slow Ride Bakery's significant sales increase and improvement in rank amidst these fluctuations suggest a growing consumer interest and potential for further market penetration.

Notable Products

In March 2024, Slow Ride Bakery's top-selling product was the Big Chocolate Cookie (10mg) within the Edible category, boasting sales of 329 units. Following closely, the Reverse Chocolate Chip Cookie (10mg) secured the second spot with a notable jump in rank from fifth to second when compared to February. The Ginger Molasses Cookie (10mg), once the leader in December 2023, settled at third place, indicating a shift in consumer preferences. The Chocolate Hazelnut Spread (10mg) made an impressive entry into the top rankings, landing at fourth despite not being ranked in February. Lastly, the Peanut Butter Cookie (10mg) experienced a slight decline, moving from second in February to fifth in March, rounding out the top five products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.