Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

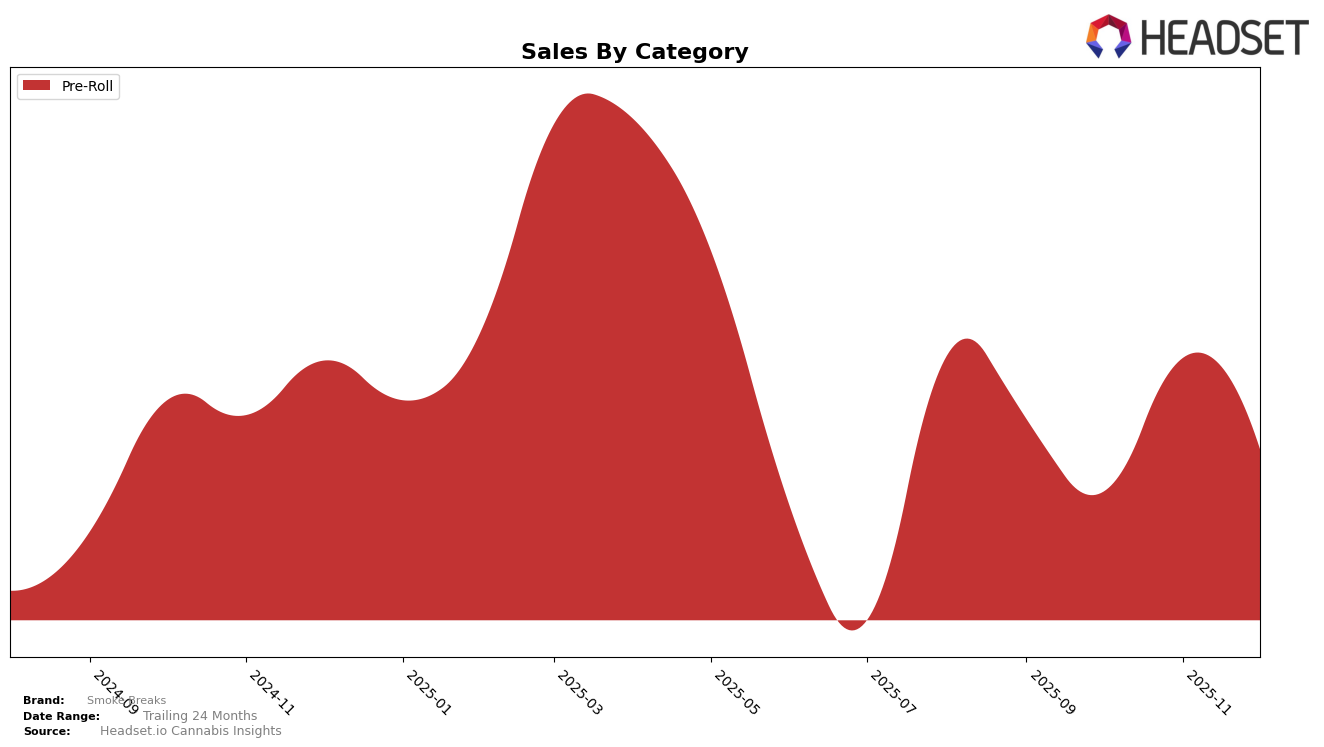

In the state of Illinois, Smoke Breaks has shown a notable trajectory in the Pre-Roll category over the last few months of 2025. While the brand was not in the top 30 in October, it rebounded in November to secure the 25th position, further improving to 24th in December. This upward trend indicates a positive reception and growing consumer interest, particularly noteworthy given the competitive nature of the Pre-Roll category. Despite a dip in October sales, the brand's recovery in subsequent months suggests effective strategies or product offerings that resonated well with the market.

Smoke Breaks' performance in Illinois is a microcosm of its broader strategy and market presence, reflecting both challenges and opportunities within the Pre-Roll category. The absence from the top 30 in October could have signaled a temporary setback, yet the brand's ability to climb back into the rankings by November highlights resilience and adaptability. Such movements are critical for stakeholders to monitor, as they provide insights into consumer preferences and competitive dynamics. The fluctuations in rankings and sales figures underscore the importance of maintaining a strong market presence and the potential for growth when brands can successfully navigate market conditions.

Competitive Landscape

In the competitive landscape of the Illinois pre-roll category, Smoke Breaks has demonstrated a notable upward trajectory in rankings from October to December 2025, moving from 32nd to 24th place. This improvement is significant, especially when considering that competitors like IC Collective and Revolution Cannabis experienced a decline in their rankings during the same period. IC Collective dropped out of the top 20 by November, while Revolution Cannabis fell from 17th to 25th place by December. Meanwhile, The Botanist and Elevate have shown less volatility, with Elevate entering the rankings in November at 27th and improving to 23rd by December. This competitive shift highlights Smoke Breaks' ability to gain market share and improve its standing amidst fluctuating performances from its rivals.

Notable Products

In December 2025, the top-performing product for Smoke Breaks was Kush Mints Pre-Roll 10-Pack (3.5g), securing the number one rank with sales reaching 914 units. Lemon Fatman Pre-Roll 5-Pack (1.75g) followed closely, dropping to the second position after holding the top spot for two consecutive months in October and November. Lemon Fatman Pre-Roll 10-Pack (3.5g) maintained a consistent presence in the rankings, securing third place after a slight dip from its second position in November. Grease Monkey Pre-Roll 5-Pack (1.75g) and Super Boof Pre-Roll 5-Pack (1.8g) completed the top five, entering the rankings for the first time in December at fourth and fifth, respectively. The shifts in rankings highlight a dynamic market with Kush Mints making a strong debut and Lemon Fatman products showing resilience despite slight fluctuations.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.