Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

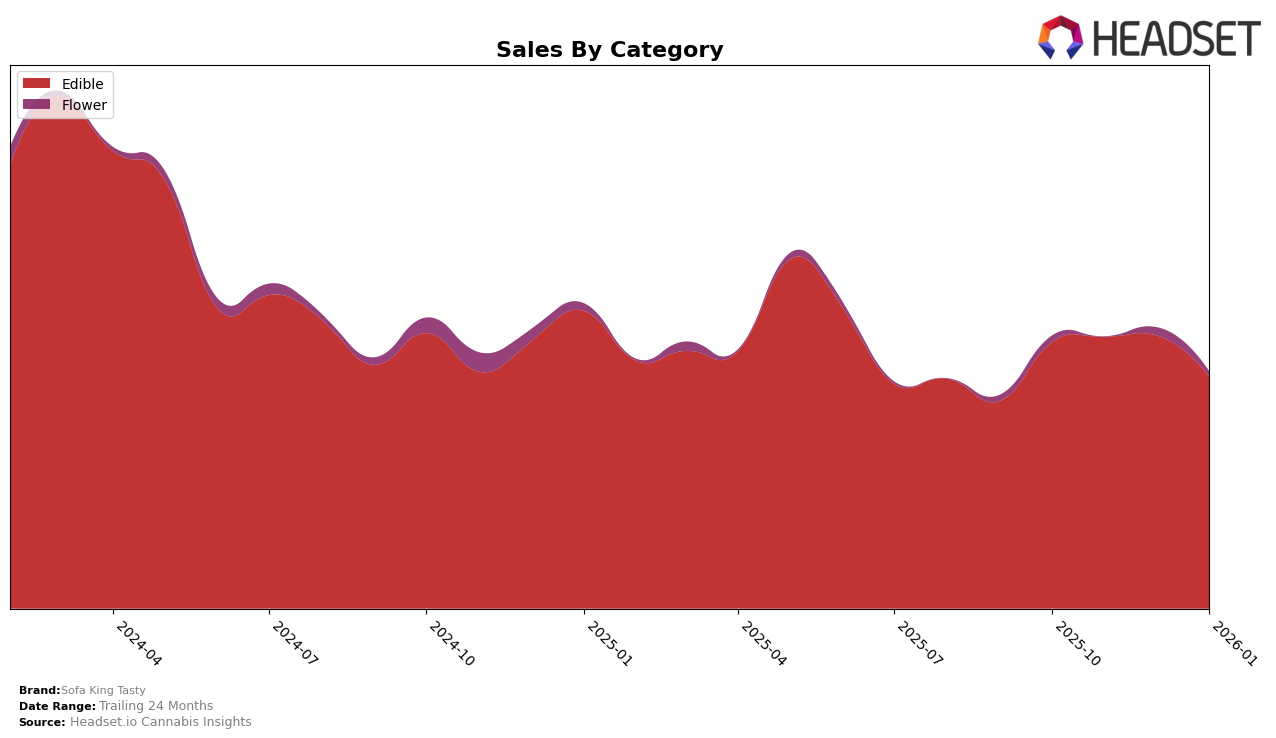

Sofa King Tasty's performance in the Arizona market has shown a slight decline in the Edible category rankings over the past few months. Starting at 12th place in October 2025, the brand has gradually moved down to 16th place by January 2026. Despite this downward trend in rankings, the brand's sales figures reveal a different narrative. From October to December 2025, Sofa King Tasty experienced a modest increase in sales, peaking in December before seeing a drop in January 2026. This suggests that while the brand may be losing its competitive edge in terms of ranking, it still maintains a relatively strong presence in terms of sales volume.

It is noteworthy that Sofa King Tasty has consistently remained within the top 30 brands in the Edible category in Arizona, indicating a steady demand for their products. However, the absence of rankings in other states or categories could imply potential areas for growth or a lack of market penetration outside of Arizona's Edible market. This situation presents both a challenge and an opportunity for the brand to explore expansion strategies or enhance its offerings to regain or improve its position in the competitive landscape. The data suggests that while Sofa King Tasty has a foothold in Arizona, there is room for improvement and expansion into other markets or product categories.

Competitive Landscape

In the competitive landscape of the Arizona edible market, Sofa King Tasty has experienced a slight decline in its rankings from October 2025 to January 2026, moving from 12th to 16th place. This shift is notable when compared to competitors such as Zenzona, which has maintained a relatively stable position, fluctuating between 14th and 15th place, and Tru Infusion, which has consistently ranked just above Sofa King Tasty, moving from 14th to 17th place. Despite the drop in rank, Sofa King Tasty's sales have remained relatively stable, indicating a loyal customer base, although they saw a dip in January 2026. Meanwhile, Dialed In Gummies entered the top 20 in December 2025 and climbed to 15th by January 2026, suggesting a rising competitor. These dynamics highlight the importance for Sofa King Tasty to innovate and possibly adjust marketing strategies to regain its competitive edge in this evolving market.

Notable Products

In January 2026, the top-performing product for Sofa King Tasty was Sativa Watermelon Gummies (100mg), which rose to the number one rank despite a decrease in sales to 3682 units. Sativa Cherry Gummies (100mg), which previously held the top spot, slipped to second place. Rainbow Crunch Gummies 10-Pack (100mg) maintained a consistent third place across the months. Hybrid Orange Gummies (100mg) stayed steady at fourth place, showing little change in its rank. Notably, Skunkee (1g) entered the rankings for the first time at fifth place, indicating a strong debut performance for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.