Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

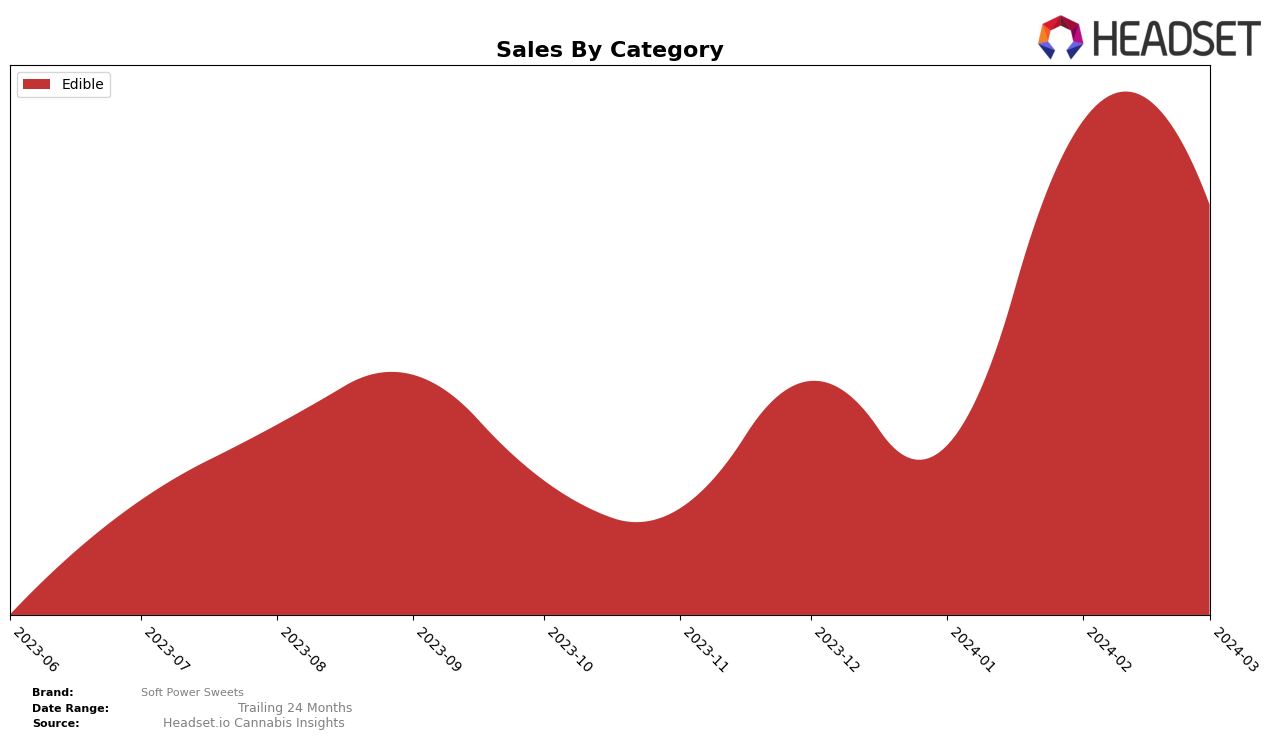

In the competitive cannabis edibles market in New York, Soft Power Sweets has shown a notable performance trajectory over the recent months. Starting from December 2023, the brand was barely holding onto its position within the top 30 brands, ranking at 32. Despite a slight improvement in January 2024, moving up to rank 30, the real breakthrough came in February 2024 when Soft Power Sweets surged to rank 22. This jump in rankings is indicative of a significant increase in consumer interest and sales, which more than doubled from January to February, reaching $31,540. Although there was a slight dip to rank 23 in March 2024, the brand's ability to climb and maintain its position within the top 30 amidst fierce competition speaks volumes about its growing popularity and market acceptance in New York's cannabis edibles category.

While the raw sales data and specific ranking numbers highlight key points of interest, they also hint at underlying trends and market dynamics that are shaping the performance of Soft Power Sweets. The slight decrease in rank from February to March 2024, despite maintaining relatively high sales, suggests a highly competitive environment where even small fluctuations in sales can impact rankings significantly. This dynamic environment underscores the importance of continuous innovation and marketing efforts to stay ahead. Furthermore, the brand's initial struggle to break into the top 30 and its subsequent rise reflect a potentially strategic adjustment in operations, product offerings, or marketing strategies that resonated well with the New York market. As Soft Power Sweets navigates through these competitive waters, its adaptability and understanding of consumer preferences will be crucial in sustaining and potentially improving its market position in the future.

Competitive Landscape

In the competitive landscape of the edible category in New York, Soft Power Sweets has shown a notable upward trajectory in both rank and sales from December 2023 to March 2024, moving from the 32nd to the 23rd position. This improvement is significant, especially when compared to competitors like OHHO, which maintained a steady rank around the 19th to 21st position but with a higher sales volume, and Bison Botanics, which also showed stability in its ranking but with slightly lower sales. Interestingly, Foy, despite not being ranked until January 2024, made a dramatic entrance to tie with Soft Power Sweets in rank by March 2024, showcasing an impressive increase in sales. Another competitor, Matter., despite starting from a lower rank, has seen a significant rise, ending up at the 25th position by March 2024 with the highest sales increase among the mentioned brands. This competitive analysis highlights Soft Power Sweets' positive momentum in the market, yet it also underscores the dynamic nature of the edible cannabis market in New York, with brands like Foy and Matter. showing remarkable growth in sales and rank, indicating a highly competitive environment.

Notable Products

In March 2024, Soft Power Sweets saw Dulce De Leche Chocolate Caramel 2-Pack (20mg) maintain its position as the top-selling product with impressive sales of 807 units, highlighting its consistent popularity across several months. Following in rank, High, I Love You Chocolate Hearts 5-Pack (50mg) secured the second spot, showing significant growth from its previous ranking in February. The third place was held by Raspberry Rainbow Almond Caramels Caramel 2-Pack (20mg), which slightly dipped in sales but managed to maintain its position in the top three. Matcha Latte Caramel 2-Pack (20mg) and Tart Cherry Chocolate Bar (60mg) rounded out the top five, with both products demonstrating steady sales and holding their ranks from the previous month. These rankings indicate a strong preference for edibles within the Soft Power Sweets lineup, with notable shifts in consumer interest and product performance over time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.