Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

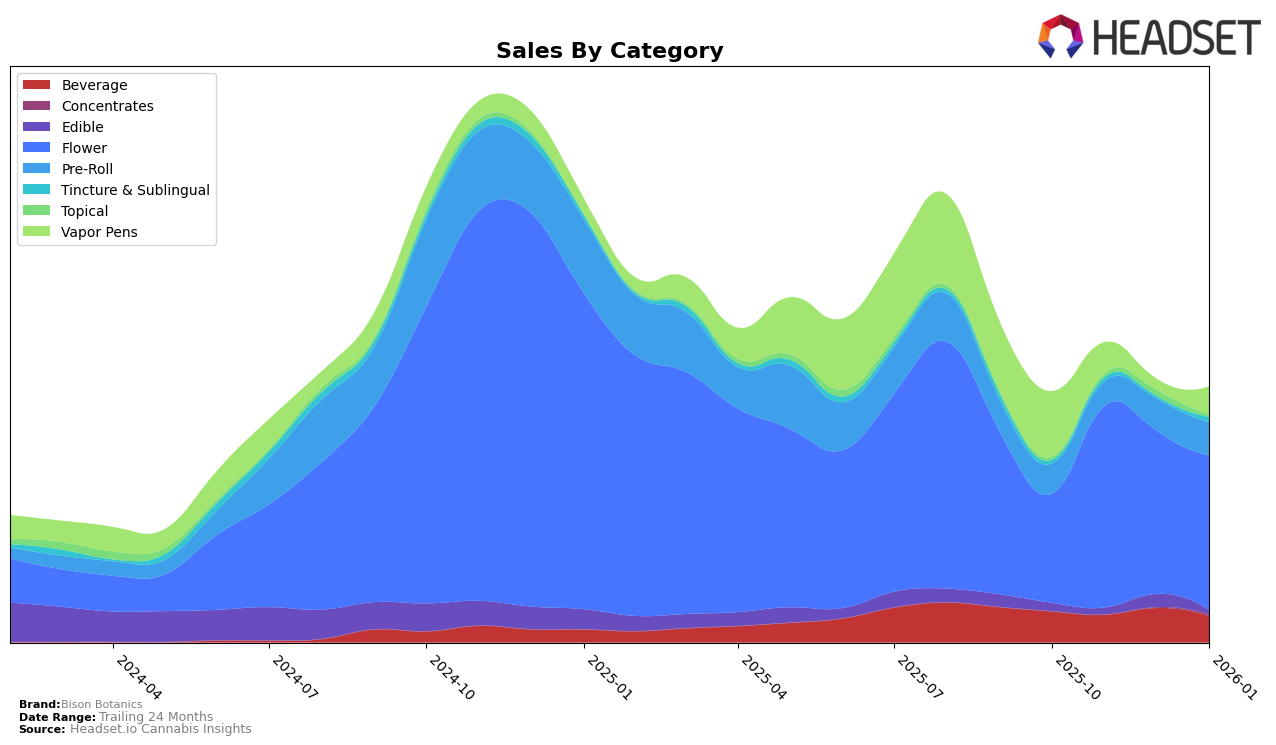

Bison Botanics has shown a consistent presence in the New York cannabis market, particularly in the Beverage category. The brand maintained a steady rank of 9th place in both October and November 2025, before slightly dropping to 10th in December 2025 and January 2026. Despite this small dip in ranking, the sales figures indicate a fluctuating yet resilient performance with a notable spike in December 2025. This suggests that Bison Botanics has managed to capture a loyal customer base in the Beverage category, even amidst competitive pressures. However, their absence from the top 30 in the Flower category in October 2025, followed by an entry at 74th in November, indicates potential challenges in gaining a foothold within this segment.

In the Vapor Pens category, Bison Botanics' performance in New York has been inconsistent, with rankings ranging from 72nd place in October 2025 to 93rd in January 2026. This fluctuation suggests a volatile market presence, potentially impacted by external market factors or shifts in consumer preferences. Notably, the brand did not appear in the top 30 rankings in December 2025, which might indicate a temporary setback or increased competition during that period. Overall, while Bison Botanics has achieved some success in certain categories, the data highlights areas for potential growth and strategic focus, particularly in expanding their market share in the Flower and Vapor Pens segments.

Competitive Landscape

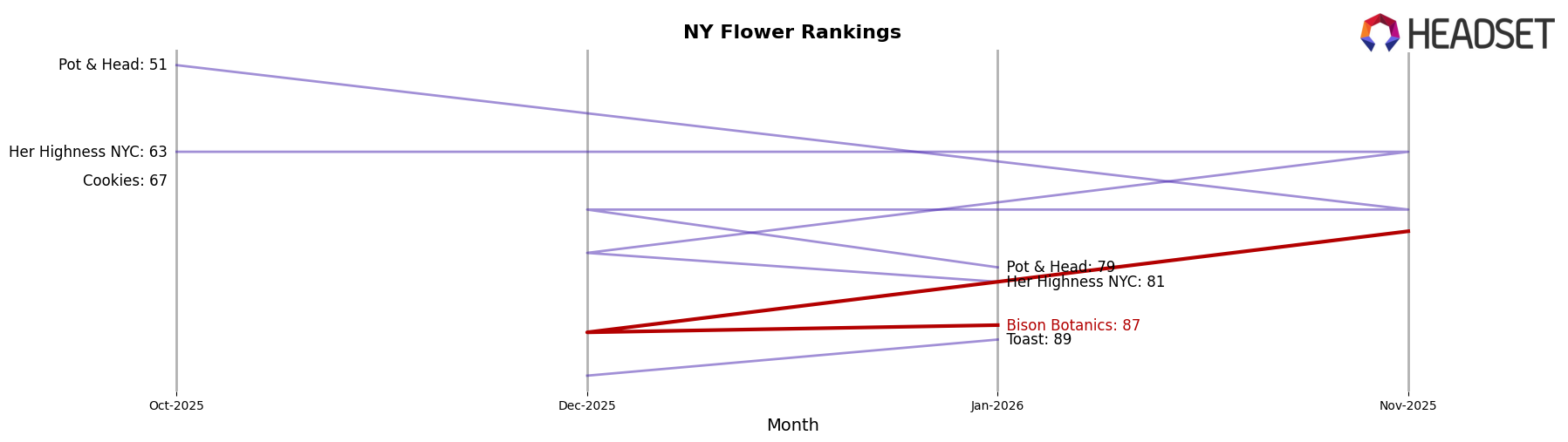

In the competitive landscape of the New York flower category, Bison Botanics has shown a dynamic shift in its market position from October 2025 to January 2026. Initially absent from the top 20 rankings in October 2025, Bison Botanics climbed to 74th place in November, and while it experienced a slight dip to 88th in December, it managed to improve marginally to 87th in January. This fluctuation in rank is notable when compared to competitors like Her Highness NYC, which maintained a more stable presence, albeit with a downward trend from 63rd in October to 81st in January. Meanwhile, Pot & Head also saw a decline from 51st to 79th over the same period. Despite these challenges, Bison Botanics' sales trajectory indicates a consistent decrease, suggesting a need for strategic adjustments to enhance competitive positioning and sales performance in the New York market.

Notable Products

In January 2026, the top-performing product for Bison Botanics was the Wild Strawberry Rhubarb Lemonade (10mg THC, 355ml, 12oz) in the Beverage category, maintaining its consistent first-place rank from previous months, though its sales decreased to 1,428 units. Funk Juice (3.5g), a Flower category product, emerged as the second top-seller with notable sales of 1,213 units. The Loganberry Sparkling Beverage (10mg THC, 355ml, 12oz) secured the third position, a slight drop from its second-place rank in December 2025. Cookies & Cream (3.5g) climbed to fourth place, marking its reappearance in the top ranks since October 2025. Lastly, the Loganberry Sparkling Beverage (5mg THC, 355ml, 12oz) entered the top five, showcasing a strong debut in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.