Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

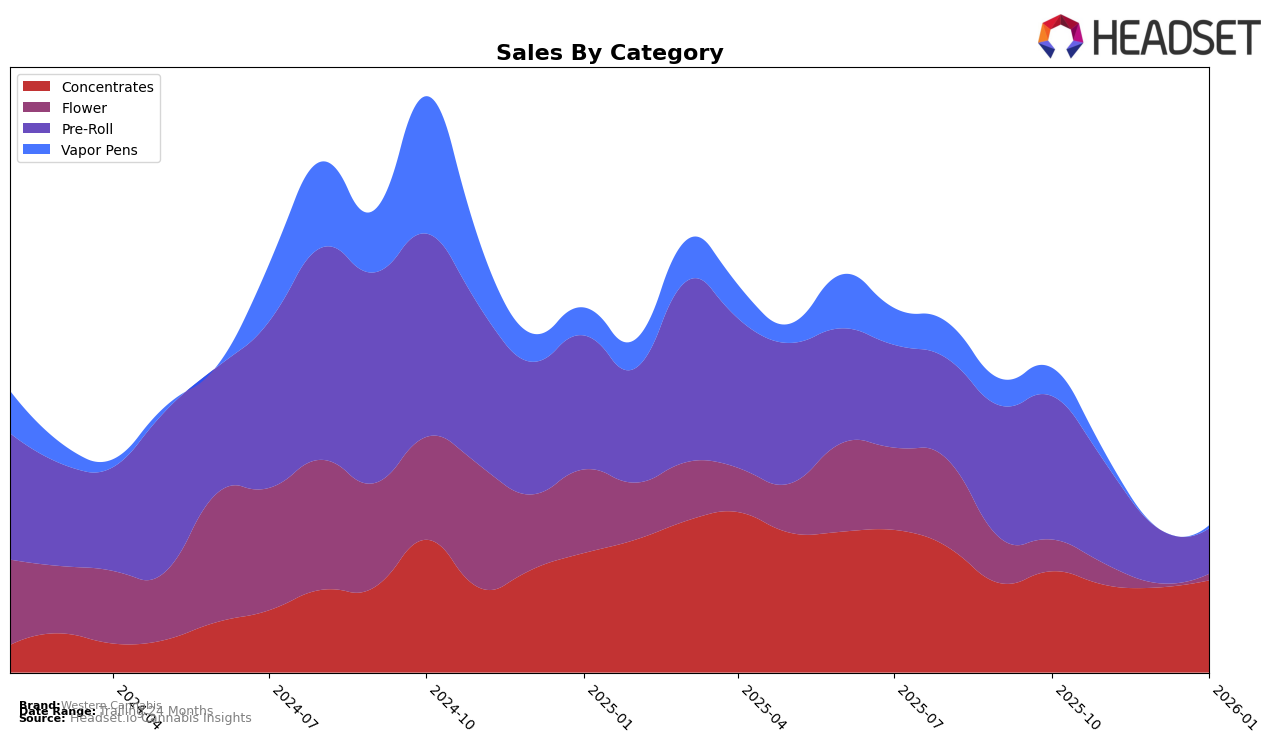

Western Cannabis has demonstrated notable performance across various categories and regions, with some intriguing trends emerging over recent months. In Alberta, the brand's ranking in the Concentrates category improved from 17th in October 2025 to 15th by January 2026, showing a consistent upward trajectory. However, their performance in the Pre-Roll category tells a different story, as they did not make it into the top 30 rankings for the last three months, suggesting a potential area for improvement. Interestingly, Western Cannabis did not maintain a consistent presence in the Vapor Pens category in Alberta, with a brief appearance in October 2025 at 71st place before dropping out of the top 30 in subsequent months, only to reappear at 84th in January 2026.

In Saskatchewan, Western Cannabis has shown a strong presence in the Concentrates category, maintaining a top 10 position throughout the last four months, peaking at 3rd place in October 2025. This is a positive indicator of their strong foothold in this category within the province. On the other hand, their performance in the Flower and Pre-Roll categories has been less stable, with rankings dropping out of the top 30 by December 2025. Meanwhile, in British Columbia, Western Cannabis had a notable decline in the Concentrates category, slipping from 11th in October 2025 to 33rd by January 2026. Their absence from the top 30 in both the Pre-Roll and Vapor Pens categories during the last three months suggests challenges in maintaining competitiveness in these segments.

Competitive Landscape

In the Alberta concentrates market, Western Cannabis has shown a steady improvement in its ranking from October 2025 to January 2026, moving from 17th to 15th place. This upward trend suggests a positive reception of their products, despite the competitive landscape. Notably, Virtue Cannabis and Roilty Concentrates have experienced fluctuations in their rankings, with Virtue Cannabis dropping from 7th to 13th and Roilty Concentrates slipping from 11th to 16th over the same period. Meanwhile, RAD (Really Awesome Dope) has maintained a relatively stable position, closely trailing Western Cannabis. The most notable surge was by Headstone Cannabis, which jumped from 26th to 8th in November 2025 but then settled at 17th by January 2026. These dynamics indicate that while Western Cannabis is gaining ground, it faces significant competition from brands that are also vying for higher market positions, which could impact future sales growth.

Notable Products

In January 2026, the top-performing product for Western Cannabis was Electric Cherry Shatter (1g) in the Concentrates category, achieving the number 1 rank with a notable sales figure of 1225.0. Matanuska TF Shatter (1g) also saw significant success, climbing to the 2nd rank from its previous 5th position in December 2025. Grape Slushee Shatter (1g) dropped to the 3rd rank after leading in December, indicating a slight decrease in momentum. Orange Creamsicle Pre-Roll 12-Pack (6g) fell to the 4th position, continuing its decline from the top spot in November. Matanuska Thunder Fuck Pre-Roll 3-Pack (1.5g) further slipped to 5th, highlighting a consistent downward trend over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.