Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

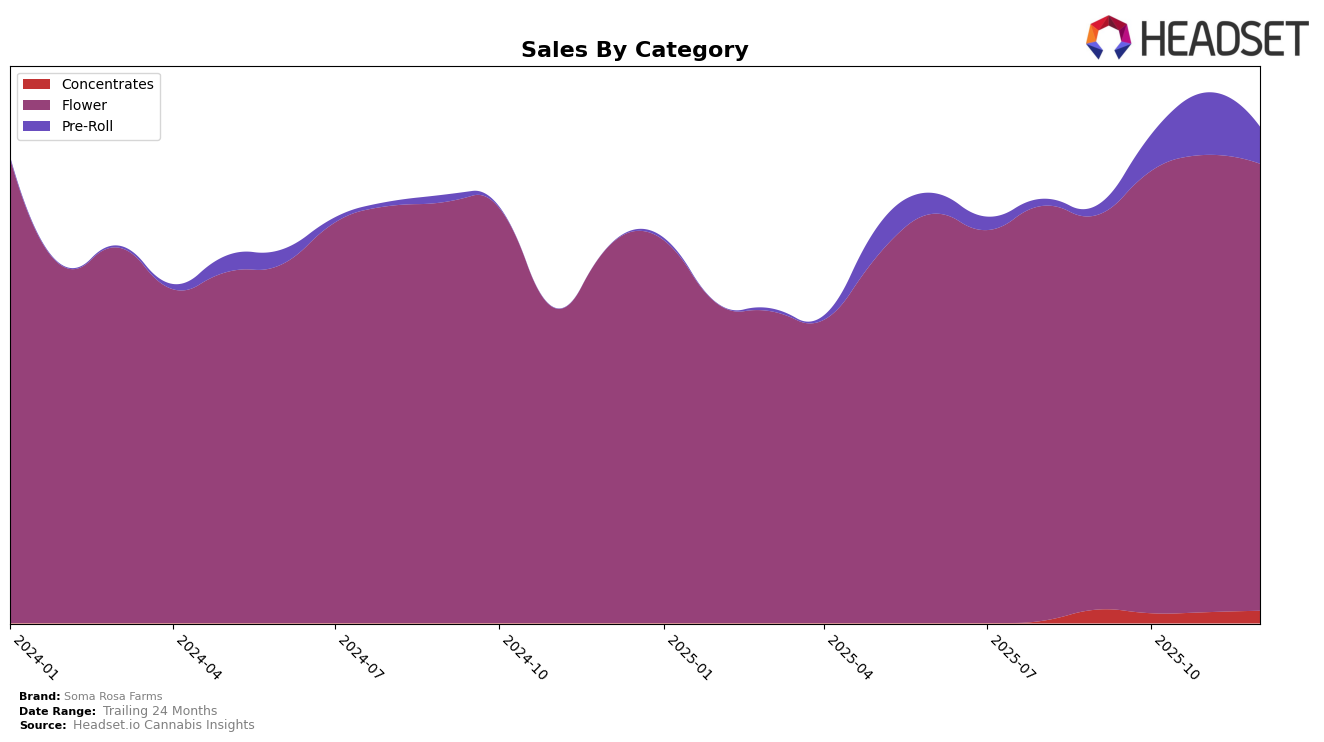

Soma Rosa Farms has shown varying performance across different product categories in California. In the concentrates category, the brand's ranking fluctuated, starting at 77th in September and returning to the same position in December, despite dipping to 91st in October. This inconsistency highlights a challenge in maintaining a strong foothold in the concentrates market. Conversely, in the flower category, Soma Rosa Farms demonstrated a more positive trend, improving its position from 31st in September to 26th in November, before slightly dropping to 29th in December. This upward movement in the flower category suggests a strengthening presence and possibly better consumer reception or product offerings during this period.

In the pre-roll category, Soma Rosa Farms entered the top 30 brands in California only in December, securing the 85th position. This late entry indicates that the brand has room for growth and potential to improve its market share in this category. The absence of a ranking in the previous months suggests that Soma Rosa Farms was not a major player in the pre-roll segment until the end of the year. This could either signify a new strategic focus on pre-rolls or a successful marketing campaign that helped boost their visibility. Overall, while there are areas of strength, particularly in the flower category, the brand faces challenges in maintaining consistent performance across other categories.

Competitive Landscape

In the competitive landscape of the California flower category, Soma Rosa Farms experienced fluctuations in its ranking from September to December 2025, reflecting a dynamic market environment. Starting at the 31st position in September, Soma Rosa Farms improved its rank to 28th in October and further to 26th in November, before slipping back to 29th in December. This indicates a competitive pressure from brands like 3C Farms / Craft Cannabis Cultivation, which showed a consistent upward trend from 37th in September to 28th by December, and Almora Farms, which also saw a rise in rankings before a dip in December. Meanwhile, Traditional Co. maintained a stable presence, fluctuating slightly but remaining close to Soma Rosa Farms' rank. Notably, Smoken Promises experienced a significant drop from 19th in September to 30th in November, before recovering to 27th in December, highlighting the volatility in the market. These shifts suggest that while Soma Rosa Farms has managed to maintain a competitive position, it faces strong competition from other brands that are either improving their market presence or recovering from temporary setbacks.

Notable Products

In December 2025, the top-performing product from Soma Rosa Farms was Lemon Tree Pre-Roll (1g) in the Pre-Roll category, which climbed to the number one position from its previous fourth place in November, with sales reaching $2,653. The Soap Pre-Roll (1g) maintained its second-place ranking from the previous month, indicating consistent performance. Vanilla Drip (3.5g) entered the top ranks at third place in the Flower category, showing a strong debut. Turquoise Jeep Pre-Roll (1g) and Obama Runtz Pre-Roll (1g) held steady at the fourth and fifth positions, respectively, similar to their November standings. Overall, the December rankings highlight a significant rise for Lemon Tree Pre-Roll and stability for other leading products from Soma Rosa Farms.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.