Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

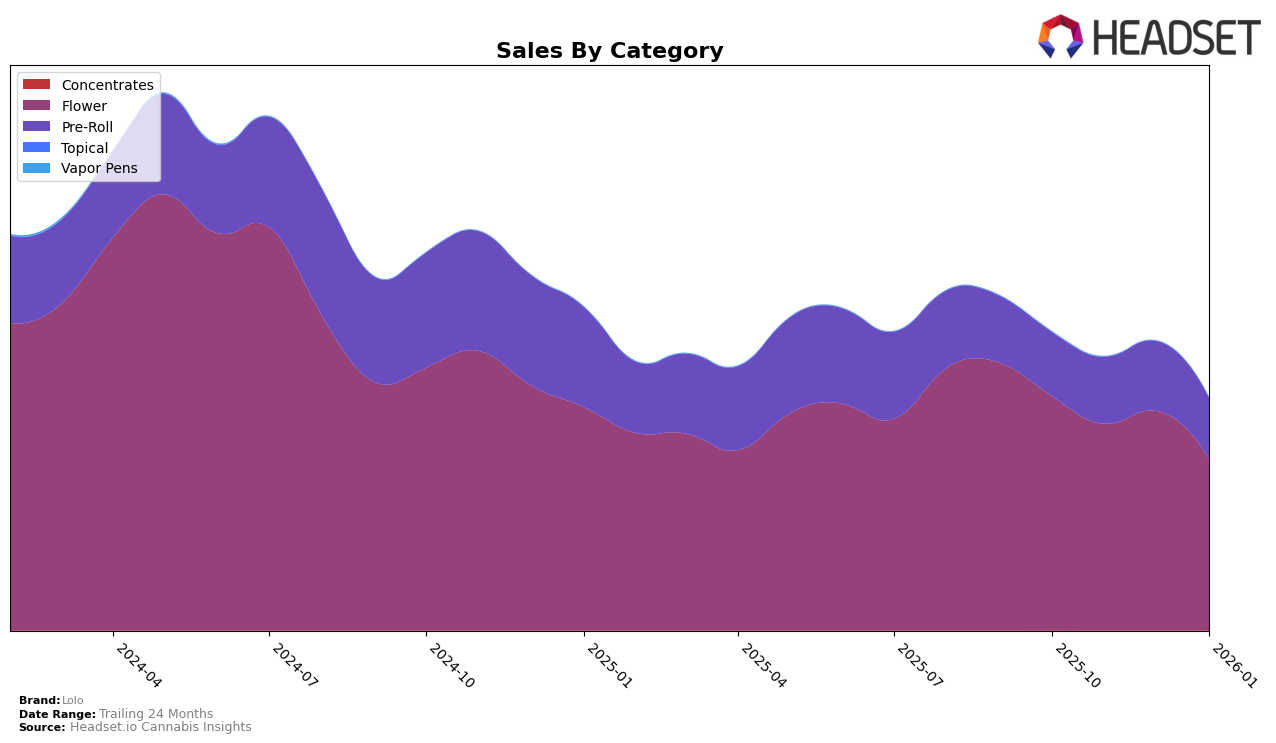

In the state of California, Lolo's performance in the Flower category has seen some fluctuations over the recent months. Despite not making it into the top 30 brands, Lolo has shown resilience in maintaining a relatively stable presence. The brand ranked 33rd in October 2025, slightly dropping to 34th in November, and improving to 32nd in December. However, by January 2026, Lolo's ranking fell to 45th, indicating a notable decline. This downward trend could suggest increased competition or possible shifts in consumer preferences. It's essential to consider these dynamics when evaluating Lolo's position in the California market.

Lolo's performance in the Pre-Roll category in California presents a different story. Although the brand did not break into the top 30, there has been a consistent upward movement in rankings from 68th in October 2025 to 56th by January 2026. Despite this positive trend, it is important to note that the brand's sales in this category saw a dip in January 2026 after peaking in December 2025. This suggests that while Lolo is gaining traction in terms of market presence, sustaining sales growth remains a challenge. Observing how Lolo adapts and strategizes in the coming months will be key to understanding its potential market impact.

Competitive Landscape

In the competitive landscape of the California flower category, Lolo's performance from October 2025 to January 2026 reveals a dynamic shift in rank and sales. Lolo experienced a decline in rank from 33rd in October 2025 to 45th by January 2026, indicating a potential challenge in maintaining its market position. During this period, Lolo's sales also showed a downward trend, with a notable decrease from November to January. In contrast, Daze Off improved its rank significantly, moving from 48th in October to 31st in January, alongside a steady increase in sales, suggesting a growing consumer preference. Meanwhile, Time Machine and Lights Out also demonstrated upward trends in both rank and sales, with Lights Out achieving a notable jump from 67th to 48th. These shifts highlight a competitive pressure on Lolo, emphasizing the need for strategic adjustments to regain its standing and counter the upward momentum of its competitors.

Notable Products

In January 2026, the top-performing product for Lolo was Berry Scones Pre-Roll (1g), leading the sales with a notable figure of 1499 units sold. The Cosmic Latte Pre-Roll (1g) followed closely as the second best-seller, with Blueberry Yum Yum Pre-Roll (1g) securing the third position. Blueberry Scone Pre-Roll (1g), which had previously fluctuated in rankings, dropped to fourth place from its second-place position in December 2025. The lolo Cherry Lato Pre-Roll (1g) rounded out the top five, showing a solid performance. This indicates a shift in consumer preference towards Berry Scones and Cosmic Latte flavors over the previous market leader, Blueberry Scone.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.