Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

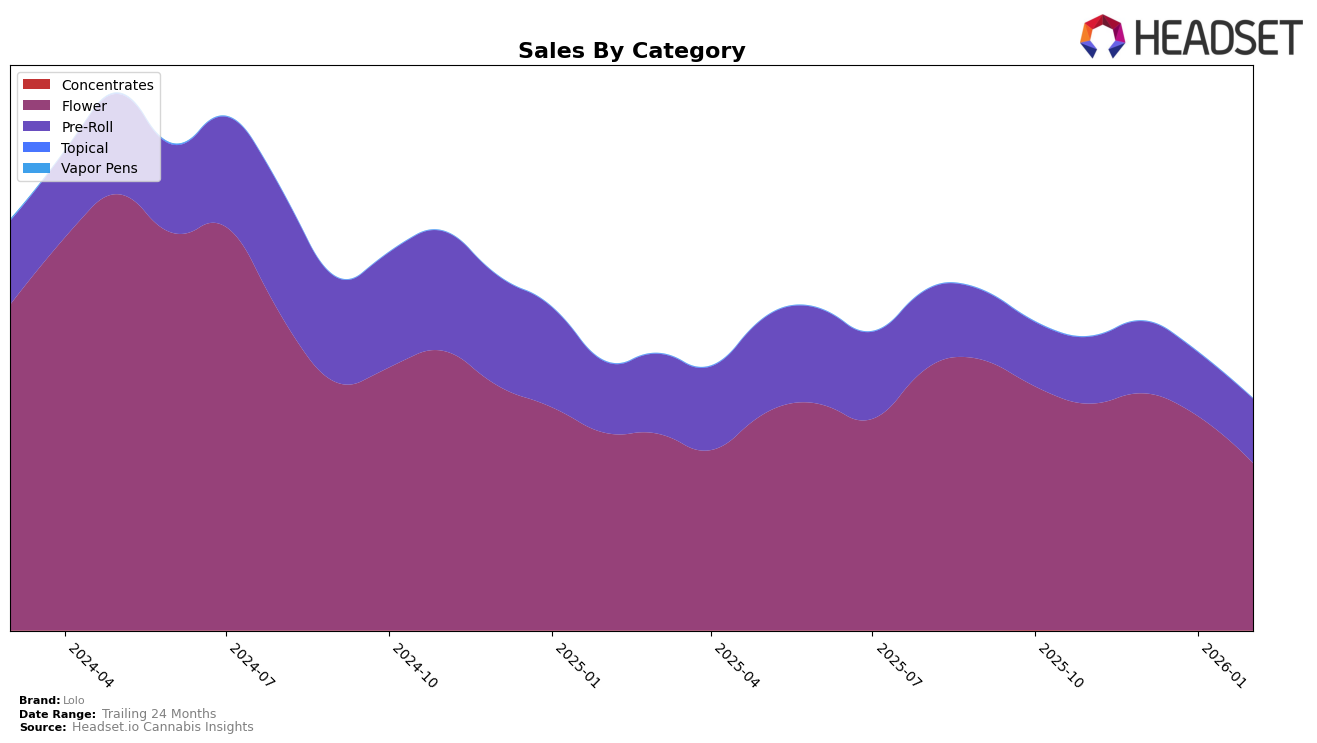

In California, Lolo's performance in the Flower category shows some fluctuations over the months. The brand moved from a rank of 33 in November 2025 to entering the top 30 in December, but then slipped out of the top 30 again by January 2026 and further down to 39 by February. This downward trend is accompanied by a decrease in sales from $709,742 in December to $500,426 in February, indicating potential challenges in maintaining market share. Notably, the movement in rankings suggests that while Lolo managed to break into the top 30 briefly, sustaining that position has proven difficult.

In the Pre-Roll category, Lolo's performance in California has been relatively stable, with a slight improvement over the months. Starting at rank 61 in November 2025, the brand improved its position to rank 50 by February 2026. While not breaking into the top 30, this upward trend in rankings indicates a positive reception or strategy in this category, contrasting with the Flower category's challenges. The sales figures reflect a steady pattern, with a slight dip in January but an overall stable trajectory, suggesting that Lolo's Pre-Roll products might be gaining traction among consumers.

Competitive Landscape

In the competitive landscape of the California flower category, Lolo has experienced notable fluctuations in its ranking and sales over the recent months. From November 2025 to February 2026, Lolo's rank shifted from 33rd to 39th, indicating a downward trend. This decline in rank is mirrored by a decrease in sales, from $678,827 in November 2025 to $500,426 in February 2026. In contrast, Almora Farms maintained a relatively stable position, hovering around the 30th rank, while Seed Junky Genetics showed a significant improvement, climbing from 83rd to 40th place, with sales increasing from $274,723 to $493,754. Meanwhile, Weedlove remained close to Lolo in rank, fluctuating slightly but maintaining a stronger sales performance. These dynamics suggest that while Lolo faces challenges in maintaining its competitive edge, other brands are capitalizing on market opportunities, potentially impacting Lolo's market share and necessitating strategic adjustments to regain momentum.

Notable Products

In February 2026, the top-performing product for Lolo was Melon OG Pre-Roll (1g), which secured the first rank with sales of 1672 units. Following closely was Purple Thai Infused Pre-Roll (1g), which improved its position from fifth in January to second in February, with notable sales figures. Blueberry Scone Pre-Roll (1g) maintained a consistent performance, ranking third in February, similar to its position in December 2025. Hella Jelly Pre-Roll (1g), which was the top product in January, saw a drop to fourth place in February. The Platinum Cookies Smalls (3.5g) entered the top five for the first time, indicating a growing interest in the Flower category.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.