Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

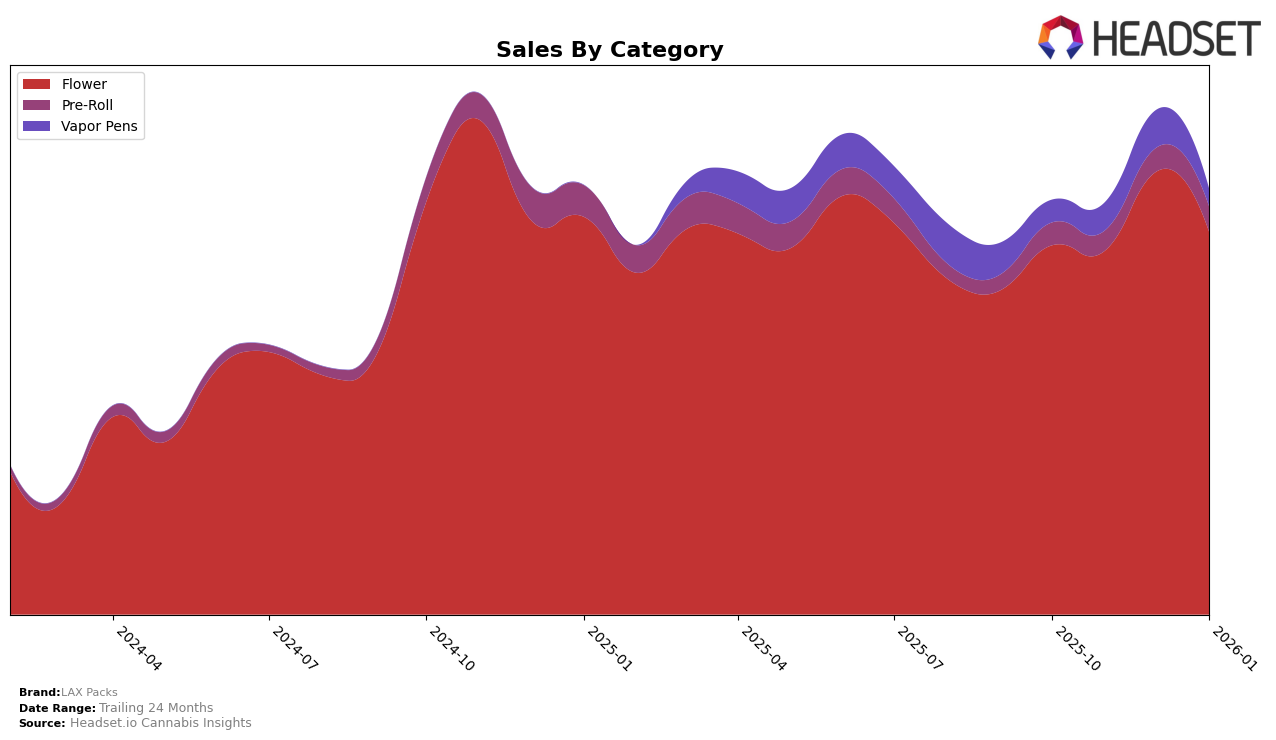

In the state of California, LAX Packs has demonstrated a consistent presence in the Flower category, maintaining a position within the top 30 brands over the past few months. Notably, the brand improved its ranking from 26th in October 2025 to 21st in December 2025, before slightly declining to 23rd in January 2026. Despite this minor fluctuation, LAX Packs' sales in the Flower category have shown resilience, with a peak in December 2025, indicating strong consumer demand during that period. This trend suggests that while the brand faces competition, it remains a significant player in the California market.

Conversely, LAX Packs' performance in the Vapor Pens category within California reveals a different narrative. The brand was absent from the top 30 rankings in October 2025, but it made notable progress by appearing at rank 98 in November and improving to 87 by December. This upward movement, albeit outside the top 30, signifies a positive trajectory and potential for growth in this category. The absence of a ranking in January 2026 might indicate a temporary setback or increased competition, which could be a point of concern for the brand's strategy in expanding its reach in Vapor Pens.

Competitive Landscape

In the competitive California flower market, LAX Packs has shown a fluctuating performance over the past few months, with its rank improving from 26th in October 2025 to 21st in December 2025, before slightly declining to 23rd in January 2026. This indicates a competitive positioning amidst brands like Delighted, which consistently maintained a higher rank, peaking at 18th in December 2025. Meanwhile, Originals experienced a downward trend, dropping from 19th in October 2025 to 25th by January 2026, which could provide an opportunity for LAX Packs to capture more market share. Despite these rank changes, LAX Packs' sales saw a notable increase in December 2025, suggesting a potential for growth if they can capitalize on the shifting dynamics and maintain consistent performance against competitors like Maven Genetics and Eighth Brother, Inc., both of which have shown varied sales trends.

Notable Products

In January 2026, the top-performing product for LAX Packs was Golden Haze (3.5g) in the Flower category, achieving the number one rank with sales of 1128 units. Sour Diesel Pre-Roll (1g) followed closely in second place, maintaining its position from the previous month. Red Eye OG (3.5g) took the third spot, showing consistent performance over the months. Red Eye OG (7g) was ranked fourth, indicating a slight decline in its ranking compared to earlier months. Notably, Jedi OG Pre-Roll (1g) dropped to fifth place from its previous second rank in December 2025, reflecting a significant decrease in sales to 789 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.