Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

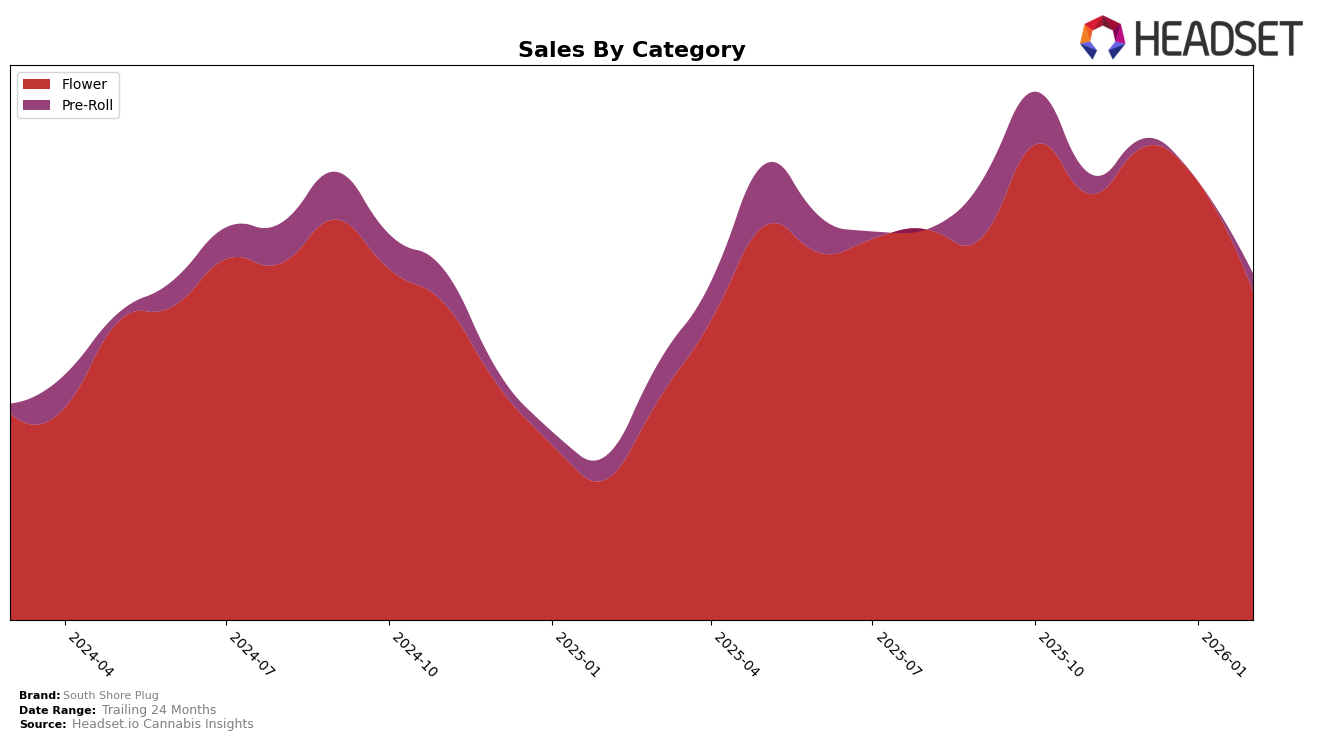

South Shore Plug has shown a consistent presence in the Massachusetts market, particularly in the Flower category. Over the observed months, the brand maintained a stable ranking, oscillating between the 8th and 10th positions. This consistency suggests a strong foothold in the Massachusetts Flower market, although a notable drop in February 2026 sales might indicate potential challenges or seasonal fluctuations. In contrast, the Pre-Roll category tells a different story. After ranking 95th in November 2025, South Shore Plug was absent from the top 30 for December and January, before reappearing in February at 94th. This inconsistency highlights a struggle to maintain a competitive edge in the Pre-Roll segment.

The performance of South Shore Plug across these categories signals both strengths and areas for improvement. While their Flower category presence in Massachusetts remains solid, the volatility in the Pre-Roll rankings could point to either an opportunity for growth or a need for strategic adjustment. The absence from the top 30 in the Pre-Roll category for two consecutive months suggests that while there is potential, the brand might need to reassess its product offerings or marketing strategies to capture a more significant share of this market. The fluctuations in rankings and sales offer valuable insights into the dynamics of consumer preferences and market competition.

Competitive Landscape

In the competitive landscape of the flower category in Massachusetts, South Shore Plug has demonstrated notable resilience and adaptability. Despite a dip in rank from 8th in December 2025 and January 2026 to 10th in February 2026, the brand maintains a strong presence among top competitors. This fluctuation in rank coincides with a decrease in sales, suggesting potential market challenges or seasonal factors. Meanwhile, Cresco Labs experienced a decline from 9th to 11th place, indicating a more significant drop in sales. Ozone showed remarkable growth, climbing from 21st in November 2025 to 8th by February 2026, surpassing South Shore Plug. Eleven also improved its position, moving from 14th to 9th, while Strane remained relatively stable, hovering around the 12th to 15th range. These dynamics highlight the competitive pressures and opportunities for South Shore Plug, emphasizing the importance of strategic adjustments to maintain and enhance its market standing.

Notable Products

In February 2026, the top-performing product for South Shore Plug was Rotten Rozay Pre-Roll (1g) in the Pre-Roll category, securing the number one rank with sales of 6863 units. Street Tartz Pre-Roll (1g) followed closely in the Pre-Roll category at second place. Gotham Gas (3.5g) in the Flower category dropped from its leading position in January 2026 to third place in February. Afghani Kush (3.5g) and Medo Magic (3.5g), both in the Flower category, held the fourth and fifth positions, respectively. Notably, Gotham Gas experienced a slight dip in sales from January to February, contributing to its change in ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.