Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

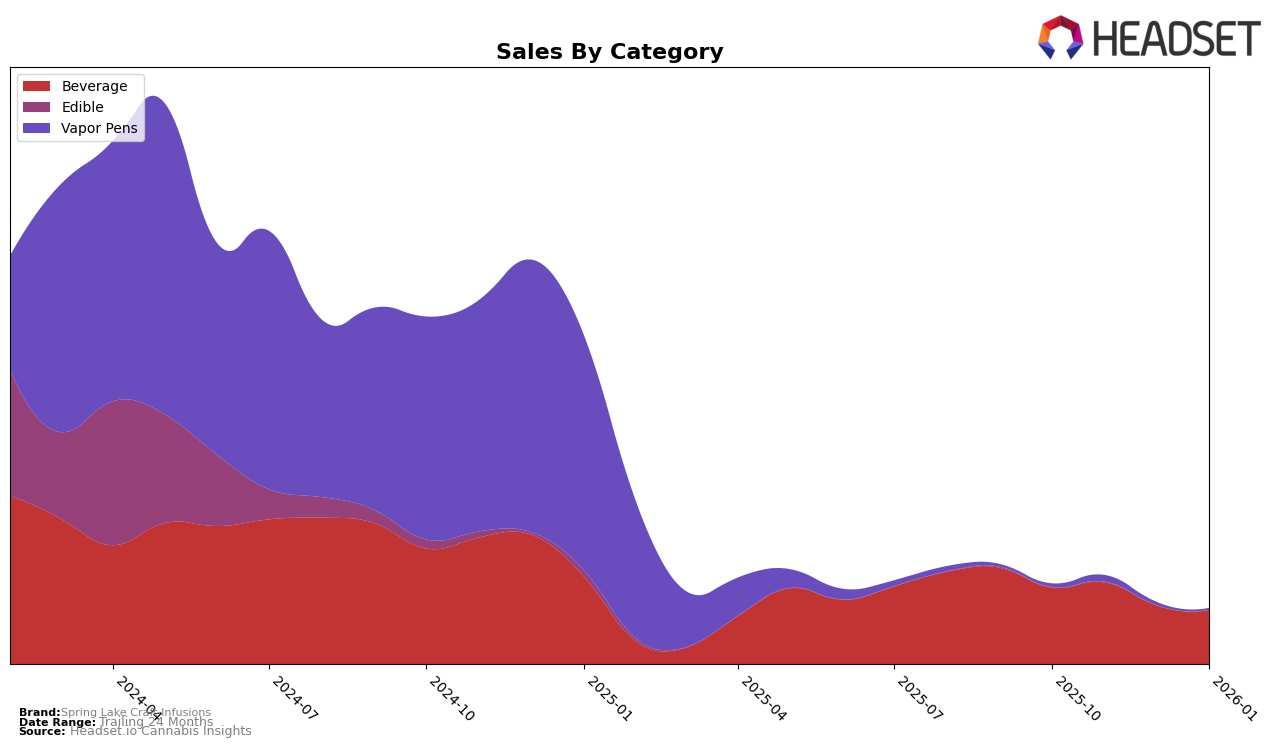

Spring Lake Craft Infusions has demonstrated a consistent performance in the Illinois beverage category, maintaining a steady rank of 9th place from October 2025 through January 2026. This stability suggests a strong foothold in the Illinois market, despite a noticeable decline in sales from November to January. The brand's ability to remain within the top 10 in a competitive category is noteworthy, although the downward sales trend could indicate potential challenges or seasonal fluctuations affecting consumer demand.

Interestingly, Spring Lake Craft Infusions did not appear in the top 30 brands in other states or provinces, which could be seen as a limitation in their market reach or strategy outside of Illinois. This absence in other markets highlights a potential area for growth or an opportunity for strategic expansion. The brand's consistent ranking in Illinois suggests a solid consumer base, but the lack of presence elsewhere might imply a need to diversify or strengthen their marketing efforts to capture additional market share in other regions.

Competitive Landscape

In the competitive Illinois beverage category, Spring Lake Craft Infusions has maintained a consistent rank of 9th place from October 2025 through January 2026, despite fluctuations in sales. This stability in rank is noteworthy given the dynamic movements of other brands in the same period. For instance, Vibations consistently outperformed Spring Lake Craft Infusions, holding a steady 8th rank, while Midweek Friday fluctuated between 7th and 9th positions. Although Spring Lake Craft Infusions experienced a decline in sales from November to January, dropping from $49,752 to $32,911, it managed to maintain its rank, indicating a resilient market position amidst competitive pressures. In contrast, Artet and Drink Loud remained just below Spring Lake Craft Infusions, highlighting its competitive edge in maintaining a top 10 position in the Illinois market.

Notable Products

For January 2026, Spring Lake Craft Infusions' top-performing product was Cherry Limeade Surp Syrup (100mg THC, 50ml) in the Beverage category, maintaining its leading position from December 2025, with sales of 505 units. Berry x Blueberry Clementine Live Rosin Surp Syrup (100mg THC, 50ml) climbed to the second position from fourth in December, indicating a significant increase in popularity with 344 units sold. Mango Strawberry Live Rosin Surp Syrup (100mg) remained steady at third place, while French Vanilla Surp Syrup (100mg) dropped to fourth, showing a decline in sales from previous months. Notably, Mimosa Live Rosin Syrup 10-Pack (100mg) entered the rankings at fifth place, suggesting a new interest in multi-pack options. These shifts highlight dynamic consumer preferences within the Beverage category for Spring Lake Craft Infusions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.