Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

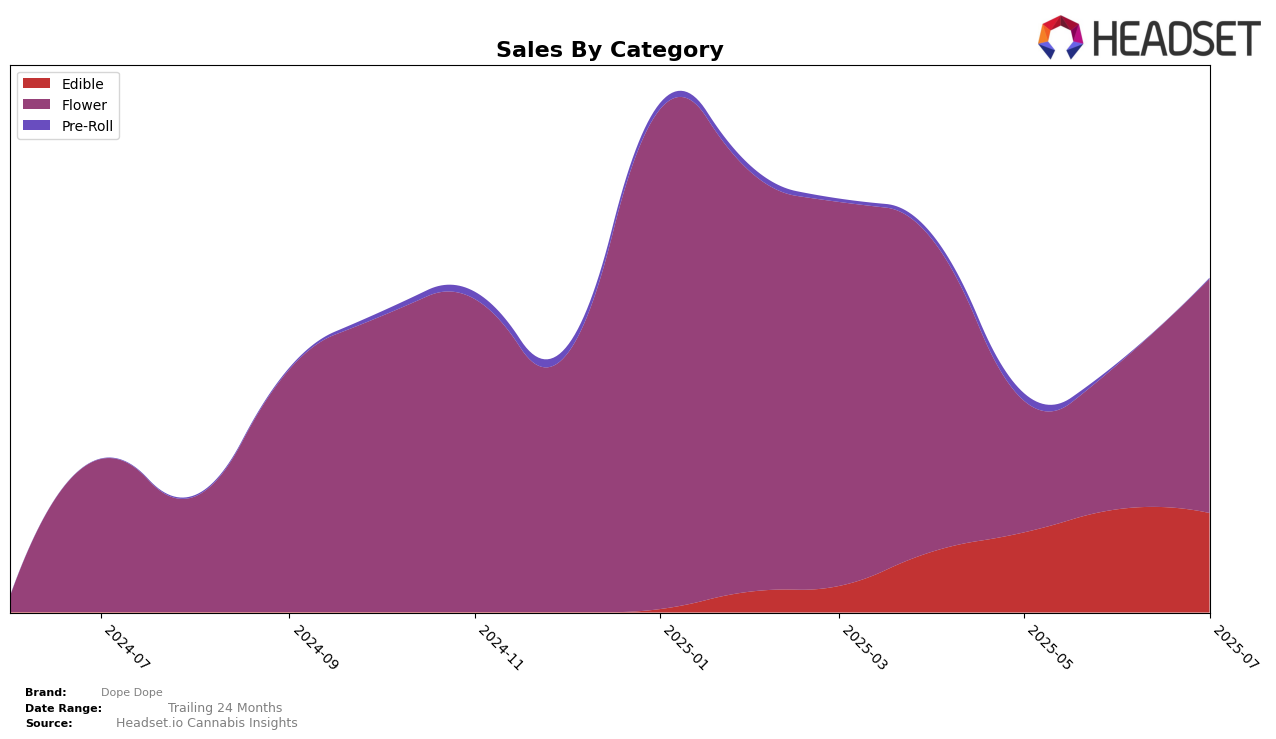

Dope Dope has shown notable performance shifts across different categories and states in recent months. In Michigan, the brand's presence in the Edible category has been on a gradual rise, moving from a rank of 65 in April to 53 by July 2025. This upward trend suggests a growing consumer preference for Dope Dope's edible offerings in the state, despite not breaking into the top 30. The sales figures support this trend, with a significant increase from April to June, indicating a strong market response to their products. However, the stabilization in rank between June and July could imply that the brand is facing competition or market saturation at this level.

In contrast, Dope Dope's performance in the Flower category in Nevada presents a different narrative. The brand experienced fluctuations, initially dropping from a rank of 20 in April to 39 in May, but then recovering to 24 by July. This volatility could be attributed to seasonal demand changes or competitive dynamics within the state. The sales data reflect a similar pattern, with a notable dip in May followed by a recovery in subsequent months. While the brand's ability to rebound is promising, the initial drop highlights potential challenges in maintaining a consistent market position in Nevada's competitive landscape.

Competitive Landscape

In the Nevada flower category, Dope Dope has experienced a dynamic shift in its competitive positioning over recent months. While it managed to climb from a rank of 39 in May 2025 to 24 in July 2025, indicating a positive trajectory, it still faces stiff competition from brands like The Grower Circle and GB Sciences, both of which also improved their rankings significantly during the same period. Notably, BLVD maintained a relatively stable presence, peaking at rank 18 in May before dropping to 25 in July, while Ghost Town Cannabis showed fluctuating performance, ending at rank 26 in July. Despite these challenges, Dope Dope's sales have shown a promising upward trend from June to July, suggesting that its strategic adjustments may be starting to pay off in terms of market share recovery.

Notable Products

In July 2025, the top-performing product for Dope Dope was the Magic Mimosa Gummy (200mg) in the Edible category, which ascended to the first rank with notable sales of 8,452 units. The Wacky Watermelon Gummy (200mg), previously holding the top position for two consecutive months, fell to second place. The Pineapple Power Gummy (200mg) improved its ranking to third place, continuing its steady rise over the past months. The Strawberry Banger Gummy (200mg) experienced a drop, moving from second to fourth place, while the Tarty Party Gummy (200mg) maintained its position at fifth. Overall, the sales dynamics indicate a significant shift for Magic Mimosa Gummy, which overtook its competitors to become the new leader in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.