Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

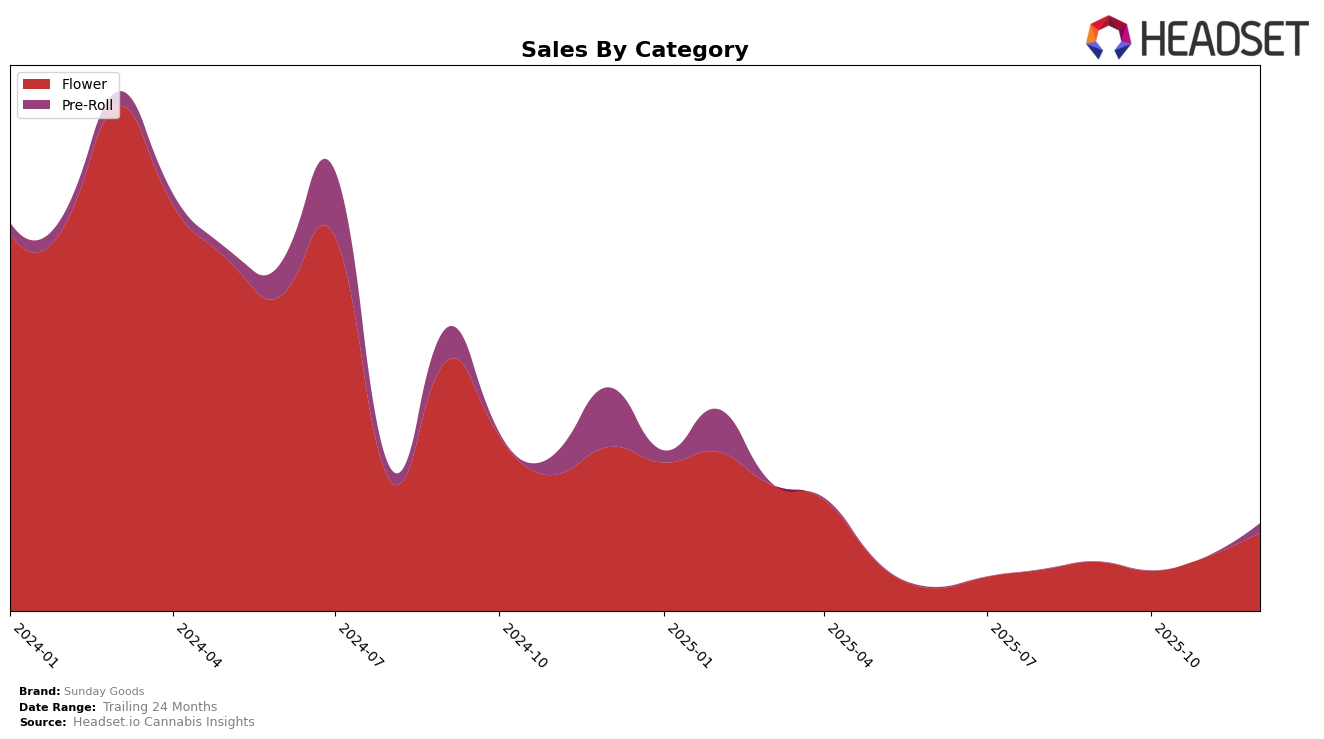

Sunday Goods has shown a notable trajectory in the Arizona market, particularly within the Flower category. Over the last few months of 2025, the brand has climbed from a rank of 35 in September to 27 in December. This upward movement indicates a strengthening presence and growing consumer preference for their Flower products in the state. Although the brand did not initially make it into the top 30 rankings, their consistent rise is a positive indicator of performance. This trend is further supported by a substantial increase in sales, with December figures showing a marked improvement from earlier months.

In contrast, the Pre-Roll category tells a different story for Sunday Goods in Arizona. The absence of a top 30 ranking until December, where they reached 49th place, suggests that this segment is still emerging for the brand. This could be viewed as a challenge, but also an opportunity for growth as they seek to replicate their success in the Flower category. Understanding the dynamics of consumer preferences and competitive positioning in this category will be crucial for Sunday Goods moving forward. The data highlights areas where the brand can focus its efforts to enhance its market presence across different product lines.

Competitive Landscape

In the competitive landscape of the Arizona flower category, Sunday Goods has shown a notable upward trend in its ranking from September to December 2025. Starting at the 35th position in September, Sunday Goods improved its rank to 27th by December, indicating a positive trajectory in market presence. This improvement is particularly significant when compared to competitors like Cheech & Chong's, which maintained a relatively stable position around the mid-20s but with higher sales figures, and Aeriz, which experienced a slight decline from 20th to 25th. Meanwhile, Tru Infusion and Halo Cannabis (formerly The Green Halo) also showed improvements, but Sunday Goods' sales surged significantly in December, closing the gap with these competitors. This suggests that Sunday Goods is gaining traction and could potentially climb higher in the rankings if this growth trend continues.

Notable Products

In December 2025, the top-performing product from Sunday Goods was Government Oasis Shake (14g) in the Flower category, achieving the highest sales rank. Government Oasis (3.5g) followed closely in second place, showing a significant rise from its third position in November. Government Oasis Pre-Roll 5-Pack (3.5g) secured the third spot, marking its first appearance in the top ranks. AK-1995 (3.5g) dropped to fourth place, continuing its downward trend from previous months. Motorbreath x Headbanger OG Popcorn (3.5g) rounded out the top five, having fallen from its peak position in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.